Answered step by step

Verified Expert Solution

Question

1 Approved Answer

K James Hanover is the sole shareholder of Hanover Consulting Ltd., which provides professional consulting services to several organizations in the oil and gas

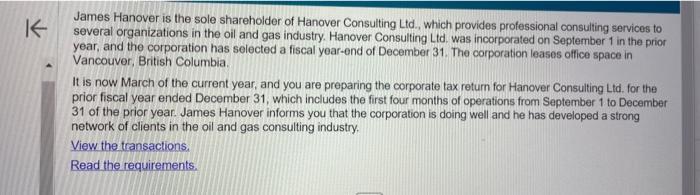

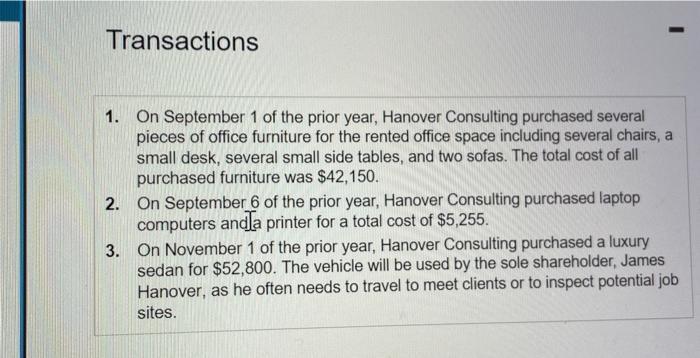

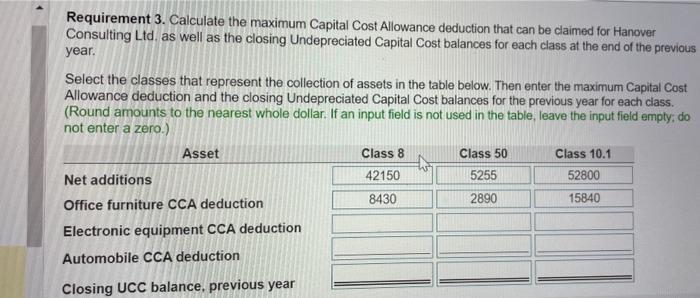

K James Hanover is the sole shareholder of Hanover Consulting Ltd., which provides professional consulting services to several organizations in the oil and gas industry. Hanover Consulting Ltd. was incorporated on September 1 in the prior year, and the corporation has selected a fiscal year-end of December 31. The corporation leases office space in Vancouver, British Columbia. It is now March of the current year, and you are preparing the corporate tax return for Hanover Consulting Ltd. for the prior fiscal year ended December 31, which includes the first four months of operations from September 1 to December 31 of the prior year. James Hanover informs you that the corporation is doing well and he has developed a strong network of clients in the oil and gas consulting industry. View the transactions. Read the requirements. Transactions 1. On September 1 of the prior year, Hanover Consulting purchased several pieces of office furniture for the rented office space including several chairs, a small desk, several small side tables, and two sofas. The total cost of all purchased furniture was $42,150. 2. On September 6 of the prior year, Hanover Consulting purchased laptop computers and a printer for a total cost of $5,255. 3. On November 1 of the prior year, Hanover Consulting purchased a luxury sedan for $52,800. The vehicle will be used by the sole shareholder, James Hanover, as he often needs to travel to meet clients or to inspect potential job sites. 3. Calculate the maximum Capital Cost Allowance deduction that can be claimed for Hanover Consulting Ltd. as well as the closing Undepreciated Capital Cost balances for each class at the end of the previous year. Requirement 3. Calculate the maximum Capital Cost Allowance deduction that can be claimed for Hanover Consulting Ltd. as well as the closing Undepreciated Capital Cost balances for each class at the end of the previous year. Select the classes that represent the collection of assets in the table below. Then enter the maximum Capital Cost Allowance deduction and the closing Undepreciated Capital Cost balances for the previous year for each class. (Round amounts to the nearest whole dollar. If an input field is not used in the table, leave the input field empty; do not enter a zero.) Asset Net additions Office furniture CCA deduction Electronic equipment CCA deduction Automobile CCA deduction Closing UCC balance, previous year Class 8 42150 8430 Class 50 5255 2890 Class 10.1 52800 15840

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Capital Cost Allowance CCA is the tax deduction in Canada that a business can claim for the depreciation of tangible property Different classes of assets have different prescribed CCA rates and ru...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started