Answered step by step

Verified Expert Solution

Question

1 Approved Answer

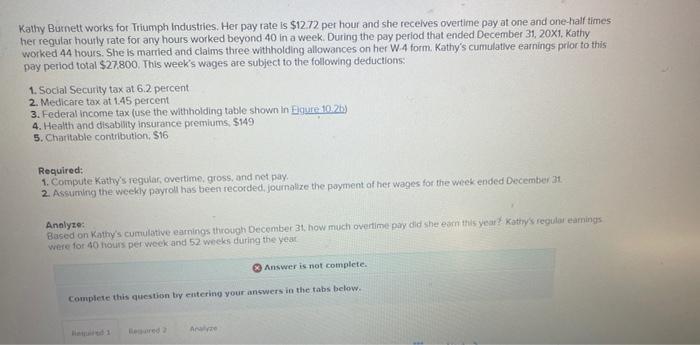

Kathy Burnett works for Triumph Industries. Her pay rate is $12.72 per hour and she recelves overtime pay at one and one-half times her regular

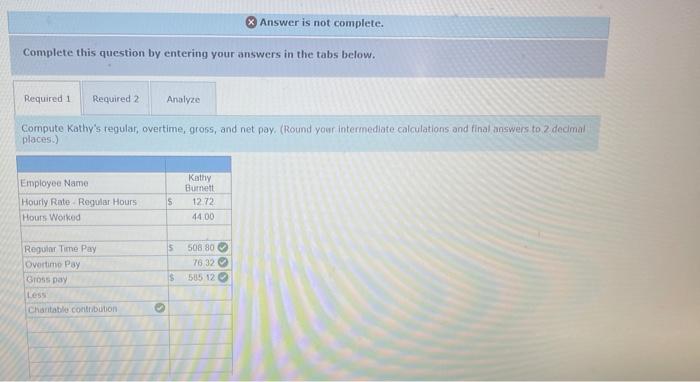

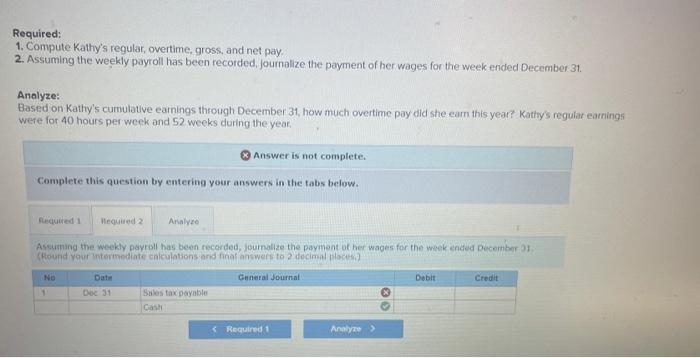

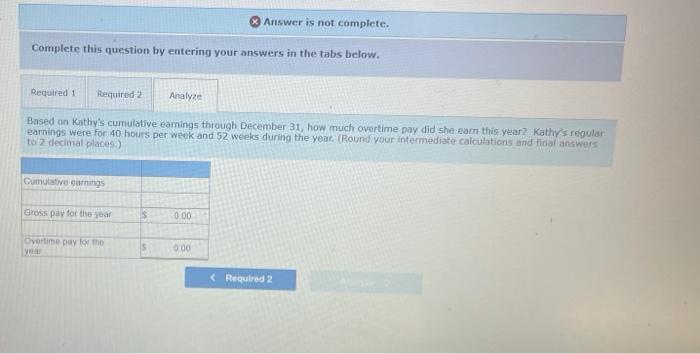

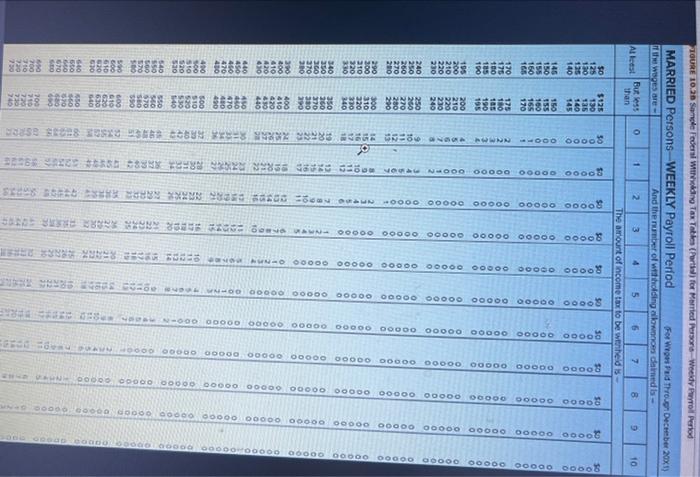

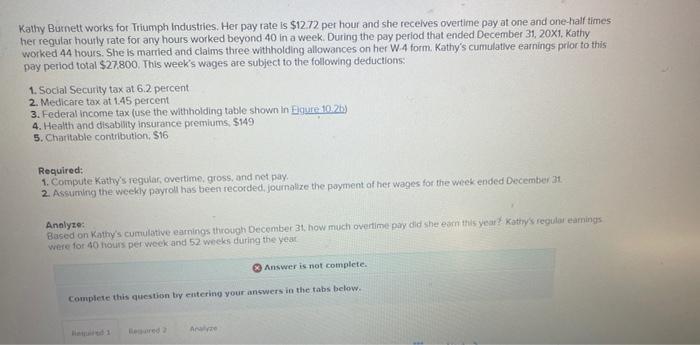

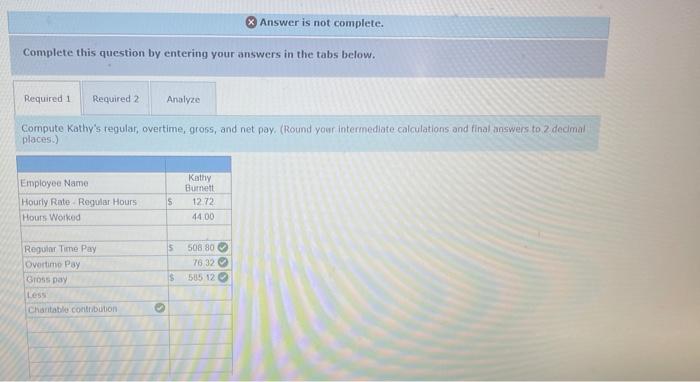

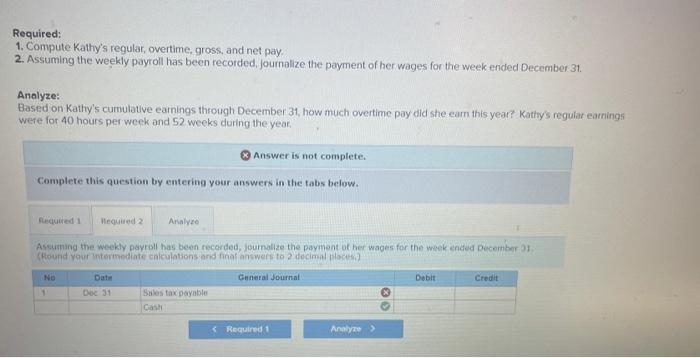

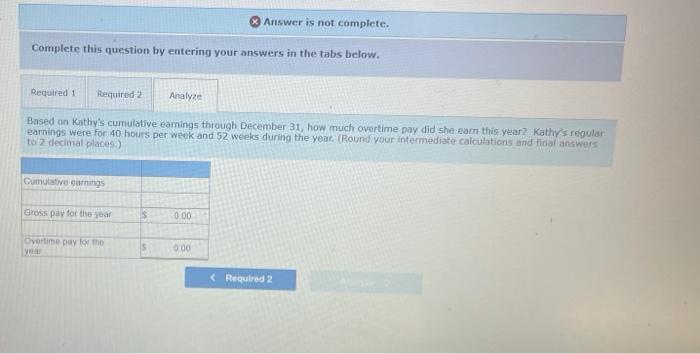

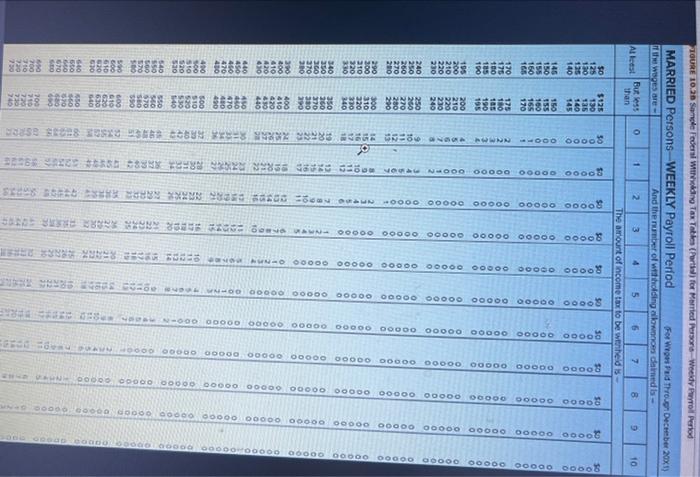

Kathy Burnett works for Triumph Industries. Her pay rate is $12.72 per hour and she recelves overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31,201, Kathy worked 44 hours. She is married and claims three withholding allowances on her W.4 form. Kathy's cumulative earnings prior to this pay period total $27,800. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3. Federal income tax (use the withholding table shown in Equire 10.2b) 4. Health and disablity insurance premiums. $149 5. Charitable contribution, $16 Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment af her wages for the week ended December 31 . Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she estri this year? Kativis regidar eamings. were for 40 hours petweek and 52 weeks during the year 3) Answer is not complete. Complete this question ty elitering your answers in the fabs below. Complete this question by entering your answers in the tabs below. Compute Kathy's regular, overtime, gross, and net pay. (Round your intermedlate calculations and final answers to. 2 dedmal places.) Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31. Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she eam this year? Kathy's reguiat eaming were for 40 hours per weck and 52 weeks during the year. x Answer is not complete. Complete this question by entering your answers in the tabs below. Asvuming the weekly payroll has been recorded, journalize the paymont of her wages for the week ended December of (thound vout ynterimediate caiculations ard finaf answers to 2 decimal plocith,) Answer is not complete. Complete this question by entering your answers in the tabs below. Based on Kathy's cumulative eamings through December 31, how much overtime pay did she earm this year? Kathy's regular earnings were for 40 hours per week and 52 weeks during the yeac. (Round your intermediate calculations and final answers) to 2 decimal places.) Kathy Burnett works for Triumph Industries. Her pay rate is $12.72 per hour and she recelves overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31,201, Kathy worked 44 hours. She is married and claims three withholding allowances on her W.4 form. Kathy's cumulative earnings prior to this pay period total $27,800. