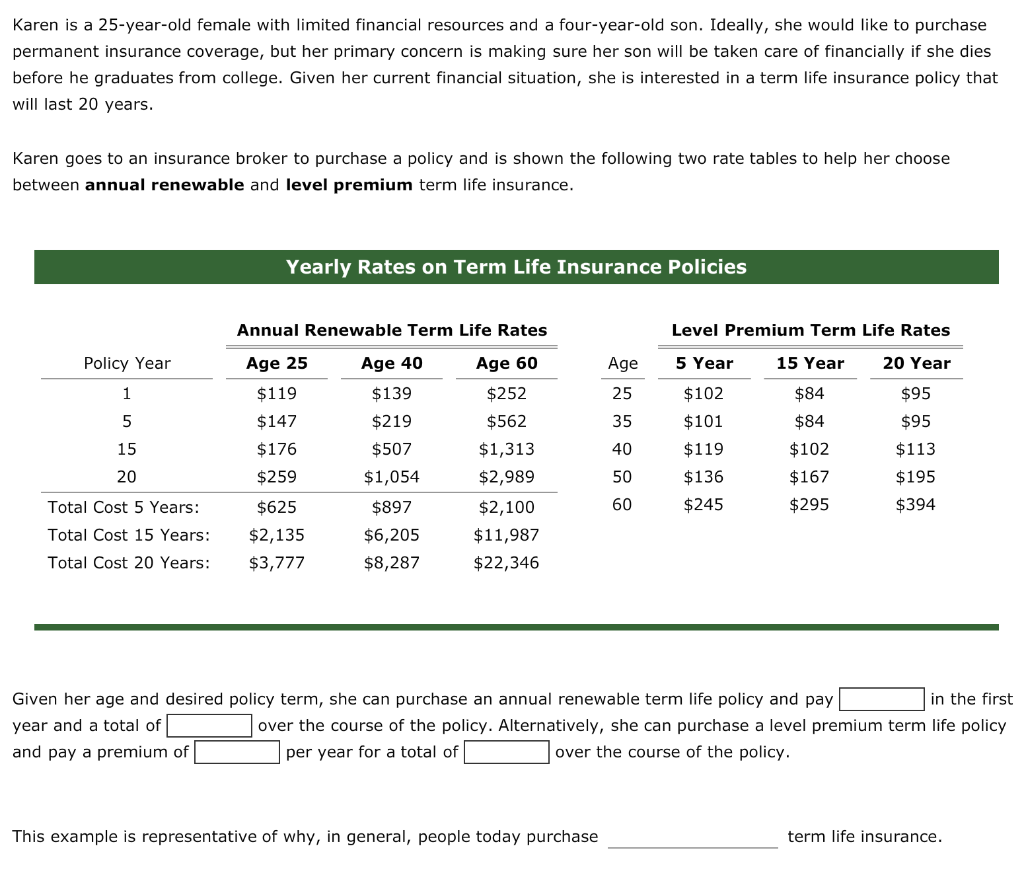

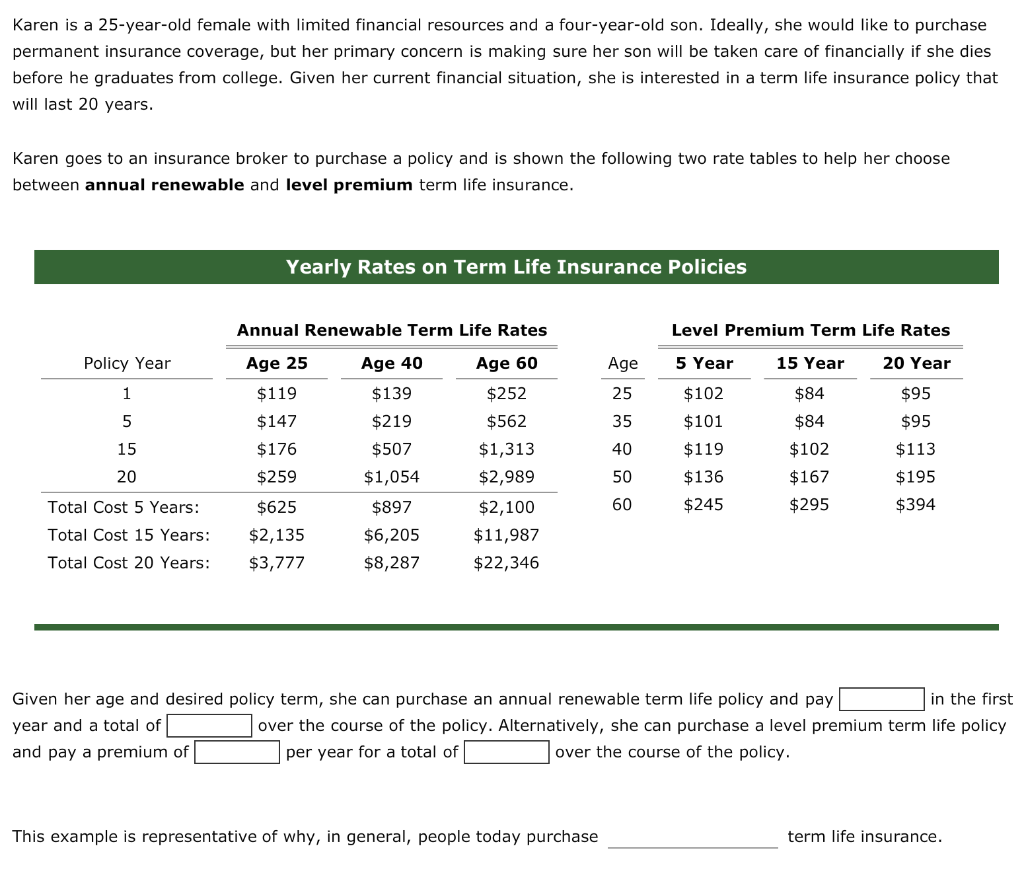

Karen is a 25-year-old female with limited financial resources and a four-year-old son. Ideally, she would like to purchase permanent insurance coverage, but her primary concern is making sure her son will be taken care of financially if she dies before he graduates from college. Given her current financial situation, she is interested in a term life insurance policy that will last 20 years. Karen goes to an insurance broker to purchase a policy and is shown the following two rate tables to help her choose between annual renewable and level premium term life insurance. Yearly Rates on Term Life Insurance Policies Annual Renewable Term Life Rates Level Premium Term Life Rates Policy Year Age 40 Age 60 Age 15 Year 20 Year $252 Age 25 $119 $147 $176 $259 25 35 $139 $219 $507 $1,054 $897 $6,205 $8,287 5 Year $102 $101 $119 $136 $245 $562 $1,313 $2,989 $2,100 $11,987 $22,346 $84 $84 $102 $167 $295 20 $95 $95 $113 $195 $394 60 Total Cost 5 Years: Total Cost 15 Years: Total Cost 20 Years: $625 $2,135 $3,777 Given her age and desired policy term, she can purchase an annual renewable term life policy and pay in the first year and a total of | over the course of the policy. Alternatively, she can purchase a level premium term life policy and pay a premium of per year for a total of c o ver the course of the policy. This example is representative of why, in general, people