Answered step by step

Verified Expert Solution

Question

1 Approved Answer

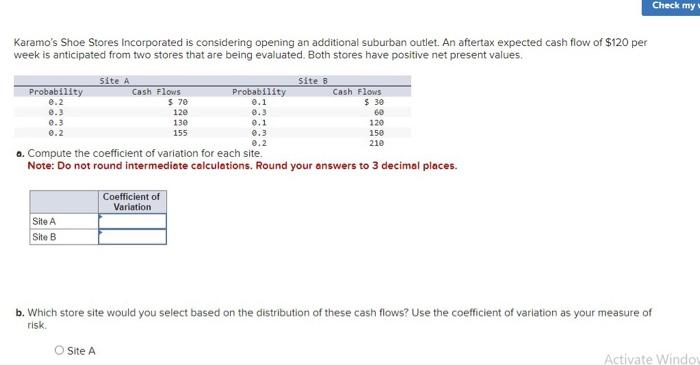

Karamo's Shoe Stores Incorporated is considering opening an additional suburban outlet. An aftertax expected cash flow of $120 per week is anticipated from two stores

Karamo's Shoe Stores Incorporated is considering opening an additional suburban outlet. An aftertax expected cash flow of $120 per week is anticipated from two stores that are being evaluated. Both stores have positive net present values. Probability 0.2 0.3 0.3 0.2 Site A Site B Site A Cash Flows $70 120 130 155 O Site A Probability 0.1 0.3 0.1 0.3 0.2 a. Compute the coefficient of variation for each site. Note: Do not round intermediate calculations. Round your answers to 3 decimal places. Coefficient of Variation Site B O Cash Flows $30 60 120 150 210 Check my b. Which store site would you select based on the distribution of these cash flows? Use the coefficient of variation as your measure of risk. Activate Window

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started