Answered step by step

Verified Expert Solution

Question

1 Approved Answer

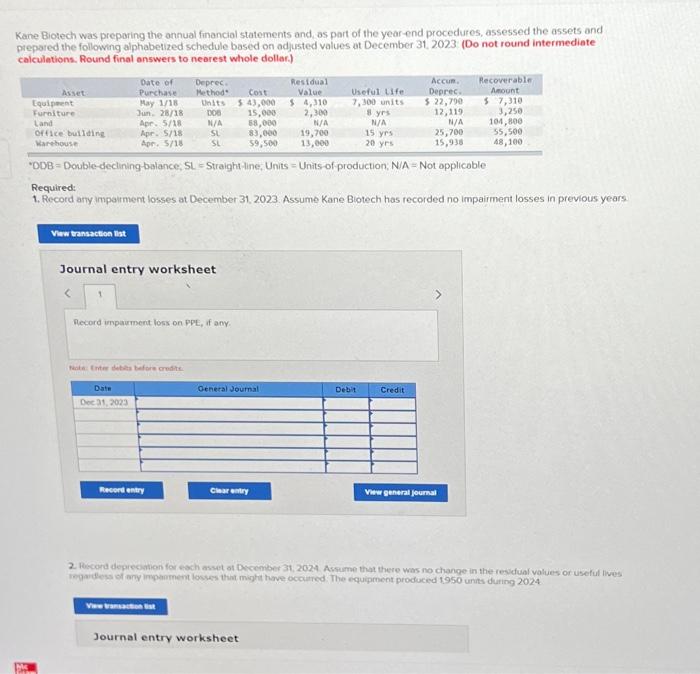

Kane Biotech was preparing the annual financial statements and, as part of the year-end procedures, assessed the assets and prepared the following alphabetized schedule based

Kane Biotech was preparing the annual financial statements and, as part of the year-end procedures, assessed the assets and prepared the following alphabetized schedule based on adjusted values at December 31, 2023: (Do not round intermediate calculations. Round final answers to nearest whole dollar.) Asset Me Equipment Furniture Land Office building Warehouse View transaction list Date of Purchase May 1/18 Jun. 28/18 Apr. 5/18 1 Apr. 5/18 Apr. 5/18 Journal entry worksheet Date Dec 31, 2023 Note: Enter debits before credits. Deprec. Method" Units DOB Record impairment loss on PPE, if any. N/A SL SL *DDB =Double-declining-balance, SL-Straight-line, Units Units-of-production, N/A = Not applicable Required: 1. Record any impairment losses at December 31, 2023. Assume Kane Biotech has recorded no impairment losses in previous years. Record entry View transaction list Cost $ 43,000 15,000 88,000 83,000 59,500 General Journal Clear entry Residual Value $ 4,310 2,300 N/A 19,700 13,000 Useful Life 7,300 units 8 yrs N/A Journal entry worksheet 15 yrs 20 yrs Debit Accum. Deprec.. $ 22,790 12,119 N/A 25,700 15,938 Credit Recoverable Amount $ 7,310 3,250 104,800 55,500 48,100 View general journal 2. Record depreciation for each asset at December 31, 2024. Assume that there was no change in the residual values or useful lives regardless of any impairment losses that might have occurred. The equipment produced 1,950 units during 2024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started