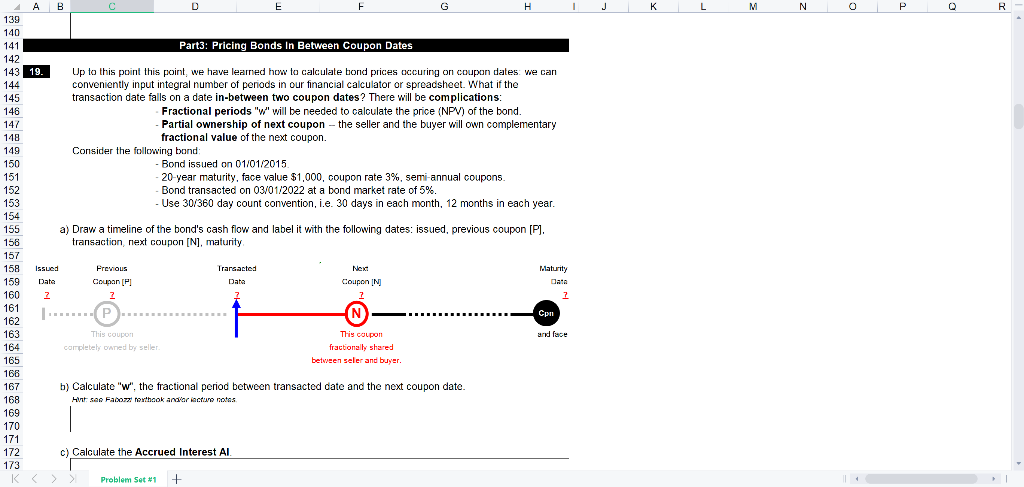

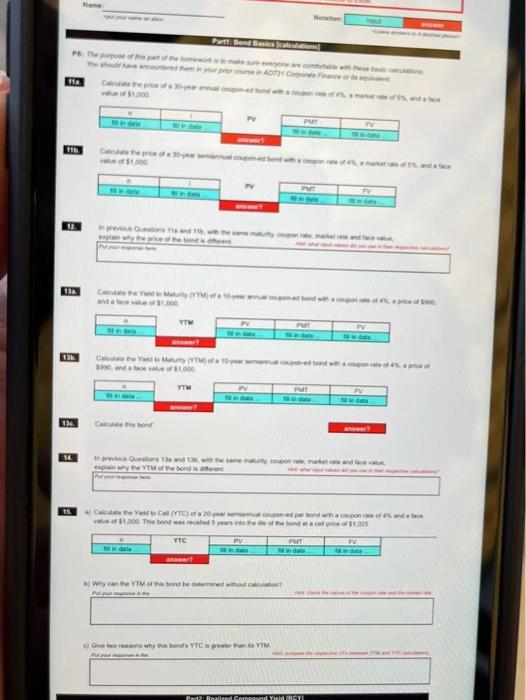

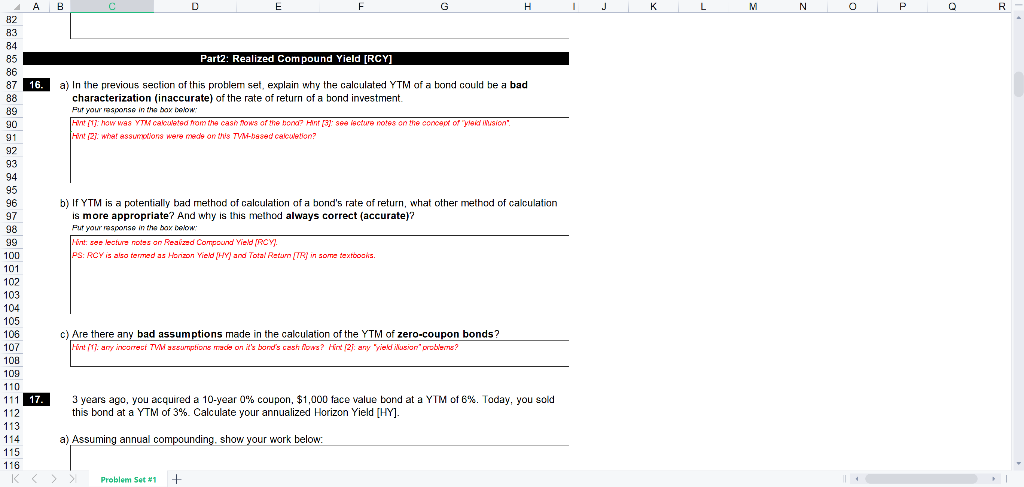

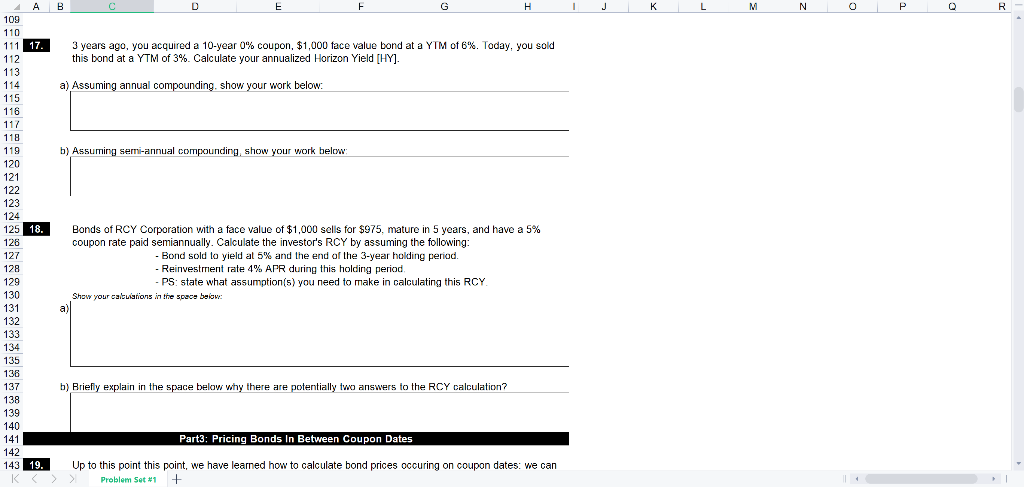

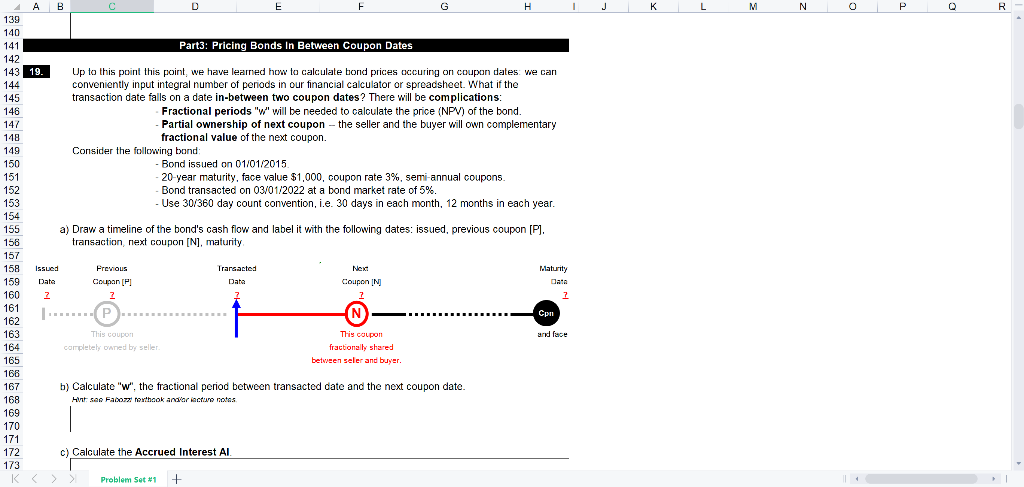

K M N P c R R AB D E F G H 82 83 84 85 Part2: Realized Compound Yield (RCY] 86 87 16. a) In the previous section of this problem set, explain why the calculated YTM of a bond could be a bad 88 characterization (inaccurate) of the rate of return of a bond investment. 89 Put your response in the box below 90 ht: how wes YTXA calculated Nom the cash flows of the bona? Har 19: see lecture notes on the concert of yli usion" 91 12]. wha! assumtions were made on TVM-seed calculation? 92 93 94 95 96 b) If YTM is a potentially bad method of calculation of a bond's rate of return, what other method of calculation 97 is more appropriate? And why is this method always correct (accurate)? 98 Put your response in the box below 99 in see lecture notes on Reaized Compound Yield (RCY) 100 PS: RCY is also termed as Horizon Yield (WY) and Total Retur (TR) in some textbooks. 101 102 c) Are there any bad assumptions made in the calculation of the YTM of zero-coupon bonds? Hint 17 any incorrect TW accuphors made on it's band's cash flows? Mir 21. any yield illusion croblem? 103 104 105 106 107 108 109 110 111 17. 112 113 114 115 116 3 years ago, you acquired a 10-year 0% coupon, $1,000 face value bond at a YTM of 6%. Today, you sold this bond at a YTM of 3%. Calculate your annualized Horizon Yield (HY). a) Assuming annual compounding show your work below: Problem Set #1 + B B D E F G H K M N P c R R 3 years ago, you acquired a 10-year 0% coupon, $1,000 face value bond at a YTM of 6%. Today, you sold this bond at a YTM of 3% Calculate your annualized Horizon Yield (HY). a) Assuming annual compounding, show your work below: b) Assuming semi-annual compounding, show your work below: A 109 110 111 17. 112 113 114 115 116 117 118 119 120 121 122 123 124 125 18. 128 127 128 129 130 131 132 133 134 135 138 137 138 139 140 141 142 143 19. . K Bonds of RCY Corporation with a face value of $1,000 sells for $975, mature in 5 years, and have a 5% coupon rate paid semiannually. Calculate the investor's RCY by assuming the following: - Bond sold to yield at 5% and the end of the 3-year holding period, - Reinvestment rate 4% APR during this holding period - PS: state what assumption(s) you need to make in calculating this RCY Show your calculations in the specs below: all b b) Briefly explain in the space below why there are potentially two answers to the RCY calculation? Part3: Pricing Bonds In Between Coupon Dates Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates: we can Problem Set 1 + K M N P c R R AB D E F G H 139 140 141 Part3: Pricing Bonds In Between Coupon Dates 142 143 19. Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates we can 144 conveniently input integral number of periods in our financial calculator or spreadsheet. What if the 145 transaction date falls on a date in-between two coupon dates? There will be complications: 146 Fractional periods "W" will be needed to calculate the price (NPV) of the bond 147 Partial ownership of next coupon - the seller and the buyer will own complementary 148 fractional value of the next coupon. 149 Consider the following bond 150 Bond issued on 01/01/2015 151 - 20-year maturity, face value $1,000, coupon rate 3%, semi-annual coupons 152 Bond transacted on 03/01/2022 at a bond market rate of 5%. 153 - Use 30/360 day count convention, i.e. 30 days in each month, 12 months in each year. 154 155 a) Draw a timeline of the bond's cash flow and label it with the following dates: issued, previous coupon [P]. 158 transaction next coupon [N], maturity 157 158 Issued Frevious Transacted Next Maturity 159 Data Counan Data Coupon IN 160 2 7 2 7 161 162 163 This coupon This coupon and luce 164 completely owned by seller fractionally shared 165 between seler and buyer 168 167 b) Calculate "w", the fractional period between transacted cate and the next coupon date 168 At ser Fabozzowthook andar lecture notes 169 170 171 172 c) Calculate the Accrued Interest Al 173 KC Problem Set #1 + Data H 1 K M N P c R and tas A B D F G 163 This coupon This coupon 164 completely cane by seller fractionally shared 165 betwaon sale and buyar 166 167 b) Calculate "w", the fractional period between transacted date and the next coupon date 168 Hint see Facozz fextbook srior lectue rotsa. 169 170 171 172 c) Calculate the Accrued Interest Al 173 174 175 176 177 178 d) Calculate the Dirty [Full] Price of this bond. 179 180 181 182 183 184 185 186 187 188 189 e) Calculate the Clean [Flat] Price of this bond. 190 191 192 193 194 195 196 End of Problem Set 1 197 K K > Problem Set #1 + The You should ATT 0.000 PUT 116 1000 PVT 12 este 03 Cew na 1.000 13 Ce who de 100 YTM PUT PV santala 136 Caled e tyre YTM Bonde Cute Cal VTC)20 aprend with 51.000 Thisted was readers of VTC PV PMI PV ) Wycan YTM borde med Gior why the bond VTC is a YIM PARC YETI K M N P c R R AB D E F G H 82 83 84 85 Part2: Realized Compound Yield (RCY] 86 87 16. a) In the previous section of this problem set, explain why the calculated YTM of a bond could be a bad 88 characterization (inaccurate) of the rate of return of a bond investment. 