Question

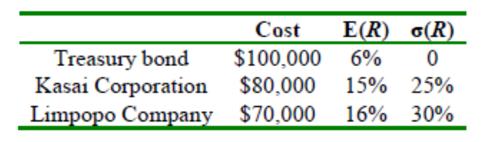

Kagera Company has made a portfolio of these three securities: The correlation coefficient between Kasai and Limpopo is 0.6. If the returns are normally distributed,

Kagera Company has made a portfolio of these three securities:

The correlation coefficient between Kasai and Limpopo is 0.6. If the returns are normally distributed, find the probability that the return of the portfolio is more than 15%.

Cost E(R) G(R) Treasury bond Kasai Corporation Limpopo Company $70,000 $100,000 $80,000 6% 15% 25% 16% 30%

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

So Probability of return more than 15 4105 AQ AR AS AT AU Cost E R Std dev weights re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

13th Edition

9780470374948, 470423684, 470374942, 978-0470423684

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App