Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kamet is an investment fund that invests on the Ghana Stock Exchange. In recent times the economy has gone through four different cycles which

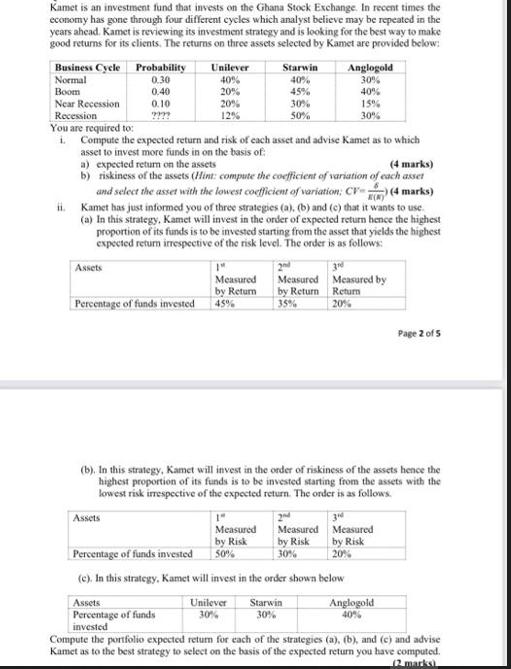

Kamet is an investment fund that invests on the Ghana Stock Exchange. In recent times the economy has gone through four different cycles which analyst believe may be repeated in the years ahead. Kamet is reviewing its investment strategy and is looking for the best way to make good returns for its clients. The returns on three assets selected by Kamet are provided below: Business Cycle Normal Boom Near Recession Probability 0.30 0.40 Assets 0.10 ???? Percentage of funds invested Assets Unilever 40% 20% 20% 12% Recession You are required to: i. Compute the expected return and risk of each asset and advise Kamet as to which asset to invest more funds in on the basis of: a) expected return on the assets (4 marks) b) riskiness of the assets (Hint: compute the coefficient of variation of each asset and select the asset with the lowest coefficient of variation; CV) (4 marks) ii. Kamet has just informed you of three strategies (a), (b) and (c) that it wants to use. (a) In this strategy, Kamet will invest in the order of expected return hence the highest proportion of its funds is to be invested starting from the asset that yields the highest expected return irrespective of the risk level. The order is as follows: Assets Percentage of funds invested 1" Measured by Return 45% Starwin 40% 45% 1" Measured by Risk 50% 30% 50% Unilever 30% Measured by Return 35% (b). In this strategy, Kamet will invest in the order of riskiness of the assets hence the highest proportion of its funds is to be invested starting from the assets with the lowest risk irrespective of the expected return. The order is as follows. Anglogold 30% 40% 15% 30% 2nd Measured by Risk 30% Starwin 30% 3rd Measured by Return 20% Percentage of funds invested (c). In this strategy, Kamet will invest in the order shown below. 3 Measured by Risk 20% Page 2 of 5 Anglogold 40% Compute the portfolio expected return for each of the strategies (a), (b), and (c) and advise Kamet as to the best strategy to select on the basis of the expected return you have computed. (2 marks)

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To compute the expected return and risk of each asset we need to multiply the probability of each bu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started