Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kamada: CIA Japan (A).Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or

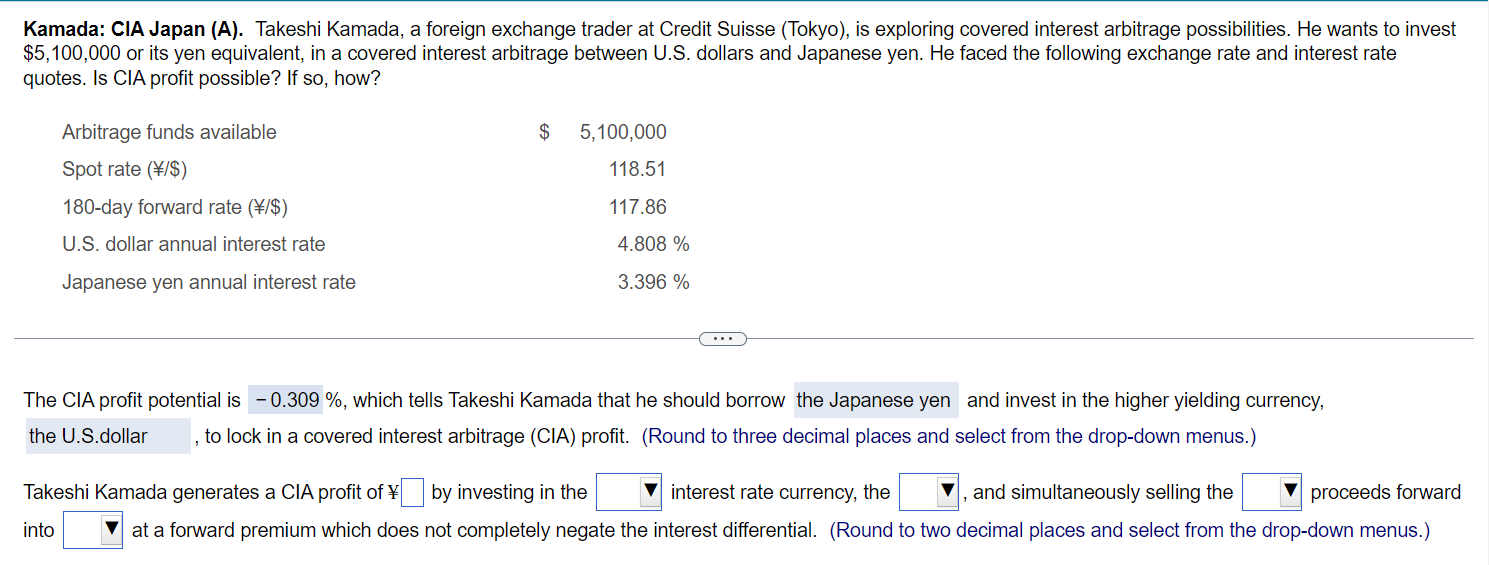

Kamada: CIA Japan (A).Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes. Is CIA profit possible? If so, how? Arbitrage funds available $ 5,100,000 Spot rate (/$) 118.51 180-day forward rate (/$) 117.86 U.S. dollar annual interest rate 4.808 % Japanese yen annual interest rate 3.396 %

Kamada: CIA Japan (A). Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes. Is CIA profit possible? If so, how? The CIA profit potential is \%, which tells Takeshi Kamada that he should borrow and invest in the higher yielding currency, to lock in a covered interest arbitrage (CIA) profit. (Round to three decimal places and select from the drop-down menus.) Takeshi Kamada generates a CIA profit of by investing in the interest rate currency, the , and simultaneously selling the proceeds forward into at a forward premium which does not completely negate the interest differential. (Round to two decimal places and select from the drop-down menus.)

Kamada: CIA Japan (A). Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage possibilities. He wants to invest $5,100,000 or its yen equivalent, in a covered interest arbitrage between U.S. dollars and Japanese yen. He faced the following exchange rate and interest rate quotes. Is CIA profit possible? If so, how? The CIA profit potential is \%, which tells Takeshi Kamada that he should borrow and invest in the higher yielding currency, to lock in a covered interest arbitrage (CIA) profit. (Round to three decimal places and select from the drop-down menus.) Takeshi Kamada generates a CIA profit of by investing in the interest rate currency, the , and simultaneously selling the proceeds forward into at a forward premium which does not completely negate the interest differential. (Round to two decimal places and select from the drop-down menus.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started