Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Katerina graduated from in December 2020 and knows that after finishing school, there is a 6- month non-repayment period on her Canada Student Loan

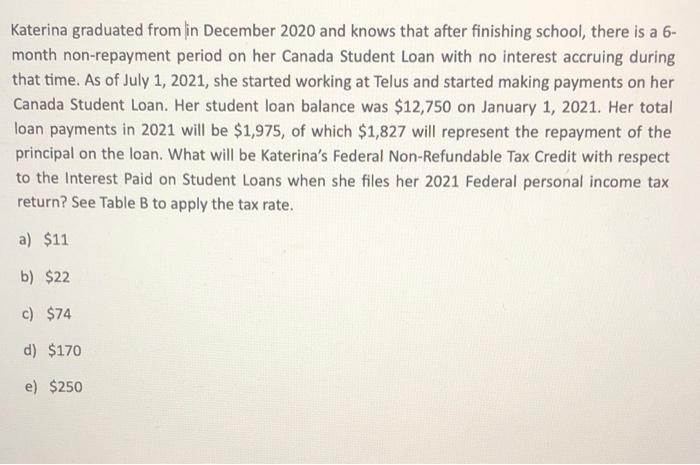

Katerina graduated from in December 2020 and knows that after finishing school, there is a 6- month non-repayment period on her Canada Student Loan with no interest accruing during that time. As of July 1, 2021, she started working at Telus and started making payments on her Canada Student Loan. Her student loan balance was $12,750 on January 1, 2021. Her total loan payments in 2021 will be $1,975, of which $1,827 will represent the repayment of the principal on the loan. What will be Katerina's Federal Non-Refundable Tax Credit with respect to the Interest Paid on Student Loans when she files her 2021 Federal personal income tax return? See Table B to apply the tax rate. a) $11 b) $22 c) $74 d) $170 e) $250

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

B 22 1st do 1975 x 015 29625 2nd do 1827 x 015 27405 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started