Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kamal and Su shared a house in Melbourne and had been buying Saturday Lotto tickets together for their entire friendship over two years. Sometimes

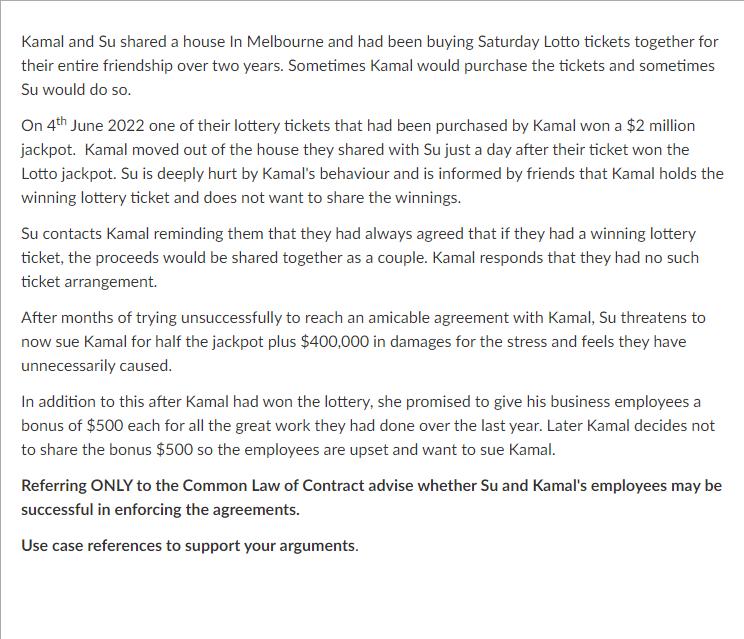

Kamal and Su shared a house in Melbourne and had been buying Saturday Lotto tickets together for their entire friendship over two years. Sometimes Kamal would purchase the tickets and sometimes Su would do so. On 4th June 2022 one of their lottery tickets that had been purchased by Kamal won a $2 million jackpot. Kamal moved out of the house they shared with Su just a day after their ticket won the Lotto jackpot. Su is deeply hurt by Kamal's behaviour and is informed by friends that Kamal holds the winning lottery ticket and does not want to share the winnings. Su contacts Kamal reminding them that they had always agreed that if they had a winning lottery ticket, the proceeds would be shared together as a couple. Kamal responds that they had no such ticket arrangement. After months of trying unsuccessfully to reach an amicable agreement with Kamal, Su threatens to now sue Kamal for half the jackpot plus $400,000 in damages for the stress and feels they have unnecessarily caused. In addition to this after Kamal had won the lottery, she promised to give his business employees a bonus of $500 each for all the great work they had done over the last year. Later Kamal decides not to share the bonus $500 so the employees are upset and want to sue Kamal. Referring ONLY to the Common Law of Contract advise whether Su and Kamal's employees may be successful in enforcing the agreements. Use case references to support your arguments.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Su and Kamals agreement to split the lottery winnings appears to be an oral agreement between friends which may be enforceable under contract l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started