Answered step by step

Verified Expert Solution

Question

1 Approved Answer

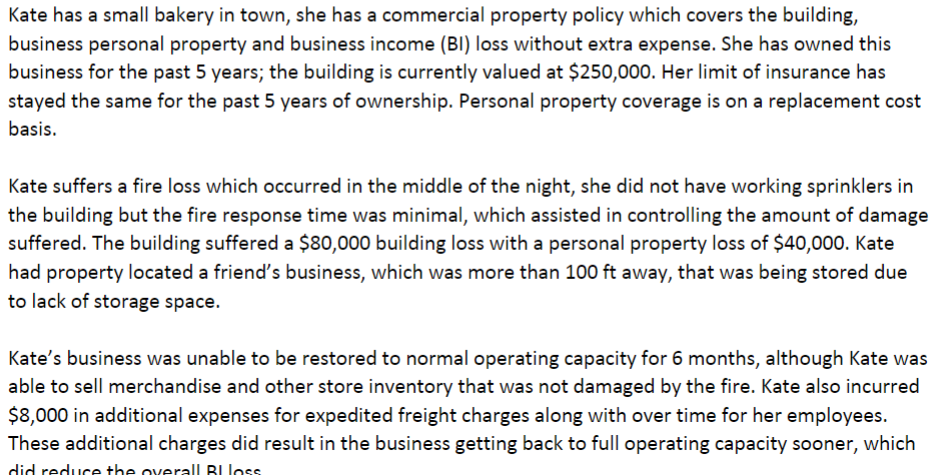

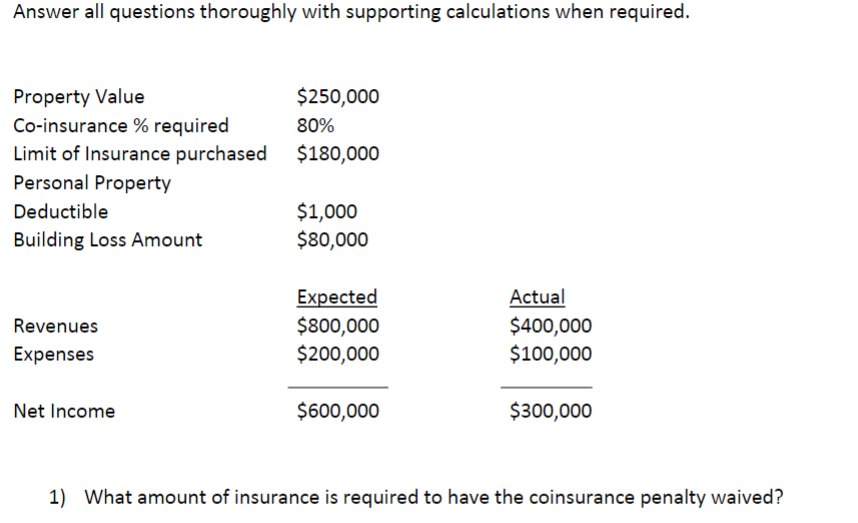

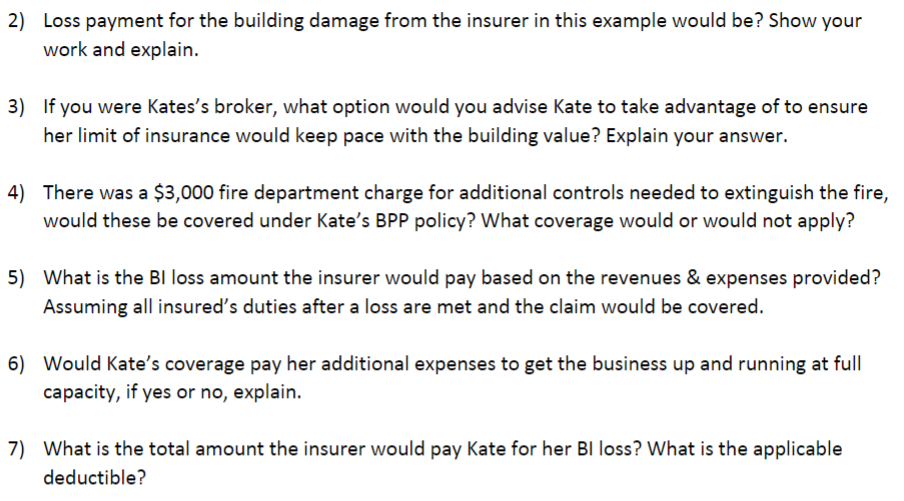

Kate has a small bakery in town, she has a commercial property policy which covers the building, business personal property and business income (BI)

Kate has a small bakery in town, she has a commercial property policy which covers the building, business personal property and business income (BI) loss without extra expense. She has owned this business for the past 5 years; the building is currently valued at $250,000. Her limit of insurance has stayed the same for the past 5 years of ownership. Personal property coverage is on a replacement cost basis. Kate suffers a fire loss which occurred in the middle of the night, she did not have working sprinklers in the building but the fire response time was minimal, which assisted in controlling the amount of damage suffered. The building suffered a $80,000 building loss with a personal property loss of $40,000. Kate had property located a friend's business, which was more than 100 ft away, that was being stored due to lack of storage space. Kate's business was unable to be restored to normal operating capacity for 6 months, although Kate was able to sell merchandise and other store inventory that was not damaged by the fire. Kate also incurred $8,000 in additional expenses for expedited freight charges along with over time for her employees. These additional charges did result in the business getting back to full operating capacity sooner, which did reduce the overall Bloss Answer all questions thoroughly with supporting calculations when required. Property Value Co-insurance % required Limit of Insurance purchased Personal Property Deductible Building Loss Amount $250,000 80% $180,000 $1,000 Revenues Expenses Net Income $80,000 Expected Actual $800,000 $400,000 $200,000 $100,000 $600,000 $300,000 1) What amount of insurance is required to have the coinsurance penalty waived? 2) Loss payment for the building damage from the insurer in this example would be? Show your work and explain. 3) If you were Kates's broker, what option would you advise Kate to take advantage of to ensure her limit of insurance would keep pace with the building value? Explain your answer. 4) There was a $3,000 fire department charge for additional controls needed to extinguish the fire, would these be covered under Kate's BPP policy? What coverage would or would not apply? 5) What is the BI loss amount the insurer would pay based on the revenues & expenses provided? Assuming all insured's duties after a loss are met and the claim would be covered. 6) Would Kate's coverage pay her additional expenses to get the business up and running at full capacity, if yes or no, explain. 7) What is the total amount the insurer would pay Kate for her BI loss? What is the applicable deductible?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started