Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kari Davis started an accounting and tax preparation business December 1, 2021. She had been operating the business casually on a part-time basis from

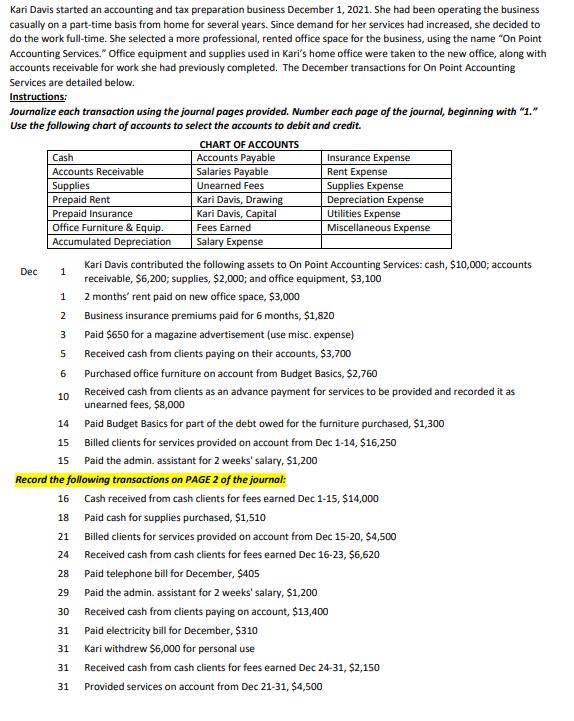

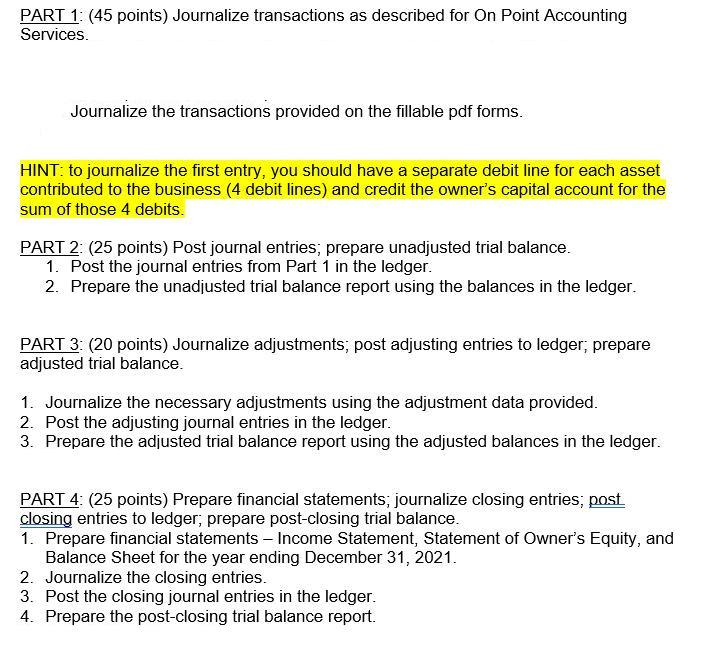

Kari Davis started an accounting and tax preparation business December 1, 2021. She had been operating the business casually on a part-time basis from home for several years. Since demand for her services had increased, she decided to do the work full-time. She selected a more professional, rented office space for the business, using the name "On Point Accounting Services." Office equipment and supplies used in Kari's home office were taken to the new office, along with accounts receivable for work she had previously completed. The December transactions for On Point Accounting Services are detailed below. Instructions: Journalize each transaction using the journal pages provided. Number each page of the journal, beginning with "1." Use the following chart of accounts to select the accounts to debit and credit. Dec Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Furniture & Equip. Accumulated Depreciation 1 1 2 3 5 6 CHART OF ACCOUNTS Accounts Payable Salaries Payable Unearned Fees 10 Kari Davis, Drawing Kari Davis, Capital Fees Earned Salary Expense Insurance Expense Rent Expense Supplies Expense Depreciation Expense Utilities Expense Miscellaneous Expense Kari Davis contributed the following assets to On Point Accounting Services: cash, $10,000; accounts receivable, $6,200; supplies, $2,000; and office equipment, $3,100 2 months' rent paid on new office space, $3,000 Business insurance premiums paid for 6 months, $1,820 Paid $650 for a magazine advertisement (use misc. expense) Received cash from clients paying on their accounts, $3,700 Purchased office furniture on account from Budget Basics, $2,760 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $8,000 14 Paid Budget Basics for part of the debt owed for the furniture purchased, $1,300 15 Billed clients for services provided on account from Dec 1-14, $16,250 15 Paid the admin. assistant for 2 weeks' salary, $1,200 Record the following transactions on PAGE 2 of the journal: 16 Cash received from cash clients for fees earned Dec 1-15, $14,000 18 Paid cash for supplies purchased, $1,510 21 Billed clients for services provided on account from Dec 15-20, $4,500 Received cash from cash clients for fees earned Dec 16-23, $6,620 24 28 Paid telephone bill for December, $405 29 Paid the admin. assistant for 2 weeks' salary, $1,200 30 Received cash from clients paying on account, $13,400 31 Paid electricity bill for December, $310 31 Kari withdrew $6,000 for personal use 31 Received cash from cash clients for fees earned Dec 24-31, $2,150 31 Provided services on account from Dec 21-31, $4,500 PART 1: (45 points) Journalize transactions as described for On Point Accounting Services. Journalize the transactions provided on the fillable pdf forms. HINT: to journalize the first entry, you should have a separate debit line for each asset contributed to the business (4 debit lines) and credit the owner's capital account for the sum of those 4 debits. PART 2: (25 points) Post journal entries; prepare unadjusted trial balance. 1. Post the journal entries from Part 1 in the ledger. 2. Prepare the unadjusted trial balance report using the balances in the ledger. PART 3: (20 points) Journalize adjustments; post adjusting entries to ledger; prepare adjusted trial balance. 1. Journalize the necessary adjustments using the adjustment data provided. 2. Post the adjusting journal entries in the ledger. 3. Prepare the adjusted trial balance report using the adjusted balances in the ledger. PART 4: (25 points) Prepare financial statements; journalize closing entries; post closing entries to ledger; prepare post-closing trial balance. 1. Prepare financial statements - Income Statement, Statement of Owner's Equity, and Balance Sheet for the year ending December 31, 2021. 2. Journalize the closing entries. 3. Post the closing journal entries in the ledger. 4. Prepare the post-closing trial balance report.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Here is the journalizing of the transactions for On Point Accounting Services I will provide the date description of the transaction and the debited and credited accounts for each entry Journal Page 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started