Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kaila and Martin have been in partnership since January 2015. On 1st January 2020 K & M partnership brought its Thika factory into full

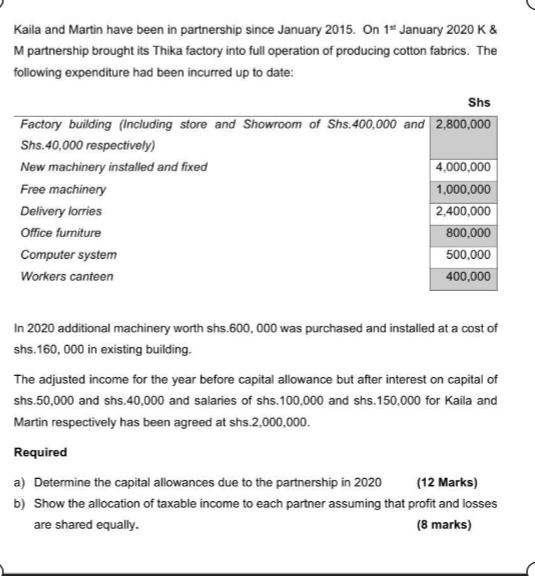

Kaila and Martin have been in partnership since January 2015. On 1st January 2020 K & M partnership brought its Thika factory into full operation of producing cotton fabrics. The following expenditure had been incurred up to date: Shs Factory building (Including store and Showroom of Shs.400,000 and 2,800,000 Shs.40,000 respectively) New machinery installed and fixed 4,000,000 Free machinery 1,000,000 Delivery lorries 2,400,000 Office furniture 800,000 Computer system 500,000 Workers canteen 400,000 In 2020 additional machinery worth shs.600,000 was purchased and installed at a cost of shs.160,000 in existing building. The adjusted income for the year before capital allowance but after interest on capital of shs.50,000 and shs.40,000 and salaries of shs.100,000 and shs.150,000 for Kaila and Martin respectively has been agreed at shs.2,000,000. Required a) Determine the capital allowances due to the partnership in 2020 (12 Marks) b) Show the allocation of taxable income to each partner assuming that profit and losses are shared equally. (8 marks)

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The capital allowances due to the partnership in 2020 would be Shs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started