Question

Kamper Company, a Canadian public corporation, acquired the shares of Marto Limited, a Canadian privately owned corporation, on July 1, 2022, from an arms-length seller.

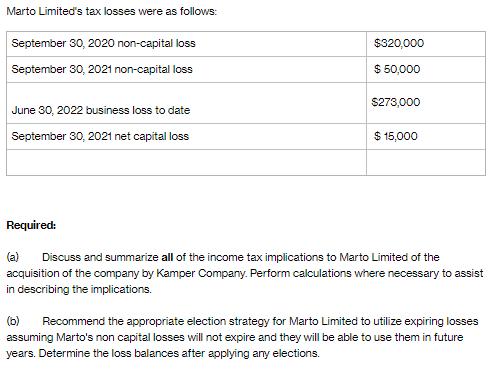

Kamper Company, a Canadian public corporation, acquired the shares of Marto Limited, a Canadian privately owned corporation, on July 1, 2022, from an arms-length seller. Marto Limited is a manufacturer of plastic ergonomic devices for the furniture industry. The management of Kamper Company purchased Marto Limited to expand the furniture components segment of its business into the plastic ergonomic products market. Kanpur Company has extensive experience in this industry and plans to make major operational changes to make Marto Limited very profitable. Both Kamper Company and Marto Limited have September 30 year-ends.

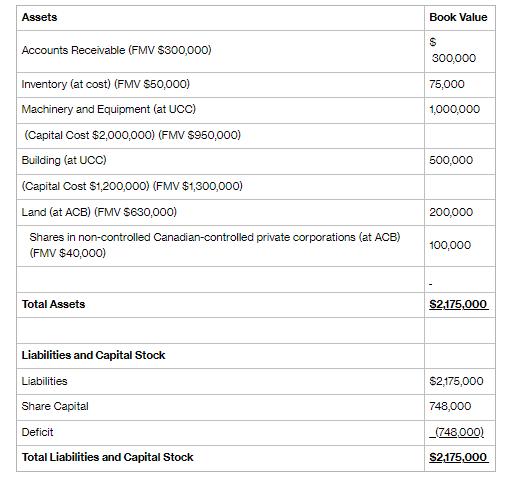

The balance sheet of Marto Limited as of June 30, 2022 was as follows:

Assets Accounts Receivable (FMV $300,000) Inventory (at cost) (FMV $50,000) Machinery and Equipment (at UCC) (Capital Cost $2,000,000) (FMV $950,000) Building (at UCC) (Capital Cost $1,200,000) (FMV $1,300,000) Land (at ACB) (FMV $630,000) Shares in non-controlled Canadian-controlled private corporations (at ACB) (FMV $40,000) Total Assets Liabilities and Capital Stock Liabilities Share Capital Deficit Total Liabilities and Capital Stock Book Value $ 300,000 75,000 1,000,000 500,000 200,000 100,000 $2,175,000 $2,175,000 748,000 _(748,000) $2,175,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Income Tax Implications for Marto Limited of the Acquisition by Kamper Company Change in Ownership The acquisition by Kamper Company represents a ch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started