Answered step by step

Verified Expert Solution

Question

1 Approved Answer

KassiLam Limited ( KassiLam ) was founded by two Soweto born young entrepreneurs while they were in Varsity. KassiLam specialises in WIFI installation

KassiLam Limited KassiLam was founded by two Soweto born young entrepreneurs while they were in Varsity. KassiLam specialises in WIFI installation in the townships and have expanded to the villages. KassiLam makes money from contracts with the government through competitive bidding. KassiLam has a December year end and prepares the financial statement in accordance with the International Financial Reporting standards IFRS KassiLam qualifies as a small business SME in terms of the Income tax Act of South Africa.

KassiLam is preparing the financial statement for the year ended December and has the following assets.

Vacant Land

KassiLam' s strategy follows that of McDonald, which is to own as much of their property. KassiLam acquired land in Limpopo and Eastern Cape as they are expanding their business to rural areas. The land was purchased in July for R in Limpopo and R in the Eastern Cape. The independent appraiser has valued this land for R in Limpopo and R in the Eastern Cape on December On December the land was valued at R in Limpopo and R in the Eastern Cape. The land is measured on revaluation basis since it was purchased, and it is the policy of KassiLam to revalue the land every year.

Plant

On April KassiLam purchased a cable plant that connects the African and American continent through the Atlantic Ocean. The plant was purchased for a total cost of R million including the inspection costs. The cable plant is depreciated over the period of years. On purchase date, R million was incurred for a major inspection and this major inspection is set to be done every years with minor upgrades. Due to drastic weather changes in South America, an urgent major inspection was approved by management as the internet was becoming slow. The inspection took place between July and September The cost of the inspection was R million and were completed and available for use on September

Machinery

On May KassiLam purchased a highly specialised technological machine on credit from a Chinese company for $ and the machine was shipped free on board on August on the same day, shipping cost of R were settled immediately by KassiLam. It was agreed between the supplier of the machine and KassiLam that the cost to assemble the machine will be shared and respectively. A consultant from China and one permanent employee from KassiLam worked on assembling the machine. The total fees that were incurred by the consultant and employee were R and Rincluding his salary of R They worked on the machine for weeks and the machine was ready for use on November This machinery was estimated to be depreciated over years on a straightline method with a RNil residual value.

FACS

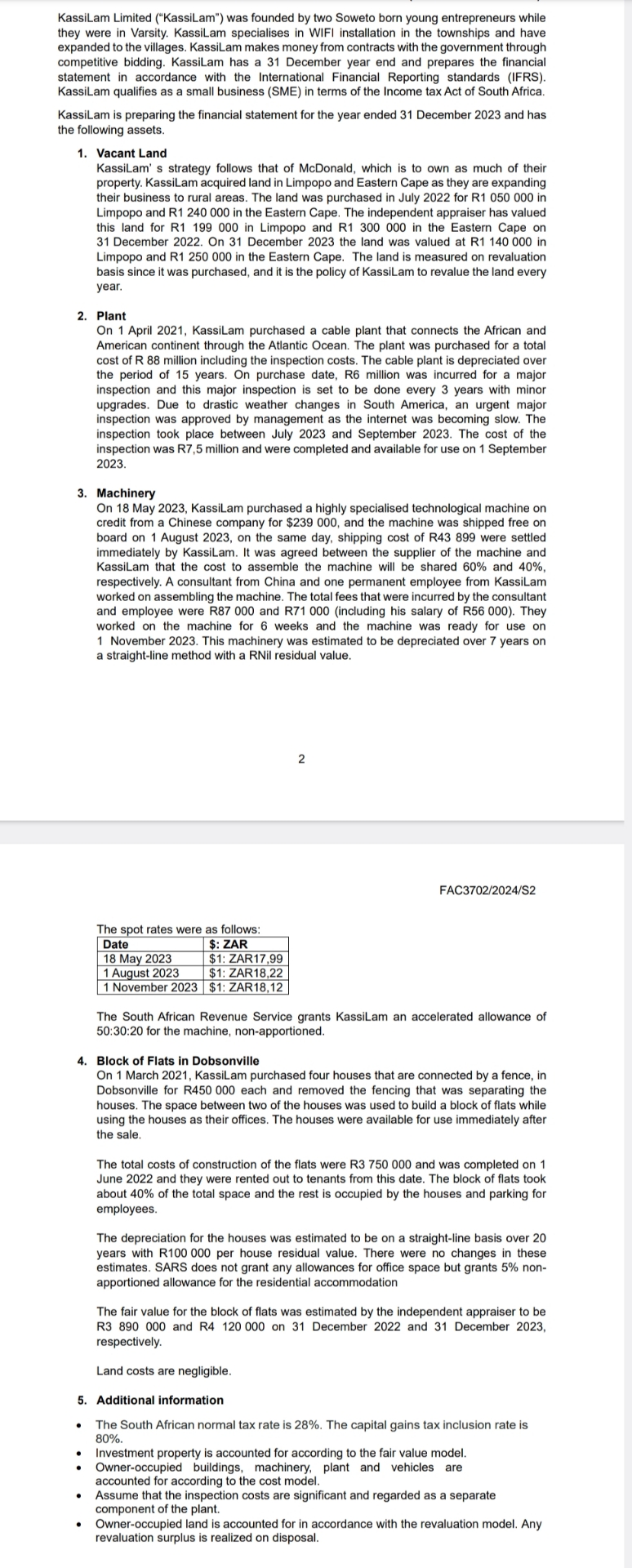

The spot rates were as follows:

tableDate$: ZAR May $: ZAR August $: ZAR November $: ZAR

The South African Revenue Service grants KassiLam an accelerated allowance of :: for the machine, nonapportioned.

Block of Flats in Dobsonville

On March KassiLam purchased four houses that are connected by a fence, in Dobsonville for R each and removed the fencing that was separating the houses. The space between two of the houses was used to build a block of flats while using the houses as their offices. The houses were available for use immediately after the sale.

The total costs of construction of the flats were R and was completed on June and they were rented out to tenants from this date. The block of flats took about of the total space and the rest is occupied by the houses and parking for employees.

The depreciation for the houses was estimated to be on a straightline basis over years with R per house residual value. There were no changes in these estimates. SARS does not grant any allowances for office space but grants nonapportioned allowance for the residential accommodation

The fair value for the block of flats was estimated by the independent appraiser to be R and R on December and December respectively.

Land costs are negligible.

Additional information

The South African normal tax rate is The capital gains tax inclusion rate is

Investment property is accounted for according to the fair value model.

Owneroccupied buildings, machinery, plant and vehicles are accounted for according to the cost model.

Assume that the inspection costs are significant and regarded as a separate component of the plant.

Owneroccupied land is accounted for in accordance with the revaluation model. Any revaluation sur

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started