Answered step by step

Verified Expert Solution

Question

1 Approved Answer

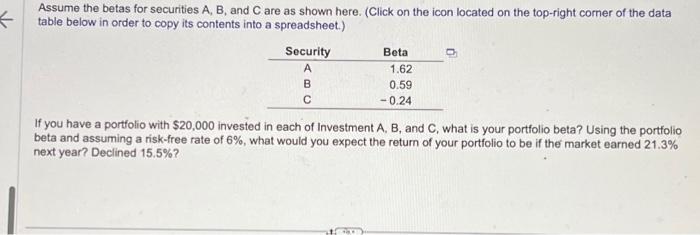

K Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right corner of the

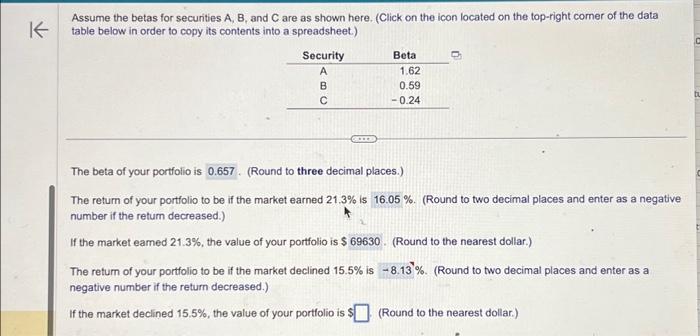

K Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security A ABC ... Beta 2 1.62 0.59 -0.24 The beta of your portfolio is 0.657 (Round to three decimal places.) The return of your portfolio to be if the market earned 21.3% is 16.05 %. (Round to two decimal places and enter as a negative number if the return decreased.) If the market earned 21.3%, the value of your portfolio is $69630. (Round to the nearest dollar.) The return of your portfolio to be if the market declined 15.5% is -8.13%. (Round to two decimal places and enter as a negative number if the return decreased.) If the market declined 15.5%, the value of your portfolio is $ (Round to the nearest dollar.) tu

if the market is 15.5%, the value of your portfolio is $____

if the market declined 15.5%, the value of your portfolio is $_____?

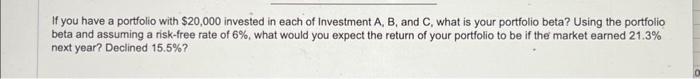

if you have a portfolio with $20,000 invested in each of investment a BNC, what is your portfolio beta? Using the portfolio beta assuming a risk free rate of 6%, what would you expect to return of your portfolio to be if the market earned 21.3% next year? Decline 15.5%?

If you have a portfolio with $20,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 6%, what would you expect the return of your portfolio to be if the market earned 21.3% next year? Declined 15.5% ? Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) The beta of your portfolio is (Round to three decimal places.) The return of your portfolio to be if the market earned 21.3% is 6. (Round to two decimal places and enter as a negative number if the retum decreased.) If the market eamed 21.3%, the value of your portfolio is $ (Round to the nearest dollar.) The retum of your portfolio to be if the market declined 15.5% is 6. (Round to two decimal places and enter as a negative number if the return decreased.) If the market declined 15.5%, the value of your portfolio is \$ (Round to the nearest dollar.) Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) If you have a portfolio with $20,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 6%, what would you expect the return of your portfolio to be if the market earned 21.3% next year? Declined 15.5% ? If you have a portfolio with $20,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 6%, what would you expect the return of your portfolio to be if the market earned 21.3% next year? Declined 15.5% ? Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) The beta of your portfolio is (Round to three decimal places.) The return of your portfolio to be if the market earned 21.3% is 6. (Round to two decimal places and enter as a negative number if the retum decreased.) If the market eamed 21.3%, the value of your portfolio is $ (Round to the nearest dollar.) The retum of your portfolio to be if the market declined 15.5% is 6. (Round to two decimal places and enter as a negative number if the return decreased.) If the market declined 15.5%, the value of your portfolio is \$ (Round to the nearest dollar.) If you have a portfolio with $20,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 6%, what would you expect the return of your portfolio to be if the market earned 21.3% next year? Declined 15.5% ? Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) The beta of your portfolio is (Round to three decimal places.) The return of your portfolio to be if the market earned 21.3% is 6. (Round to two decimal places and enter as a negative number if the retum decreased.) If the market eamed 21.3%, the value of your portfolio is $ (Round to the nearest dollar.) The retum of your portfolio to be if the market declined 15.5% is 6. (Round to two decimal places and enter as a negative number if the return decreased.) If the market declined 15.5%, the value of your portfolio is \$ (Round to the nearest dollar.) Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) If you have a portfolio with $20,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 6%, what would you expect the return of your portfolio to be if the market earned 21.3% next year? Declined 15.5% ? If you have a portfolio with $20,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 6%, what would you expect the return of your portfolio to be if the market earned 21.3% next year? Declined 15.5% ? Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet) The beta of your portfolio is (Round to three decimal places.) The return of your portfolio to be if the market earned 21.3% is 6. (Round to two decimal places and enter as a negative number if the retum decreased.) If the market eamed 21.3%, the value of your portfolio is $ (Round to the nearest dollar.) The retum of your portfolio to be if the market declined 15.5% is 6. (Round to two decimal places and enter as a negative number if the return decreased.) If the market declined 15.5%, the value of your portfolio is \$ (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started