Answered step by step

Verified Expert Solution

Question

1 Approved Answer

K Assume you want to retire early at age 54. You plan to save using one of the following two strategies: (1) save $3,300

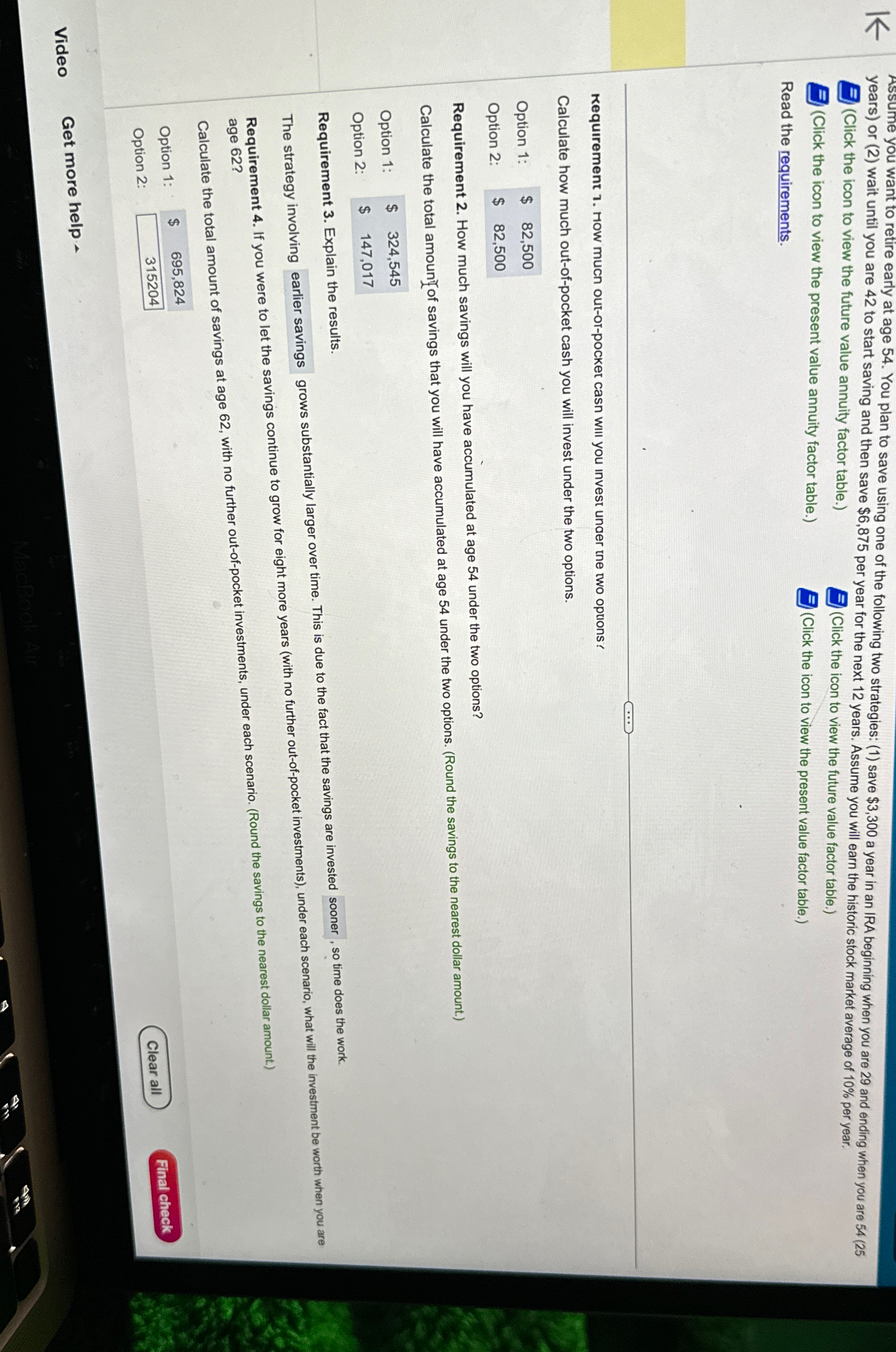

K Assume you want to retire early at age 54. You plan to save using one of the following two strategies: (1) save $3,300 a year in an IRA beginning when you are 29 and ending when you are 54 (25 years) or (2) wait until you are 42 to start saving and then save $6,875 per year for the next 12 years. Assume you will earn the historic stock market average of 10% per year. (Click the icon to view the future value annuity factor table.) (Click the icon to view the present value annuity factor table.) Read the requirements. (Click the icon to view the future value factor table.) (Click the icon to view the present value factor table.) Requirement 1. How much out-of-pocket casn will you invest under the two options? Calculate how much out-of-pocket cash you will invest under the two options. Option 1: $ 82,500 Option 2: $ 82,500 Requirement 2. How much savings will you have accumulated at age 54 under the two options? Calculate the total amount of savings that you will have accumulated at age 54 under the two options. (Round the savings to the nearest dollar amount.) Option 1: $ 324,545 Option 2: $ 147,017 Requirement 3. Explain the results. The strategy involving earlier savings grows substantially larger over time. This is due to the fact that the savings are invested sooner, so time does the work. Requirement 4. If you were to let the savings continue to grow for eight more years (with no further out-of-pocket investments), under each scenario, what will the investment be worth when you are age 62? Calculate the total amount of savings at age 62, with no further out-of-pocket investments, under each scenario. (Round the savings to the nearest dollar amount.) Option 1: Option 2: 695,824 315204 Video Get more help MacBook Air Clear all Final check F12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started