Question: K Problem E: The standard amount of output for the Chicago plant of Worldworth Company is 50,000 units per month Overhead is applied based on

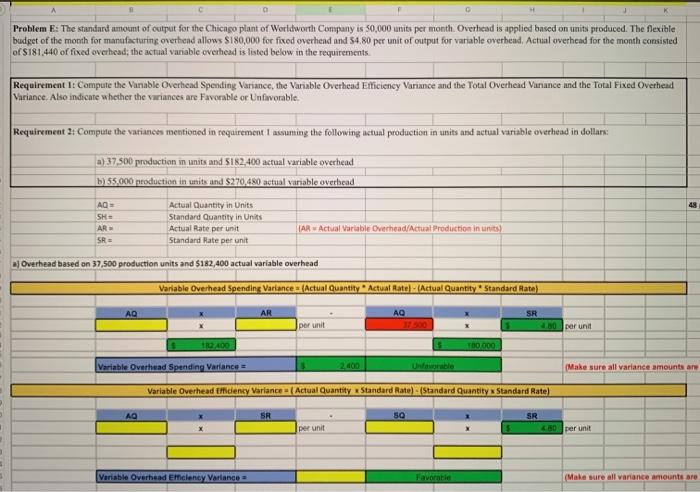

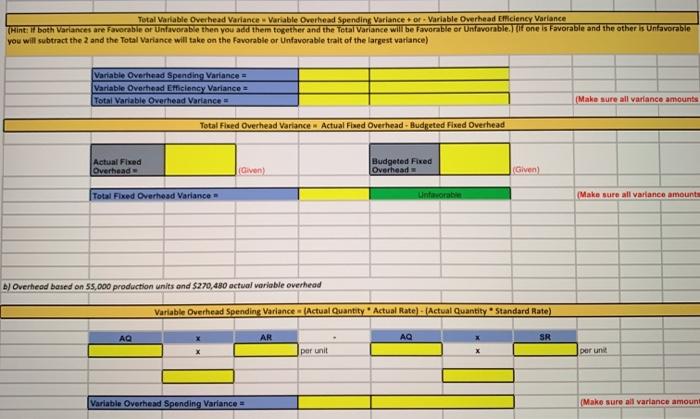

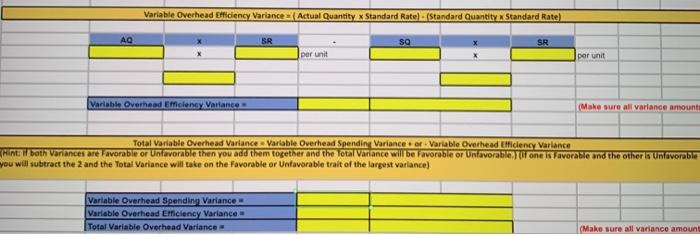

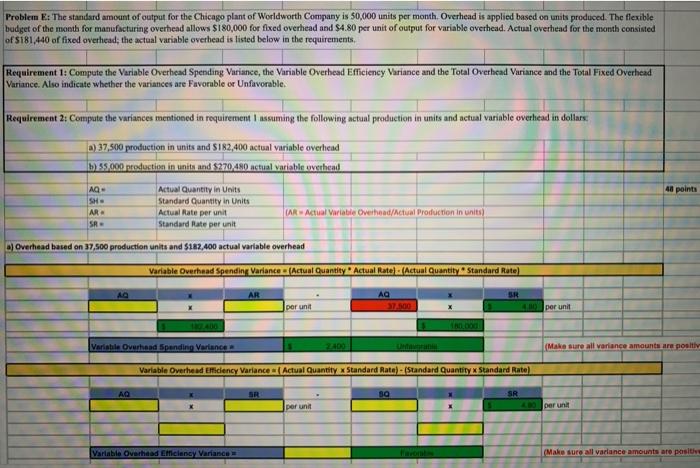

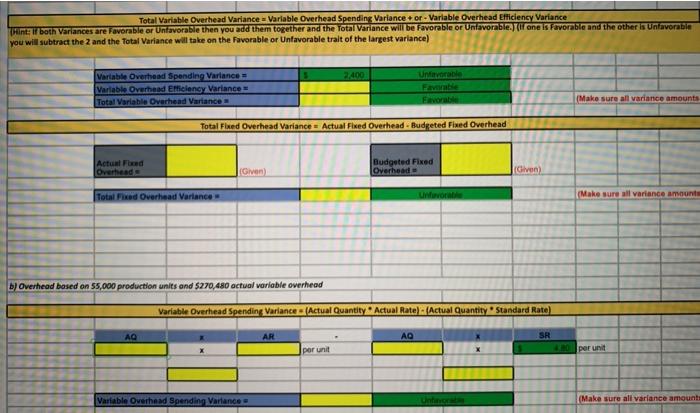

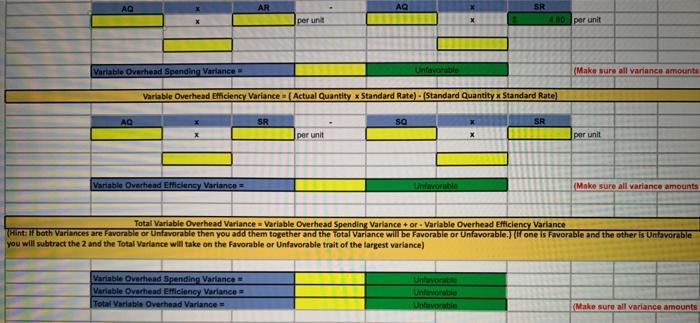

K Problem E: The standard amount of output for the Chicago plant of Worldworth Company is 50,000 units per month Overhead is applied based on units produced. The flexible budget of the month for manufacturing overhead allows $180,000 for fixed overhead and 54.80 per unit of output for variable overhead. Actual overhead for the month consisted of $181.440 of fixed overhead; the actual variable overhead is listed below in the requirements Requirement 1: Compute the Variable Overhead Spending Variance, the Variable Overhead Efficiency Variance and the Total Overhead Variance and the Total Fixed Overhead Variance. Also indicate whether the variances are Favorable or Unfavorable Requirement 2: Compute the variances mentioned in requirement lassunting the following actual production in units and actual variable overhead in dollars: a) 37.500 production in units and 5182,400 actual variable overhead b) 55.000 production in units and $270,480 actual variable overhead 18 AQ SHE AR SR Actual Quantity in Units Standard Quantity in Units Actual Rate per unit Standard Rate per unit IAR Actual Variable Overhead/Actual Production in units) b) Overhead based on 37,500 production units and $182,400 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Ratel - (Actual Quantity Standard Rate) AQ AR AQ SR 480 per unit per unit 3 102 400 T80.000 Variable Overhead Spending Variance Make sure all variance amounts are Variable Overhead Effidency Variance Actual Quantity Standard Rate) (Standard Quantity Standard Rate) SR SO SR 480 per unit per unit Variable Overhead Emclancy Variance Favoratie (Make sure all variance amounts are Total Variable Overhead Variance Variable Overhead Spending Variance of Variable Overhead Efficiency Variance (Hint: I both Variances are favorable or Unfavorable then you add them together and the Total Variance will be Favorable or Unfavorable.)f one is Favorable and the other is unfavorable you will subtract the 2 and the Total Variance will take on the Favorable or Unfavorable trait of the largest variance) Variable Overhead Spending Variance = Variable Overhead Efficiency Variance Total Variable Overhead Variance = (Make sure all variance amounts Total Fixed Overhead Variance - Actual Fixed Overhead - Budgeted Fixed Overhead Actual Fixed Overhead Budgeted Fixed Overhead Given) (Given) Total Fixed Overhead Variance Unfavorable (Make sure all variance amount A) Overhead based on 55,000 production units and $270,480 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Rate) - (Actual Quantity Standard Rate) AQ AR AQ SR per unit per un Variable Overhead Spending Variance - (Make sure all variance amount Variable Overhead Efficiency Variance Actual Quantity x Standard Rate). Standard Quantity Standard Rate) AQ SR so SR per unit per unit Variable Overhead Miciency Variance (Make sure all variance amount Total Variable Overhead Variance Variable Overhead Spending Variance of Variable Overhead Efficiency Variance in both Variances are avorable or Unfavorable then you add them together and the Total Variance will be avorable or Unfavorable it one is favorable and the other is unfavorable you will subtract the 2 and the Total Variance will