Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kathy is a 2 5 percent partner in the KDP Partnership and receives $ 1 2 0 , 0 0 0 cash in complete liquidation

Kathy is a percent partner in the KDP Partnership and receives $ cash in complete liquidation of her partnership interest. Kathy's outside basis immediately before the distribution is $ KDP currently has a election in effect and has no hot assets or liabilities. Which of the following statements is true?

A KDP will increase the basis of its assets by $ and Kathy will recognize a $ loss on the distribution.

B KDP will increase the basis of its assets by $ and Kathy will recognize a $ gain on the distribution.

C KDP will decrease the basis of its assets by $ and Kathy will recognize a $ loss on the distribution.

D KDP will decrease the basis of its assets by $ and Kathy will recognize a $ gain on the distribution.

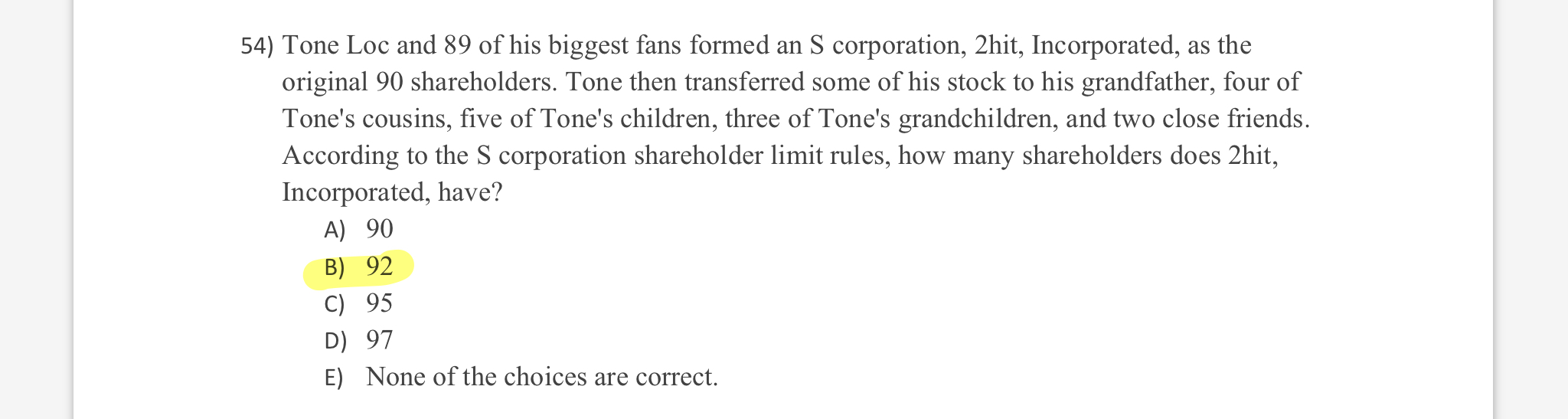

Tone Loc and of his biggest fans formed an corporation, hit, Incorporated, as the original shareholders. Tone then transferred some of his stock to his grandfather, four of Tone's cousins, five of Tone's children, three of Tone's grandchildren, and two close friends. According to the S corporation shareholder limit rules, how many shareholders does hit, Incorporated, have?

A

B

C

D

E None of the choices are correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started