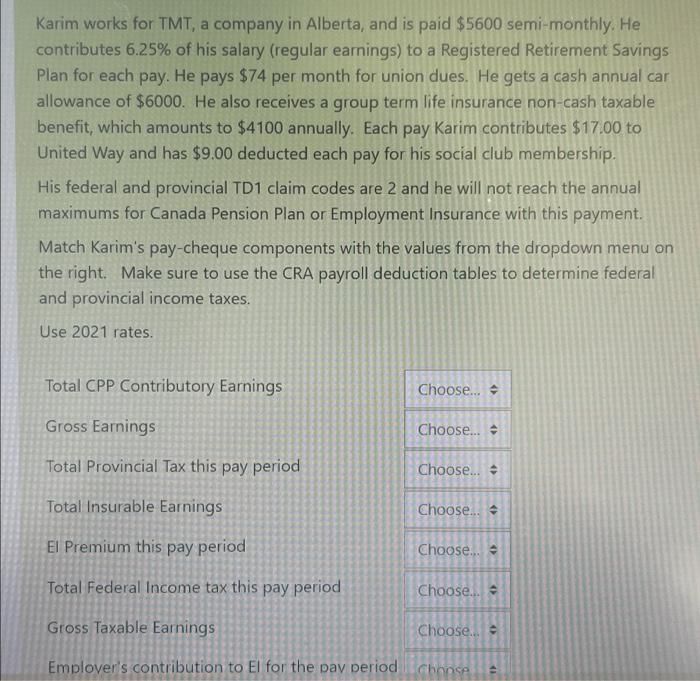

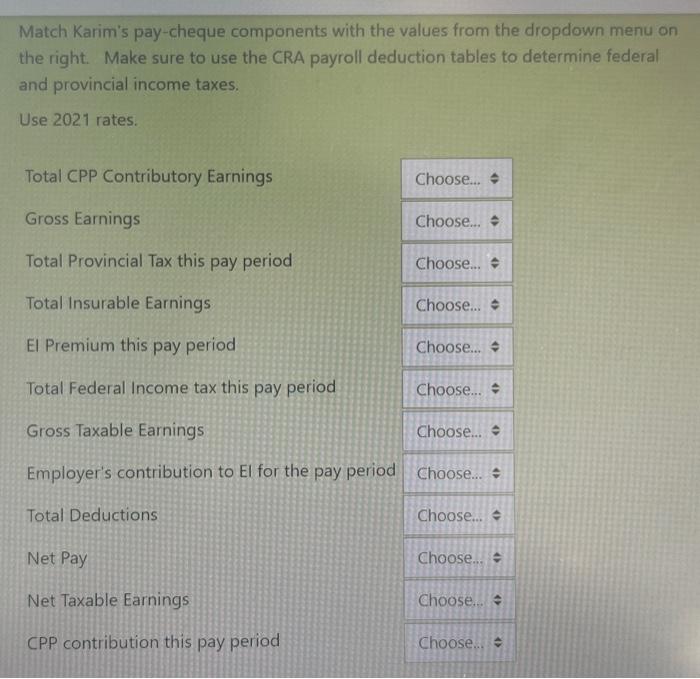

Karim works for TMT, a company in Alberta, and is paid $5600 semi-monthly. He contributes 6.25% of his salary (regular earnings) to a Registered Retirement Savings Plan for each pay. He pays $74 per month for union dues. He gets a cash annual car allowance of $6000. He also receives a group term life insurance non-cash taxable benefit, which amounts to $4100 annually. Each pay Karim contributes $17.00 to United Way and has $9.00 deducted each pay for his social club membership. His federal and provincial TD1 claim codes are 2 and he will not reach the annual maximums for Canada Pension Plan or Employment Insurance with this payment. Match Karim's pay-cheque components with the values from the dropdown menu on the right. Make sure to use the CRA payroll deduction tables to determine federal and provincial income taxes. Use 2021 rates Total CPP Contributory Earnings Choose... - Gross Earnings Choose... - Total Provincial Tax this pay period Choose... Total Insurable Earnings Choose... 4 El Premium this pay period Choose... Total Federal Income tax this pay period Choose.. Gross Taxable Earnings Choose... ? Emplover's contribution to El for the pay period choose Match Karim's pay-cheque components with the values from the dropdown menu on the right. Make sure to use the CRA payroll deduction tables to determine federal and provincial income taxes. Use 2021 rates Total CPP Contributory Earnings Choose... Gross Earnings Choose... Total Provincial Tax this pay period Choose... Total Insurable Earnings Choose... El Premium this pay period Choose... Total Federal Income tax this pay period Choose... - Gross Taxable Earnings Choose... Employer's contribution to El for the pay period Choose... Total Deductions Choose... Net Pay Choose... Net Taxable Earnings Choose... CPP contribution this pay period Choose... Karim works for TMT, a company in Alberta, and is paid $5600 semi-monthly. He contributes 6.25% of his salary (regular earnings) to a Registered Retirement Savings Plan for each pay. He pays $74 per month for union dues. He gets a cash annual car allowance of $6000. He also receives a group term life insurance non-cash taxable benefit, which amounts to $4100 annually. Each pay Karim contributes $17.00 to United Way and has $9.00 deducted each pay for his social club membership. His federal and provincial TD1 claim codes are 2 and he will not reach the annual maximums for Canada Pension Plan or Employment Insurance with this payment. Match Karim's pay-cheque components with the values from the dropdown menu on the right. Make sure to use the CRA payroll deduction tables to determine federal and provincial income taxes. Use 2021 rates Total CPP Contributory Earnings Choose... - Gross Earnings Choose... - Total Provincial Tax this pay period Choose... Total Insurable Earnings Choose... 4 El Premium this pay period Choose... Total Federal Income tax this pay period Choose.. Gross Taxable Earnings Choose... ? Emplover's contribution to El for the pay period choose Match Karim's pay-cheque components with the values from the dropdown menu on the right. Make sure to use the CRA payroll deduction tables to determine federal and provincial income taxes. Use 2021 rates Total CPP Contributory Earnings Choose... Gross Earnings Choose... Total Provincial Tax this pay period Choose... Total Insurable Earnings Choose... El Premium this pay period Choose... Total Federal Income tax this pay period Choose... - Gross Taxable Earnings Choose... Employer's contribution to El for the pay period Choose... Total Deductions Choose... Net Pay Choose... Net Taxable Earnings Choose... CPP contribution this pay period Choose