Answered step by step

Verified Expert Solution

Question

1 Approved Answer

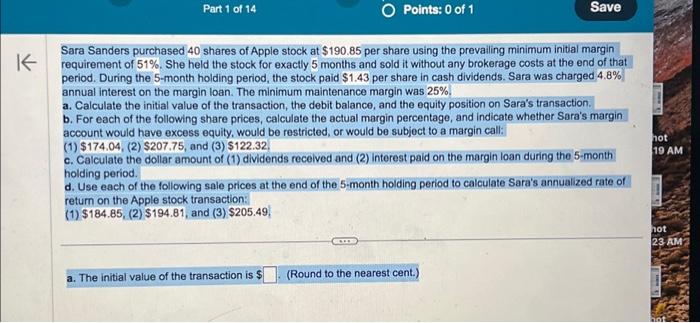

K Part 1 of 14 O Points: 0 of 1 Sara Sanders purchased 40 shares of Apple stock at $190.85 per share using the prevailing

K Part 1 of 14 O Points: 0 of 1 Sara Sanders purchased 40 shares of Apple stock at $190.85 per share using the prevailing minimum initial margin requirement of 51%. She held the stock for exactly 5 months and sold it without any brokerage costs at the end of that period. During the 5-month holding period, the stock paid $1.43 per share in cash dividends. Sara was charged 4.8% annual interest on the margin loan. The minimum maintenance margin was 25%. a. Calculate the initial value of the transaction, the debit balance, and the equity position on Sara's transaction. a. The initial value of the transaction is $ Save b. For each of the following share prices, calculate the actual margin percentage, and indicate whether Sara's margin account would have excess equity, would be restricted, or would be subject to a margin call: (1) $174.04, (2) $207.75, and (3) $122.32. c. Calculate the dollar amount of (1) dividends received and (2) interest paid on the margin loan during the 5-month holding period. d. Use each of the following sale prices at the end of the 5-month holding period to calculate Sara's annualized rate of return on the Apple stock transaction: (1) $184.85, (2) $194.81, and (3) $205.49. (Round to the nearest cent.) hot 19 AM hot 23 AM hot

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started