Question

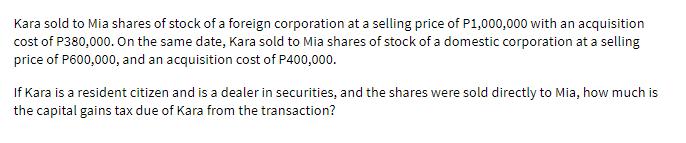

Kara sold to Mia shares of stock of a foreign corporation at a selling price of P1,000,000 with an acquisition cost of P380,000. On

Kara sold to Mia shares of stock of a foreign corporation at a selling price of P1,000,000 with an acquisition cost of P380,000. On the same date, Kara sold to Mia shares of stock of a domestic corporation at a selling price of P600,000, and an acquisition cost of P400,000. If Kara is a resident citizen and is a dealer in securities, and the shares were sold directly to Mia, how much is the capital gains tax due of Kara from the transaction?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

For the capital gains tax due of Kara from the transaction the calculation is as follows Foreign Cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Valuation The Art and Science of Corporate Investment Decisions

Authors: Sheridan Titman, John D. Martin

3rd edition

133479528, 978-0133479522

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App