89 Put your response in the box below 90 ht: how wes YTXA calculated Nom the cash flows of the bona? Har 19: see lecture notes on the concert of yli usion" 91 12]. wha! assumtions were made on TVM-seed calculation? 92 93 94 95 96 b) If YTM is a potentially bad method of calculation of a bond's rate of return, what other method of calculation 97 is more appropriate? And why is this method always correct (accurate)? 98 Put your response in the box below 99 in see lecture notes on Reaized Compound Yield (RCY) 100 PS: RCY is also termed as Horizon Yield (WY) and Total Retur (TR) in some textbooks. 101 102 c) Are there any bad assumptions made in the calculation of the YTM of zero-coupon bonds? Hint 17 any incorrect TW accuphors made on it's band's cash flows? Mir 21. any yield illusion croblem? 103 104 105 106 107 108 109 110 111 17. 112 113 114 115 116 3 years ago, you acquired a 10-year 0% coupon, $1,000 face value bond at a YTM of 6%. Today, you sold this bond at a YTM of 3%. Calculate your annualized Horizon Yield (HY). a) Assuming annual compounding show your work below: Problem Set #1 + B B D E F G H K M N P c R R 3 years ago, you acquired a 10-year 0% coupon, $1,000 face value bond at a YTM of 6%. Today, you sold this bond at a YTM of 3% Calculate your annualized Horizon Yield (HY). a) Assuming annual compounding, show your work below: b) Assuming semi-annual compounding, show your work below: A 109 110 111 17. 112 113 114 115 116 117 118 119 120 121 122 123 124 125 18. 128 127 128 129 130 131 132 133 134 135 138 137 138 139 140 141 142 143 19. . K Bonds of RCY Corporation with a face value of $1,000 sells for $975, mature in 5 years, and have a 5% coupon rate paid semiannually. Calculate the investor's RCY by assuming the following: - Bond sold to yield at 5% and the end of the 3-year holding period, - Reinvestment rate 4% APR during this holding period - PS: state what assumption(s) you need to make in calculating this RCY Show your calculations in the specs below: all b b) Briefly explain in the space below why there are potentially two answers to the RCY calculation? Part3: