Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kaplan | Home GU Fine 217860?module_item_id=833172 KKaplan Online Cour... G affiliate.kapre.com/... Leadership Profile -... BEAN SUPERSTORE Comparative Income Statement Year Ended December 31, 2017,

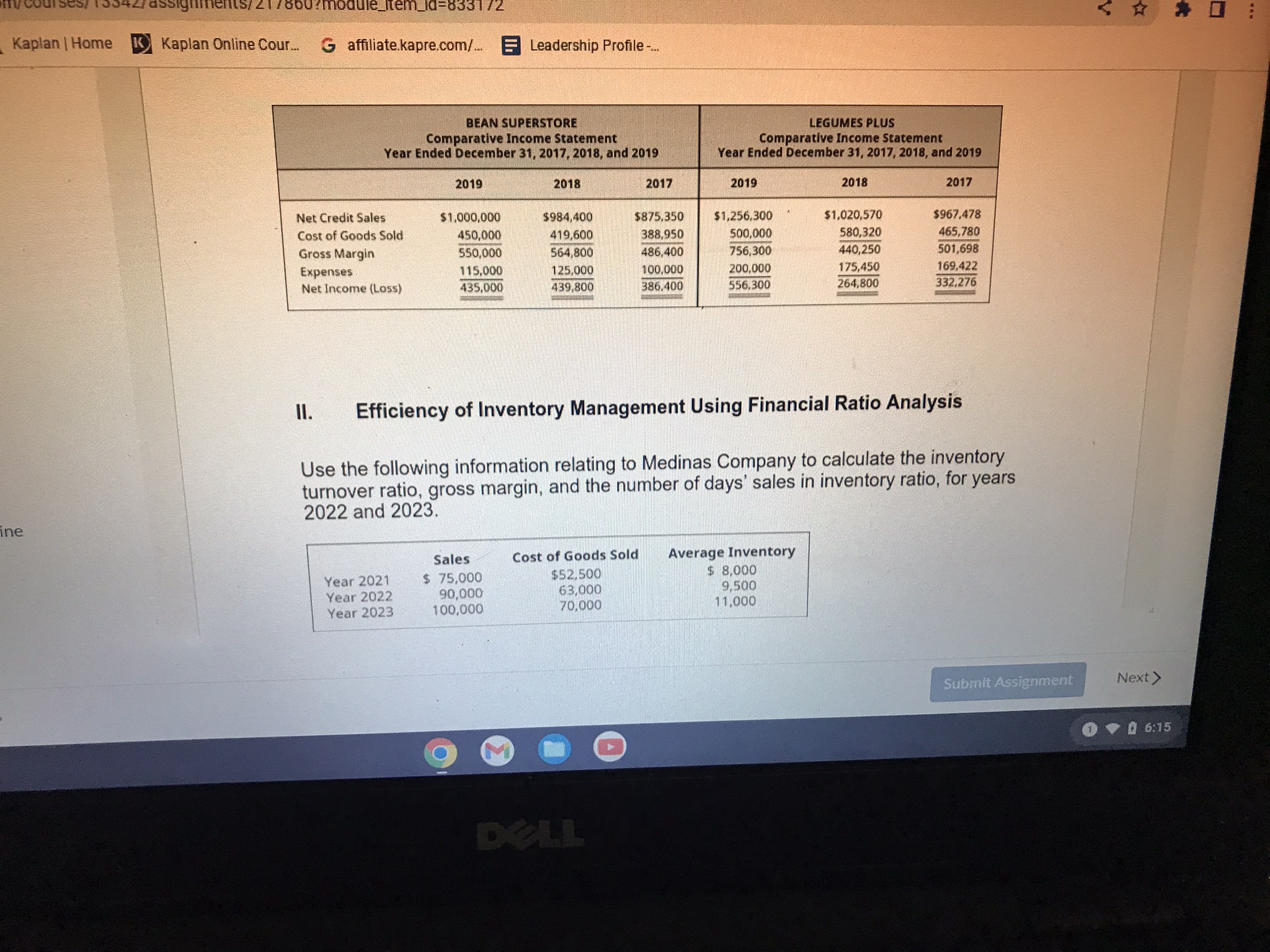

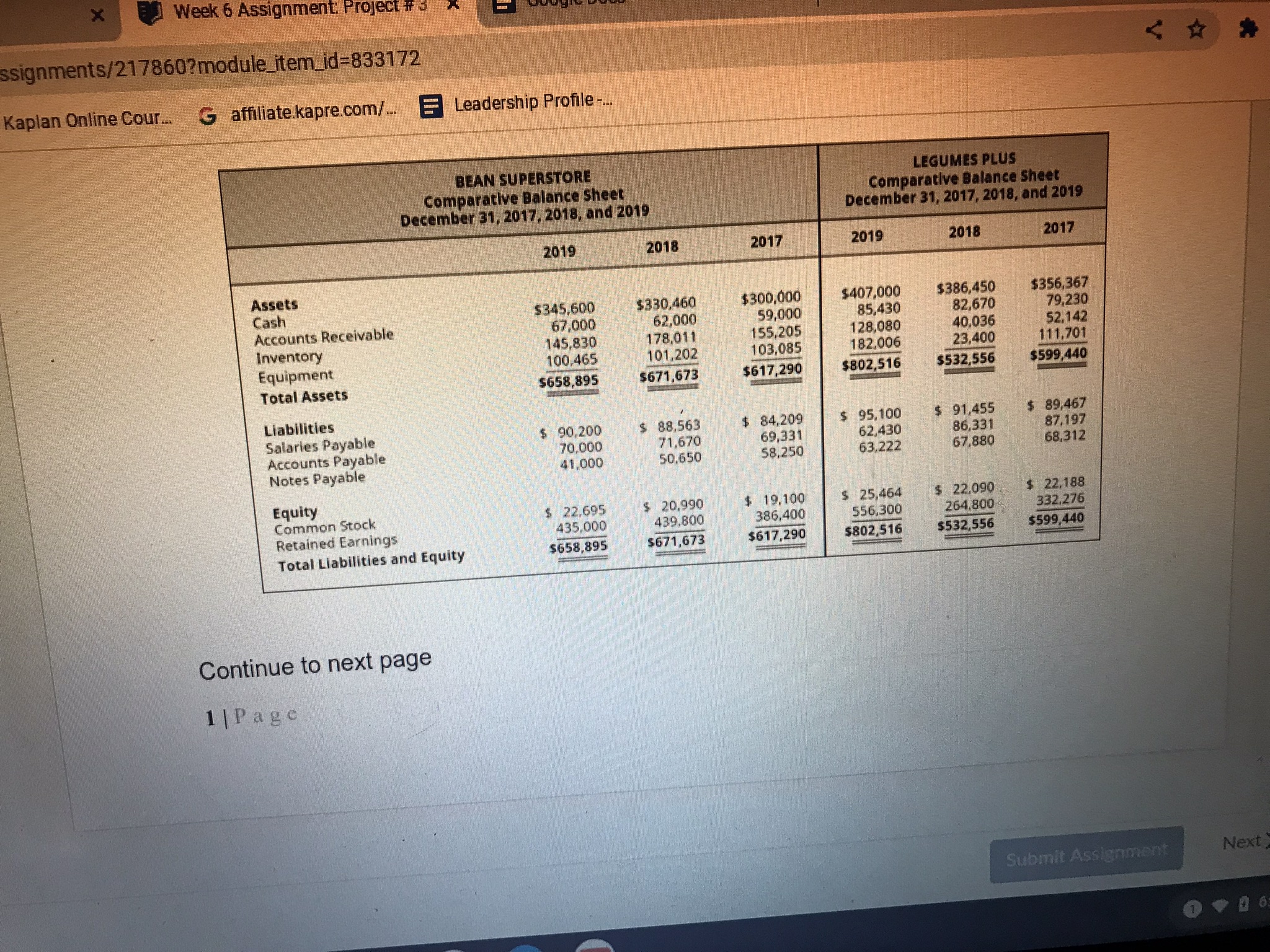

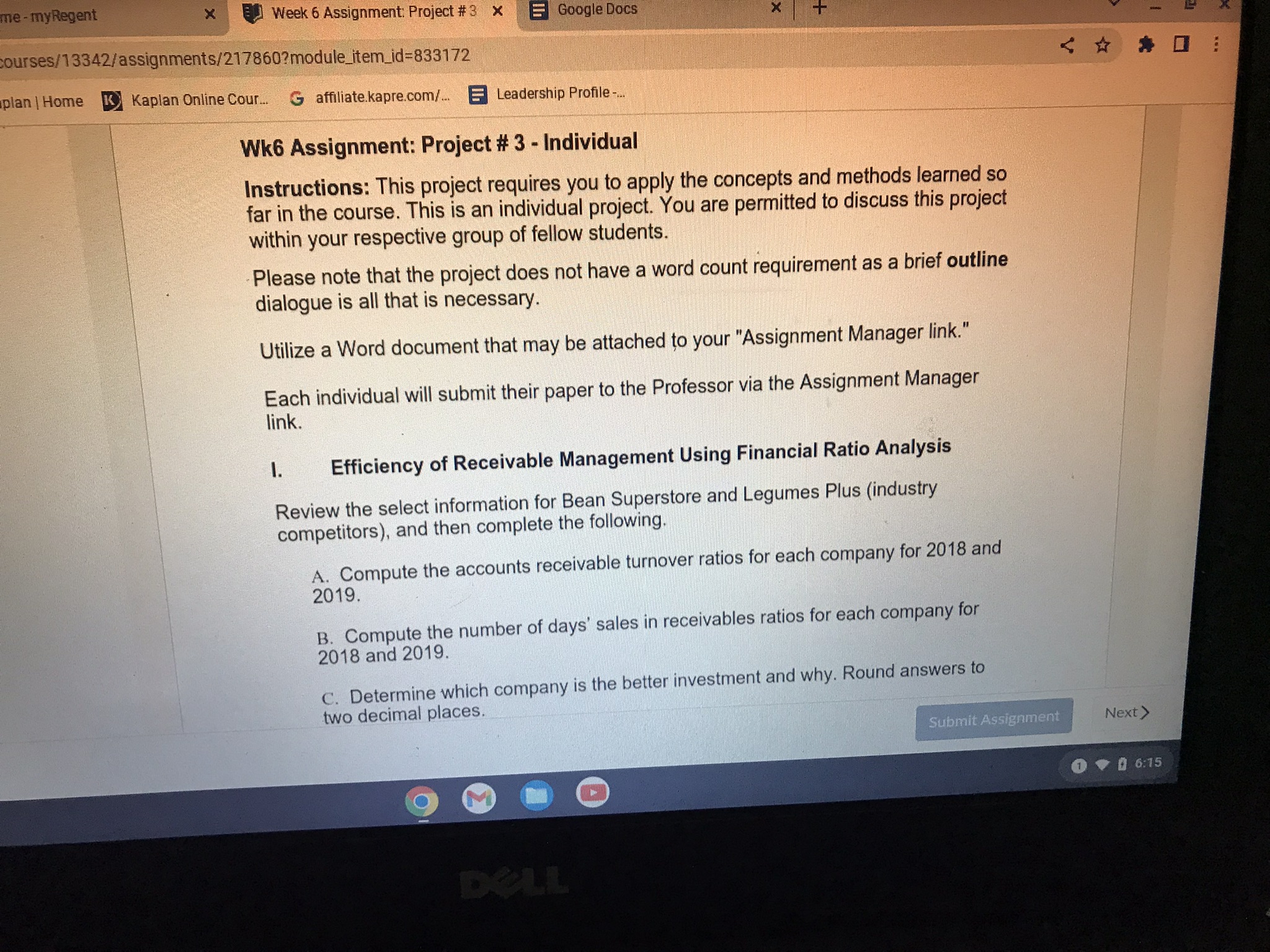

Kaplan | Home GU Fine 217860?module_item_id=833172 KKaplan Online Cour... G affiliate.kapre.com/... Leadership Profile -... BEAN SUPERSTORE Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 LEGUMES PLUS Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 2019 2018 2017 2019 2018 2017 Net Credit Sales $1,000,000 $984,400 Cost of Goods Sold 450,000 419,600 $875,350 388,950 $1,256,300 $1,020,570 $967,478 500,000 580,320 465,780 Gross Margin Expenses 550,000 564,800 486,400 756,300 440,250 501,698 115,000 125,000 100,000 200,000 175,450 169,422 Net Income (Loss) 435,000 439,800 386,400 556,300 264,800. 