today purchase term life insurance. Karen is a 25-year-old female with limited financial resources and a four-year-old son. Ideally, she would like to purchase permanent insurance coverage, but her primary concern is making sure her son will be taken care of financially if she dies before he graduates from college. Given her current financial situation, she is interested in a term life insurance policy that will last 20 years. Karen goes to an insurance broker to purchase a policy and is shown the following two rate tables to help her choose between annual renewable and level premium term life insurance. Yearly Rates on Term Life Insurance Policies Annual Renewable Term Life Rates Level Premium Term Life Rates Policy Year Age 40 Age 60 Age 15 Year 20 Year $252 Age 25 $119 $147 $176 $259 25 35 $139 $219 $507 $1,054 $897 $6,205 $8,287 5 Year $102 $101 $119 $136 $245 $562 $1,313 $2,989 $2,100 $11,987 $22,346 $84 $84 $102 $167 $295 20 $95 $95 $113 $195 $394 60 Total Cost 5 Years: Total Cost 15 Years: Total Cost 20 Years: $625 $2,135 $3,777 Given her age and desired policy term, she can purchase an annual renewable term life policy and pay in the first year and a total of | over the course of the policy. Alternatively, she can purchase a level premium term life policy and pay a premium of per year for a total of c o ver the course of the policy. This example is representative of why, in general, people today purchase term life insurance