Pricing Bonds In Between Coupon Dates Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates: we can Problem Set 1 + K M N P c R R AB D E F G H 139 140 141 Part3: Pricing Bonds In Between Coupon Dates 142 143 19. Up to this point this point, we have learned how to calculate bond prices occuring on coupon dates we can 144 conveniently input integral number of periods in our financial calculator or spreadsheet. What if the 145 transaction date falls on a date in-between two coupon dates? There will be complications: 146 Fractional periods "W" will be needed to calculate the price (NPV) of the bond 147 Partial ownership of next coupon - the seller and the buyer will own complementary 148 fractional value of the next coupon. 149 Consider the following bond 150 Bond issued on 01/01/2015 151 - 20-year maturity, face value $1,000, coupon rate 3%, semi-annual coupons 152 Bond transacted on 03/01/2022 at a bond market rate of 5%. 153 - Use 30/360 day count convention, i.e. 30 days in each month, 12 months in each year. 154 155 a) Draw a timeline of the bond's cash flow and label it with the following dates: issued, previous coupon [P]. 158 transaction next coupon [N], maturity 157 158 Issued Frevious Transacted Next Maturity 159 Data Counan Data Coupon IN 160 2 7 2 7 161 162 163 This coupon This coupon and luce 164 completely owned by seller fractionally shared 165 between seler and buyer 168 167 b) Calculate "w", the fractional period between transacted cate and the next coupon date 168 At ser Fabozzowthook andar lecture notes 169 170 171 172 c) Calculate the Accrued Interest Al 173 KC Problem Set #1 + Data H 1 K M N P c R and tas A B D F G 163 This coupon This coupon 164 completely cane by seller fractionally shared 165 betwaon sale and buyar 166 167 b) Calculate "w", the fractional period between transacted date and the next coupon date 168 Hint see Facozz fextbook srior lectue rotsa. 169 170 171 172 c) Calculate the Accrued Interest Al 173 174 175 176 177 178 d) Calculate the Dirty [Full] Price of this bond. 179 180 181 182 183 184 185 186 187 188 189 e) Calculate the Clean [Flat] Price of this bond. 190 191 192 193 194 195 196 End of Problem Set 1 197 K K > Problem Set #1 + The You should ATT 0.000 PUT 116 1000 PVT 12 este 03 Cew na 1.000 13 Ce who de 100 YTM PUT PV santala 136 Caled e tyre YTM Bonde Cute Cal VTC)20 aprend with 51.000 Thisted was readers of VTC PV PMI PV ) Wycan YTM borde med Gior why the bond VTC is a YIM PARC YETI