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3. Federal income tax (use the withholding table shown in Equire 10.2b) 4. Health and disablity insurance premiums. $149 5. Charitable contribution, $16 Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment af her wages for the week ended December 31 . Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she estri this year? Kativis regidar eamings. were for 40 hours petweek and 52 weeks during the year 3) Answer is not complete. Complete this question ty elitering your answers in the fabs below. Complete this question by entering your answers in the tabs below. Compute Kathy's regular, overtime, gross, and net pay. (Round your intermedlate calculations and final answers to. 2 dedmal places.) Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31. Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she eam this year? Kathy's reguiat eaming were for 40 hours per weck and 52 weeks during the year. x Answer is not complete. Complete this question by entering your answers in the tabs below. Asvuming the weekly payroll has been recorded, journalize the paymont of her wages for the week ended December of (thound vout ynterimediate caiculations ard finaf answers to 2 decimal plocith,) Answer is not complete. Complete this question by entering your answers in the tabs below. Based on Kathy's cumulative eamings through December 31, how much overtime pay did she earm this year? Kathy's regular earnings were for 40 hours per week and 52 weeks during the yeac. (Round your intermediate calculations and final answers) to 2 decimal places.)

Kathy Burnett works for Triumph Industries. Her pay rate is $12.72 per hour and she recelves overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31,201, Kathy worked 44 hours. She is married and claims three withholding allowances on her W.4 form. Kathy's cumulative earnings prior to this pay period total $27,800. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3. Federal income tax (use the withholding table shown in Equire 10.2b) 4. Health and disablity insurance premiums. $149 5. Charitable contribution, $16 Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment af her wages for the week ended December 31 . Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she estri this year? Kativis regidar eamings. were for 40 hours petweek and 52 weeks during the year 3) Answer is not complete. Complete this question ty elitering your answers in the fabs below. Complete this question by entering your answers in the tabs below. Compute Kathy's regular, overtime, gross, and net pay. (Round your intermedlate calculations and final answers to. 2 dedmal places.) Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31. Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she eam this year? Kathy's reguiat eaming were for 40 hours per weck and 52 weeks during the year. x Answer is not complete. Complete this question by entering your answers in the tabs below. Asvuming the weekly payroll has been recorded, journalize the paymont of her wages for the week ended December of (thound vout ynterimediate caiculations ard finaf answers to 2 decimal plocith,) Answer is not complete. Complete this question by entering your answers in the tabs below. Based on Kathy's cumulative eamings through December 31, how much overtime pay did she earm this year? Kathy's regular earnings were for 40 hours per week and 52 weeks during the yeac. (Round your intermediate calculations and final answers) to 2 decimal places.) Kathy Burnett works for Triumph Industries. Her pay rate is $12.72 per hour and she recelves overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31,201, Kathy worked 44 hours. She is married and claims three withholding allowances on her W.4 form. Kathy's cumulative earnings prior to this pay period total $27,800. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3. Federal income tax (use the withholding table shown in Equire 10.2b) 4. Health and disablity insurance premiums. $149 5. Charitable contribution, $16 Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment af her wages for the week ended December 31 . Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she estri this year? Kativis regidar eamings. were for 40 hours petweek and 52 weeks during the year 3) Answer is not complete. Complete this question ty elitering your answers in the fabs below. Complete this question by entering your answers in the tabs below. Compute Kathy's regular, overtime, gross, and net pay. (Round your intermedlate calculations and final answers to. 2 dedmal places.) Required: 1. Compute Kathy's regular, overtime, gross, and net pay. 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31. Analyze: Based on Kathy's cumulative earnings through December 31, how much overtime pay did she eam this year? Kathy's reguiat eaming were for 40 hours per weck and 52 weeks during the year. x Answer is not complete. Complete this question by entering your answers in the tabs below. Asvuming the weekly payroll has been recorded, journalize the paymont of her wages for the week ended December of (thound vout ynterimediate caiculations ard finaf answers to 2 decimal plocith,) Answer is not complete. Complete this question by entering your answers in the tabs below. Based on Kathy's cumulative eamings through December 31, how much overtime pay did she earm this year? Kathy's regular earnings were for 40 hours per week and 52 weeks during the yeac. (Round your intermediate calculations and final answers) to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started