332,276 II. Efficiency of Inventory Management Using Financial Ratio Analysis Use the following information relating to Medinas Company to calculate the inventory turnover ratio, gross margin, and the number of days' sales in inventory ratio, for years 2022 and 2023. Sales Year 2021 $ 75,000 Year 2022 90,000 Year 2023 100,000 Cost of Goods Sold $52,500 63,000 70,000 Average Inventory $ 8,000 9,500 11,000 DELL * Submit Assignment Next > 6:15 Week 6 Assignment: Project #3 ssignments/217860?module_item_id=833172 Kaplan Online Cour... Gaffiliate.kapre.com/... Leadership Profile -... Assets BEAN SUPERSTORE Comparative Balance Sheet December 31, 2017, 2018, and 2019 2019 LEGUMES PLUS Comparative Balance Sheet December 31, 2017, 2018, and 2019 2018 2017 2019 2018 2017 Cash $345,600 $330,460 $300,000 $407,000 $386,450 $356,367 Accounts Receivable 67,000 62,000 59,000 85,430 82,670 79,230 Inventory 145,830 178,011 155,205 128,080 40,036 52,142 Equipment 100,465 101,202 103,085 182,006 23,400 111,701 $658,895 $671,673 $617,290 $802,516 $532,556 $599,440 Total Assets Liabilities Salaries Payable Accounts Payable Notes Payable Equity $ 90,200 70,000 41,000 $ 88,563 71,670 50,650 $ 84,209 69,331 58,250 $ 95,100 62,430 63,222 $ 91,455 86,331 67,880 $ 89,467 87,197 68,312 Common Stock Retained Earnings Total Liabilities and Equity $ 22,695 435,000 $658,895 $ 20,990 439.800 $671,673 $ 19,100 386,400 $617,290 $ 25,464 556,300 $802,516 $ 22,090 264,800 $532,556 $ 22,188 332,276 $599,440 Continue to next page 1| Page < * Submit Assignment Next me-myRegent Week 6 Assignment: Project # 3 Google Docs X Courses/13342/assignments/217860?module_item_id=833172 plan | Home Kaplan Online Cour... + G affiliate.kapre.com/... Leadership Profile -... Wk6 Assignment: Project #3 - Individual Instructions: This project requires you to apply the concepts and methods learned so far in the course. This is an individual project. You are permitted to discuss this project within your respective group of fellow students. Please note that the project does not have a word count requirement as a brief outline dialogue is all that is necessary. Utilize a Word document that may be attached to your "Assignment Manager link." Each individual will submit their paper to the Professor via the Assignment Manager link. 1. Efficiency of Receivable Management Using Financial Ratio Analysis Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days' sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places. DELL Submit Assignment Next > 6:15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started