take on the favorable or Unfavorable trait of the largest variance) Variable Overhead Spending Variances Variable Overhead Efficiency Variance Total Variable Overhead Variance (Make sure all variance amount Problem E: The standard amount of output for the Chicago plant of Worldworth Company is 50,000 units per month Overhead is applied based on units produced. The flexible budget of the month for manufacturing overhead allows $180,000 for fixed overhead and $4.80 per unit of output for variable overhead. Actual overhead for the month consisted of S181.440 of fixed overhead, the actual variable overhead is listed below in the requirements. Requirement 1: Compute the Variable Overhead Spending Variance, the Variable Overhead Efficiency Variance and the Total Overhead Variance and the Total Fixed Overhead Variance. Also indicate whether the variances are Favorable or Unfavorable. Requirement 2: Compute the variances mentioned in requirement I assuming the following actual production in units and actual variable overhead in dollars 6) 37,500 production in units and S182,400 actual variable overhead b) 55.000 production in units and $270 480 actual variable avsthead 40 points AQ- SH AR SR Actual Quantity in Units Standard Quantity in Units Actual Rate per unit Standard Rate per unit (ARActual Variable Overhead/Actual Production in units) Overhead based on 37,500 production units and $182,400 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Rate). (Actual Quantity Standard Rate) AG AR AQ per una 40 per unit Variable Overhead Spending Variance Make sure all variance amounts are positiv Variable Overhead Eiciency Variance Actual Quantity x Standard Rate) - (Standard Quantityx Standard Ratel AQ SR 39 SR per unit per unit Variable Overhead Emiciency Variance (Make sure all variance amounts aro pasiti Total Variable Overhead Variance Variable Overhead Spending Variance + or - Variable Overhead Efficiency Variance Hint: I both variances are Favorable or Unfavorable then you add them together and the Total Variance will be favorable or Untavorable. (one is favorable and the other is unfavorable you will subtract the 2 and the Total Variance will take on the favorable or Unfavorable trait of the largest variance) 2.400 Until Variable Overhead Spending Variances Variable Overhead Emiciency Variances Total Variable Overhead Variance Favorable (Make sure all variance amounts Total Fixed Overhead Variance - Actual Fixed Overhead - Budreted Fixed Overhead Actual Food Overheads Budgeted Fixed Overhead Given Given Total Fixed Overhead Variance Una (Make sure all variance amount b) Overhead based on 55,000 production units and $270,480 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Rate). (Actual Quantity Standard Rate) AQ AR AQ SR per unit O per unit Variable Overhead Spending Variance (Make sure all variance amount AD AR SR 40 per unit per unit Variable Overhead Spending Variance Unfavorable Make sure all variance amounts Variable Overhead Efficiency. Variance (Actual Quantity x Standard Rate) Standard Quantityx Standard Rate) AQ SR sa SR per unit per unit Variable Overhend Efficiency Variance = (Make sure all variance amounts Total Variable Overhead Variance = Variable Overhead Spending Variance + or - Variable Overhead Efficiency Variance Hint: if both Variances are favorable or Unfavorable then you add them together and the Total Variance will be Favorable or Unfavorable. (if one is Favorable and the other is Unfavorable you will subtract the 2 and the Total Variance will take on the favorable or Unfavorable trait of the largest variance) Variable