Answered step by step

Verified Expert Solution

Question

1 Approved Answer

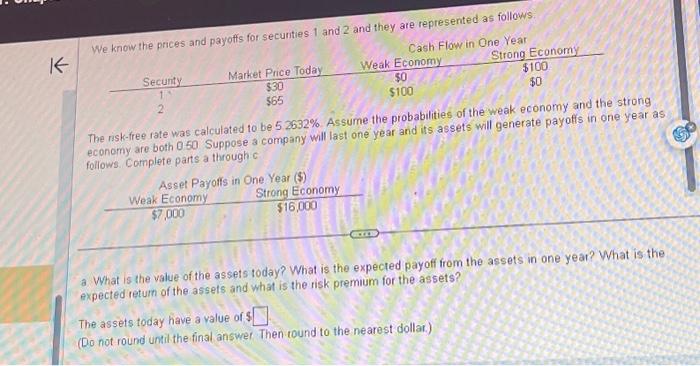

K We know the prices and payoffs for securities 1 and 2 and they are represented as follows. Cash Flow in One Year Strong Economy

K We know the prices and payoffs for securities 1 and 2 and they are represented as follows. Cash Flow in One Year Strong Economy Security 15 2 Market Price Today $30 $65 Asset Payoffs in One Year ($) Weak Economy $7,000 Weak Economy Strong Economy $16,000 $0 $100 The risk-free rate was calculated to be 5.2632%. Assume the probabilities of the weak economy and the strong economy are both 0.50 Suppose a company will last one year and its assets will generate payoffs in one year as follows. Complete parts a through c. $100 $0 a. What is the value of the assets today? What is the expected payoff from the assets in one year? What is the expected return of the assets and what is the risk premium for the assets? The assets today have value of $ (Do not round until the final answer. Then round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started