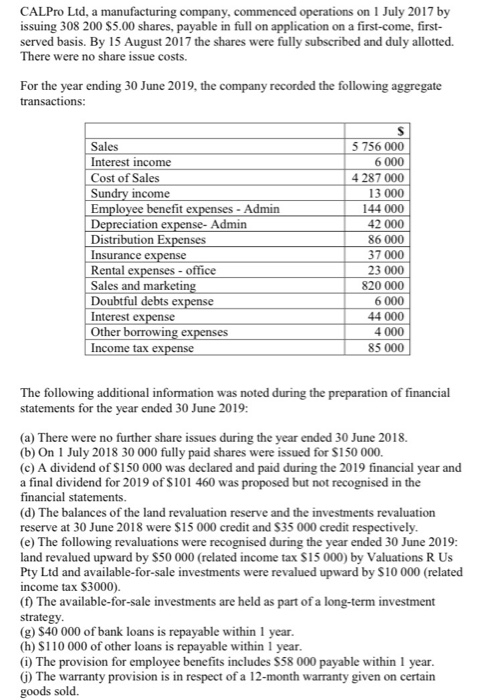

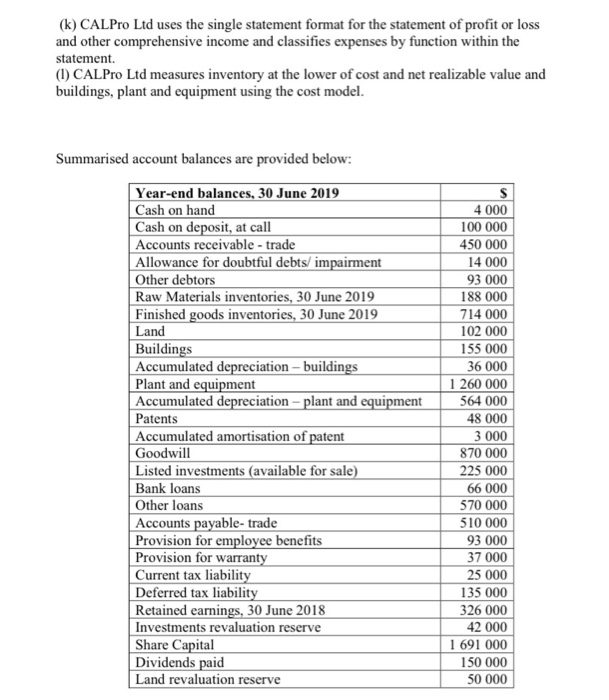

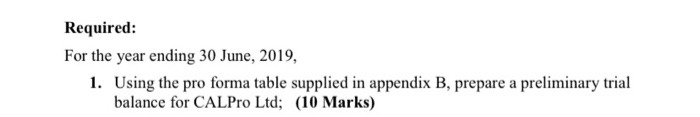

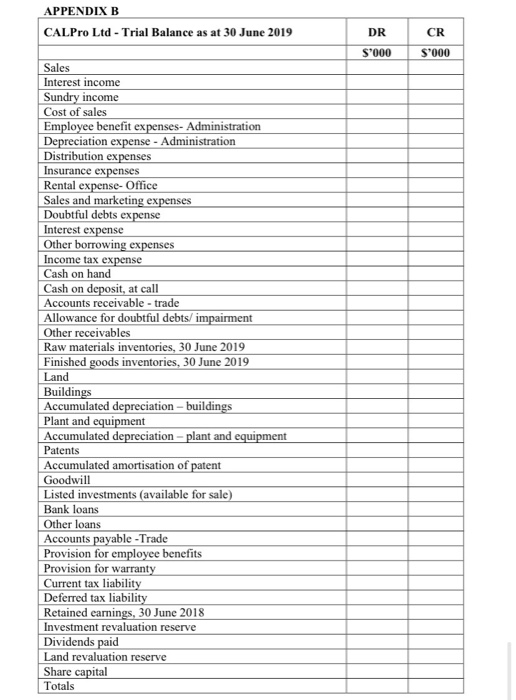

(k) CAL Pro Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement. (1) CAL Pro Ltd measures inventory at the lower of cost and net realizable value and buildings, plant and equipment using the cost model. Summarised account balances are provided below: Year-end balances, 30 June 2019 Cash on hand Cash on deposit, at call Accounts receivable - trade Allowance for doubtful debts/ impairment Other debtors Raw Materials inventories, 30 June 2019 Finished goods inventories, 30 June 2019 Land Buildings Accumulated depreciation - buildings Plant and equipment Accumulated depreciation - plant and equipment Patents Accumulated amortisation of patent Goodwill Listed investments (available for sale) Bank loans Other loans Accounts payable-trade Provision for employee benefits Provision for warranty Current tax liability Deferred tax liability Retained earnings, 30 June 2018 Investments revaluation reserve Share Capital Dividends paid Land revaluation reserve 4 000 100 000 450 000 14 000 93 000 188 000 714 000 102 000 155 000 36 000 1 260 000 564 000 48 000 3 000 870 000 225 000 66 000 570 000 510 000 93 000 37 000 25 000 135 000 326 000 42 000 1 691 000 150 000 50 000 Required: For the year ending 30 June, 2019, 1. Using the pro forma table supplied in appendix B, prepare a preliminary trial balance for CALPro Ltd; (10 Marks) APPENDIX B CALPro Ltd - Trial Balance as at 30 June 2019 DR S'000 CR S'000 Sales Interest income Sundry income Cost of sales Employee benefit expenses- Administration Depreciation expense - Administration Distribution expenses Insurance expenses Rental expense-Office Sales and marketing expenses Doubtful debts expense Interest expense Other borrowing expenses Income tax expense Cash on hand Cash on deposit, at call Accounts receivable - trade Allowance for doubtful debts/ impairment Other receivables Raw materials inventories, 30 June 2019 Finished goods inventories, 30 June 2019 Land Buildings Accumulated depreciation - buildings Plant and equipment Accumulated depreciation - plant and equipment Patents Accumulated amortisation of patent Goodwill Listed investments (available for sale) Bank loans Other loans Accounts payable -Trade Provision for employee benefits Provision for warranty Current tax liability Deferred tax liability Retained earnings, 30 June 2018 Investment revaluation reserve Dividends paid Land revaluation reserve Share capital Totals