Question

Entries for investments in bonds, interest, and sale of bonds Kalyagin Investments acquired $220,000 of Jerris Corp., 7% bonds at their face amount on

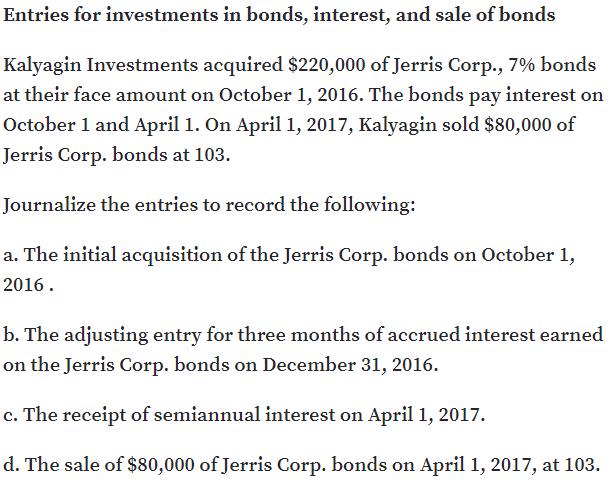

Entries for investments in bonds, interest, and sale of bonds Kalyagin Investments acquired $220,000 of Jerris Corp., 7% bonds at their face amount on October 1, 2016. The bonds pay interest on October 1 and April 1. On April 1, 2017, Kalyagin sold $80,000 of Jerris Corp. bonds at 103. Journalize the entries to record the following: a. The initial acquisition of the Jerris Corp. bonds on October 1, 2016. b. The adjusting entry for three months of accrued interest earned on the Jerris Corp. bonds on December 31, 2016. c. The receipt of semiannual interest on April 1, 2017. d. The sale of $80,000 of Jerris Corp. bonds on April 1, 2017, at 103.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Prepare the journal entry to record the following transacti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

13th edition

1285866304, 978-1285866307

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App