Overhead Spending Variance Variable Overhead Efficiency Variance Total Variable Overhead Variance Untevorable navorable (Make sure all variance amounts K Problem E: The standard amount of output for the Chicago plant of Worldworth Company is 50,000 units per month Overhead is applied based on units produced. The flexible budget of the month for manufacturing overhead allows $180,000 for fixed overhead and 54.80 per unit of output for variable overhead. Actual overhead for the month consisted of $181.440 of fixed overhead; the actual variable overhead is listed below in the requirements Requirement 1: Compute the Variable Overhead Spending Variance, the Variable Overhead Efficiency Variance and the Total Overhead Variance and the Total Fixed Overhead Variance. Also indicate whether the variances are Favorable or Unfavorable Requirement 2: Compute the variances mentioned in requirement lassunting the following actual production in units and actual variable overhead in dollars: a) 37.500 production in units and 5182,400 actual variable overhead b) 55.000 production in units and $270,480 actual variable overhead 18 AQ SHE AR SR Actual Quantity in Units Standard Quantity in Units Actual Rate per unit Standard Rate per unit IAR Actual Variable Overhead/Actual Production in units) b) Overhead based on 37,500 production units and $182,400 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Ratel - (Actual Quantity Standard Rate) AQ AR AQ SR 480 per unit per unit 3 102 400 T80.000 Variable Overhead Spending Variance Make sure all variance amounts are Variable Overhead Effidency Variance Actual Quantity Standard Rate) (Standard Quantity Standard Rate) SR SO SR 480 per unit per unit Variable Overhead Emclancy Variance Favoratie (Make sure all variance amounts are Total Variable Overhead Variance Variable Overhead Spending Variance of Variable Overhead Efficiency Variance (Hint: I both Variances are favorable or Unfavorable then you add them together and the Total Variance will be Favorable or Unfavorable.)f one is Favorable and the other is unfavorable you will subtract the 2 and the Total Variance will take on the Favorable or Unfavorable trait of the largest variance) Variable Overhead Spending Variance = Variable Overhead Efficiency Variance Total Variable Overhead Variance = (Make sure all variance amounts Total Fixed Overhead Variance - Actual Fixed Overhead - Budgeted Fixed Overhead Actual Fixed Overhead Budgeted Fixed Overhead Given) (Given) Total Fixed Overhead Variance Unfavorable (Make sure all variance amount A) Overhead based on 55,000 production units and $270,480 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Rate) - (Actual Quantity Standard Rate) AQ AR AQ SR per unit per un Variable Overhead Spending Variance - (Make sure all variance amount Variable Overhead Efficiency Variance Actual Quantity x Standard Rate). Standard Quantity Standard Rate) AQ SR so SR per unit per unit Variable Overhead Miciency Variance (Make sure all variance amount Total Variable Overhead Variance Variable Overhead Spending Variance of Variable Overhead Efficiency Variance in both Variances are avorable or Unfavorable then you add them together and the Total Variance will be avorable or Unfavorable it one is favorable and the other is unfavorable you will subtract the 2 and the Total Variance will take on the favorable or Unfavorable trait of the largest variance) Variable Overhead Spending Variances Variable Overhead Efficiency Variance Total Variable Overhead Variance (Make sure all variance amount Problem E: The standard amount of output