Answered step by step

Verified Expert Solution

Question

1 Approved Answer

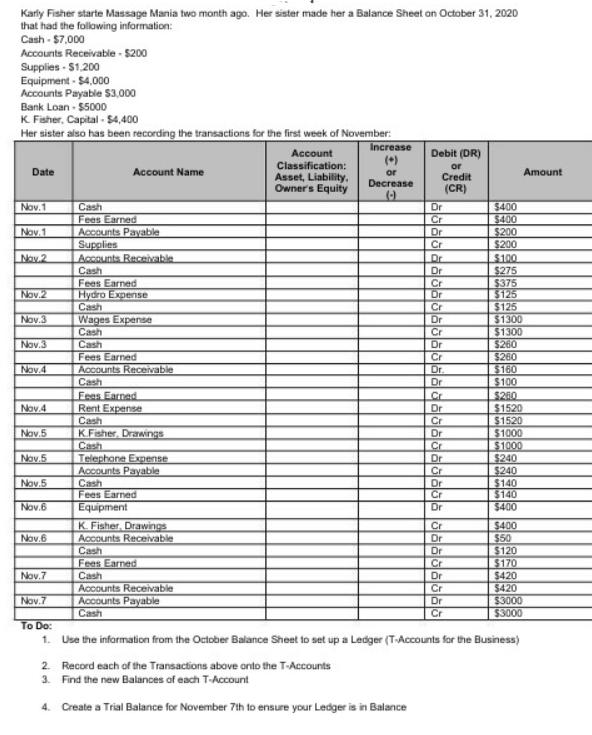

Karly Fisher starte Massage Mania two month ago. Her sister made her a Balance Sheet on October 31, 2020 that had the following information:

Karly Fisher starte Massage Mania two month ago. Her sister made her a Balance Sheet on October 31, 2020 that had the following information: Cash - $7,000 Accounts Receivable - $200 Supplies $1,200 Equipment - $4,000 Accounts Payable $3,000 Bank Loan $5000 K. Fisher, Capital-$4,400 Her sister also has been recording the transactions for the first week of November: Date Nov.1 Nov.1 Naz Nov.2 Nov.3 Nov.3 Nov.4 Nov.4 Nov.5 Nov.5 Nov.5 Nov.6 Nov.6 Nov.7 Nov.7 Account Name Cash Fees Earned Accounts Payable Supplies Accounts Receivable Cash Fees Earned Hydro Expense Cash Wages Expense Cash Cash Fees Earned Accounts Receivable Cash Fees Earned Rent Expense Cash K.Fisher, Drawings Cash Telephone Expense Accounts Payable Cash Fees Earned Equipment K. Fisher, Drawings Accounts Receivable Cash Fees Earned Cash Accounts Receivable Accounts Payable Cash Account Classification: Asset, Liability. Owner's Equity Increase or Decrease Debit (DR) or Credit (CR) 2. Record each of the Transactions above onto the T-Accounts 3. Find the new Balances of each T-Account 4. Create a Trial Balance for November 7th to ensure your Ledger is in Balance 999999999999999999999999999999999 Dr Cr Dr Cr Cr Cr $400 $400 $200 $200 $100 $275 $375 $125 $125 $1300 $1300 $260 $260 $160 $100 $260 $1520 $1520 $1000 $1000 $240 $240 $140 $140 $400 Amount $400 $50 $120 $170 $420 $420 $3000 $3000 To Do: 1. Use the information from the October Balance Sheet to set up a Ledger (T-Accounts for the Business)

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Ledger TAccounts for Massage Mania Cash October 31 7000 Opening Balance November 1 400 Transaction November 2 275 Transaction November 3 260 Transaction November 4 100 Transaction November 5 140 Trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started