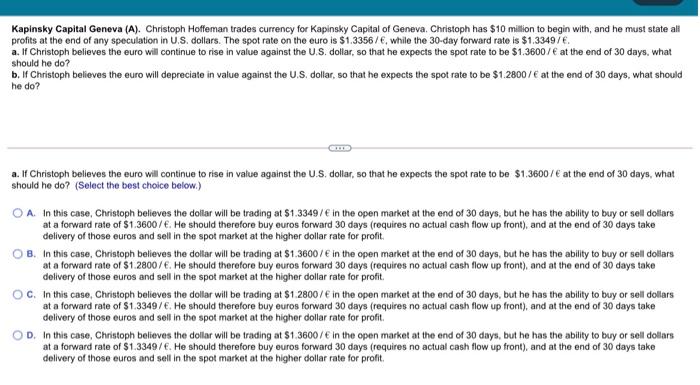

Kapinsky Capital Geneva (A). Christoph Hoffeman trades currency for Kapinsky Capital of Geneva. Christoph has $10 million to begin with, and he must state alt profits at the end of any speculation in U.S. dollars. The spot rate on the euro is $1.3356/, while the 30-day forward rate is $1.33497. a. If Christoph believes the euro will continue to rise in value against the U.S. dollar, so that he expects the spot rate to be $1.3600/ at the end of 30 days. what should he do? b. If Christoph believes the euro will depreciate in value against the U.S. dollar, so that he expects the spot rate to be $1.2800/ at the end of 30 days, what should he do? a. If Christoph believes the euro will continue to rise in value against the U.S. dollar, so that he expects the spot rate to be $1.3600/ at the end of 30 days, what should he do? (Select the best choice below.) O A. In this case, Christoph believes the dollar will be trading at $1.3349/ in the open market at the end of 30 days, but he has the ability to buy or sell dollars at a forward rate of $1.3600/. He should therefore buy euros forward 30 days (requires no actual cash flow up front), and at the end of 30 days take delivery of those euros and sell in the spot market at the higher dollar rate for profit OB. In this case, Christoph believes the dollar will be trading at $1.3600/ in the open market at the end of 30 days, but he has the ability to buy or sell dollars at a forward rate of 51.2800/. He should therefore buy euros forward 30 days (requires no actual cash flow up front), and at the end of 30 days take delivery of those euros and sell in the spot market at the higher dollar rate for profit OC. In this case, Christoph believes the dollar will be trading at $1.2800/ in the open market at the end of 30 days, but he has the ability to buy or sell dollars at a forward rate of $1.3349/. He should therefore buy euros forward 30 days (requires no actual cash flow up front), and at the end of 30 days take delivery of those euros and sell in the spot market at the higher dollar rate for profit. OD. In this case, Christoph believes the dollar will be trading at $1.3600/ in the open market at the end of 30 days, but he has the ability to buy or sell dollars at a forward rate of $1.3349/. He should therefore buy euros forward 30 days (requires no actual cash flow up front), and at the end of 30 days take delivery of those euros and sell in the spot market at the higher dollar rate for profit