for the Chicago plant of Worldworth Company is 50,000 units per month Overhead is applied based on units produced. The flexible budget of the month for manufacturing overhead allows $180,000 for fixed overhead and $4.80 per unit of output for variable overhead. Actual overhead for the month consisted of S181.440 of fixed overhead, the actual variable overhead is listed below in the requirements. Requirement 1: Compute the Variable Overhead Spending Variance, the Variable Overhead Efficiency Variance and the Total Overhead Variance and the Total Fixed Overhead Variance. Also indicate whether the variances are Favorable or Unfavorable. Requirement 2: Compute the variances mentioned in requirement I assuming the following actual production in units and actual variable overhead in dollars 6) 37,500 production in units and S182,400 actual variable overhead b) 55.000 production in units and $270 480 actual variable avsthead 40 points AQ- SH AR SR Actual Quantity in Units Standard Quantity in Units Actual Rate per unit Standard Rate per unit (ARActual Variable Overhead/Actual Production in units) Overhead based on 37,500 production units and $182,400 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Rate). (Actual Quantity Standard Rate) AG AR AQ per una 40 per unit Variable Overhead Spending Variance Make sure all variance amounts are positiv Variable Overhead Eiciency Variance Actual Quantity x Standard Rate) - (Standard Quantityx Standard Ratel AQ SR 39 SR per unit per unit Variable Overhead Emiciency Variance (Make sure all variance amounts aro pasiti Total Variable Overhead Variance Variable Overhead Spending Variance + or - Variable Overhead Efficiency Variance Hint: I both variances are Favorable or Unfavorable then you add them together and the Total Variance will be favorable or Untavorable. (one is favorable and the other is unfavorable you will subtract the 2 and the Total Variance will take on the favorable or Unfavorable trait of the largest variance) 2.400 Until Variable Overhead Spending Variances Variable Overhead Emiciency Variances Total Variable Overhead Variance Favorable (Make sure all variance amounts Total Fixed Overhead Variance - Actual Fixed Overhead - Budreted Fixed Overhead Actual Food Overheads Budgeted Fixed Overhead Given Given Total Fixed Overhead Variance Una (Make sure all variance amount b) Overhead based on 55,000 production units and $270,480 actual variable overhead Variable Overhead Spending Variance (Actual Quantity Actual Rate). (Actual Quantity Standard Rate) AQ AR AQ SR per unit O per unit Variable Overhead Spending Variance (Make sure all variance amount AD AR SR 40 per unit per unit Variable Overhead Spending Variance Unfavorable Make sure all variance amounts Variable Overhead Efficiency. Variance (Actual Quantity x Standard Rate) Standard Quantityx Standard Rate) AQ SR sa SR per unit per unit Variable Overhend Efficiency Variance = (Make sure all variance amounts Total Variable Overhead Variance = Variable Overhead Spending Variance + or - Variable Overhead Efficiency Variance Hint: if both Variances are favorable or Unfavorable then you add them together and the Total Variance will be Favorable or Unfavorable. (if one is Favorable and the other is Unfavorable you will subtract the 2 and the Total Variance will take on the favorable or Unfavorable trait of the largest variance) Variable Overhead Spending Variance Variable Overhead Efficiency Variance Total Variable Overhead Variance Untevorable navorable (Make sure all variance amounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts