Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are

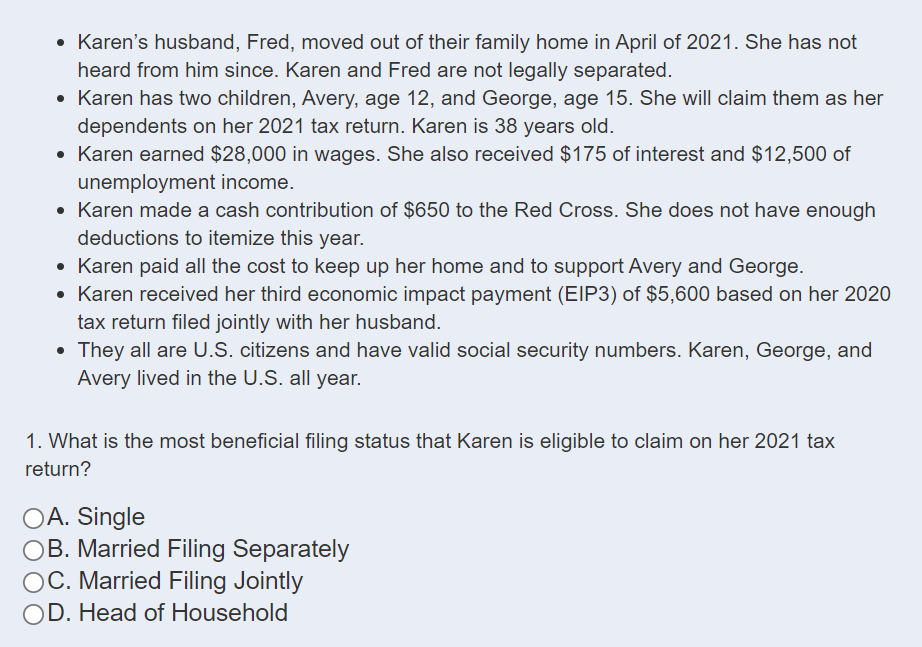

Karen's husband, Fred, moved out of their family home in April of 2021. She has not heard from him since. Karen and Fred are not legally separated. Karen has two children, Avery, age 12, and George, age 15. She will claim them as her dependents on her 2021 tax return. Karen is 38 years old. Karen earned $28,000 in wages. She also received $175 of interest and $12,500 of unemployment income. Karen made a cash contribution of $650 to the Red Cross. She does not have enough deductions to itemize this year. Karen paid all the cost to keep up her home and to support Avery and George. Karen received her third economic impact payment (EIP3) of $5,600 based on her 2020 tax return filed jointly with her husband. They all are U.S. citizens and have valid social security numbers. Karen, George, and Avery lived in the U.S. all year. 1. What is the most beneficial filing status that Karen is eligible to claim on her 2021 tax return? OA. Single OB. Married Filing Separately OC. Married Filing Jointly OD. Head of Household

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer is Option D Explanation is as follow The most ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started