Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Katrina Aung opened Katrina's Catering on September 1, 2020. During the first month of operations, the following transactions occurred: Sept. 1 2 3 3

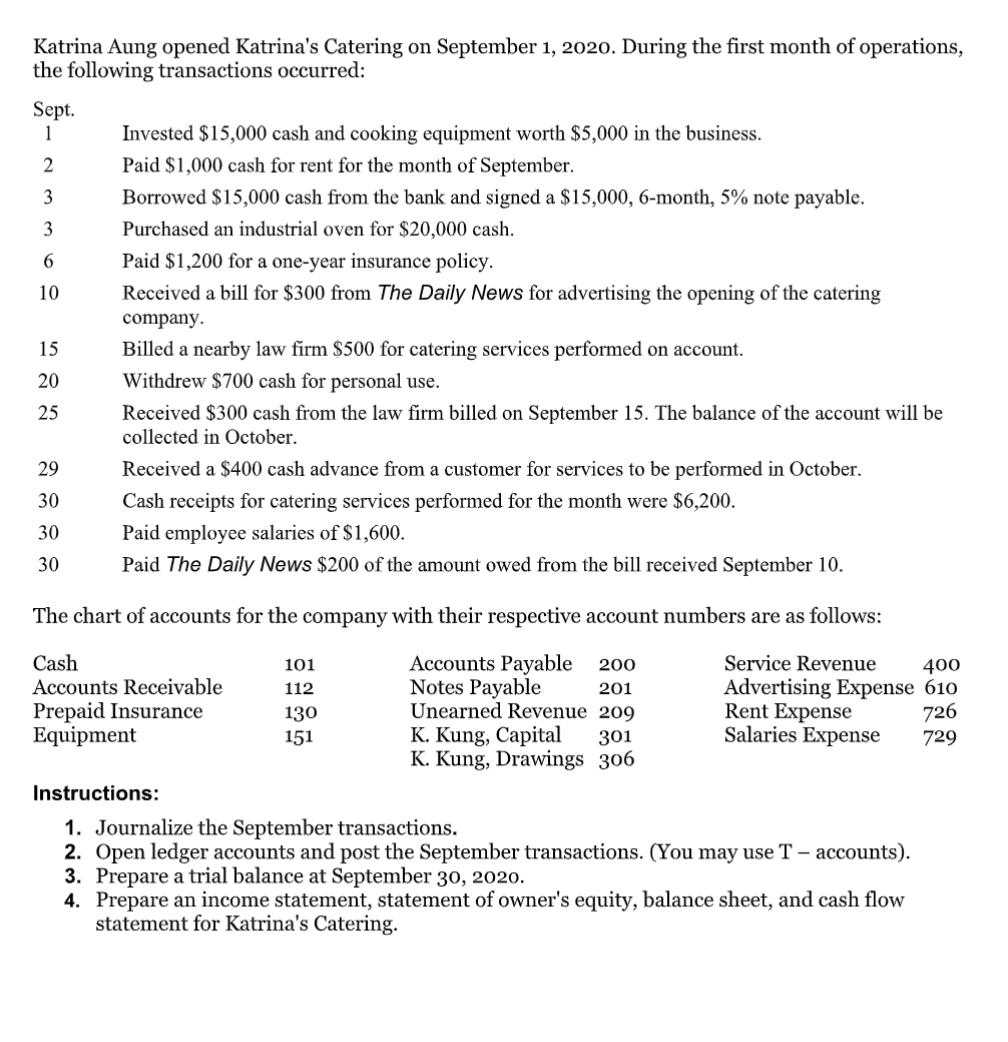

Katrina Aung opened Katrina's Catering on September 1, 2020. During the first month of operations, the following transactions occurred: Sept. 1 2 3 3 6 10 15 20 25 29 30 30 30 Invested $15,000 cash and cooking equipment worth $5,000 in the business. Paid $1,000 cash for rent for the month of September. Borrowed $15,000 cash from the bank and signed a $15,000, 6-month, 5% note payable. Purchased an industrial oven for $20,000 cash. Paid $1,200 for a one-year insurance policy. Received a bill for $300 from The Daily News for advertising the opening of the catering company. Billed a nearby law firm $500 for catering services performed on account. Withdrew $700 cash for personal use. Received $300 cash from the law firm billed on September 15. The balance of the account will be collected in October. Received a $400 cash advance from a customer for services to be performed in October. Cash receipts for catering services performed for the month were $6,200. Paid employee salaries of $1,600. Paid The Daily News $200 of the amount owed from the bill received September 10. The chart of accounts for the company with their respective account numbers are as follows: Cash Accounts Receivable 201 Accounts Payable 200 Notes Payable Unearned Revenue 209 K. Kung, Capital 301 Prepaid Insurance Equipment K. Kung, Drawings 306 101 112 130 151 400 Service Revenue Advertising Expense 610 Rent Expense 726 Salaries Expense 729 Instructions: 1. Journalize the September transactions. 2. Open ledger accounts and post the September transactions. (You may use T - accounts). 3. Prepare a trial balance at September 30, 2020. 4. Prepare an income statement, statement of owner's equity, balance sheet, and cash flow statement for Katrina's Catering.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution Here are the solutions to the problems 1 Journalize the September transactions Sept 1 Cash 101 15000 Cooking Equipment 151 5000 K Kung Capital 301 10000 Sept 2 Rent Expense 306 1000 Cash 101 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started