Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Katsura Corporation incurred pre-operating costs: Investigatory expenses of $18,000 New employee training $25,000 Advertising $10,000 Land and building for use as a retail store

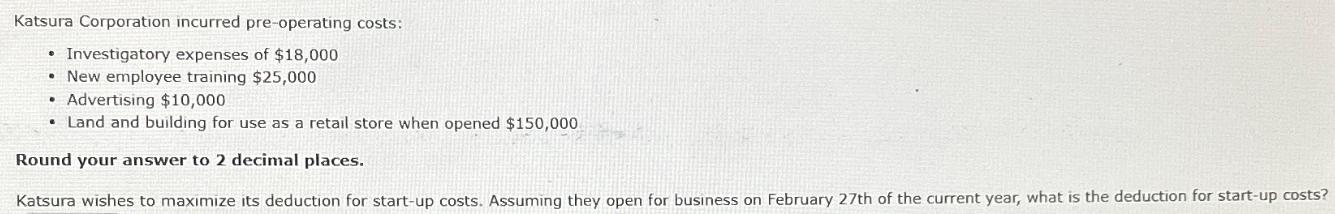

Katsura Corporation incurred pre-operating costs: Investigatory expenses of $18,000 New employee training $25,000 Advertising $10,000 Land and building for use as a retail store when opened $150,000 Round your answer to 2 decimal places. Katsura wishes to maximize its deduction for start-up costs. Assuming they open for business on February 27th of the current year, what is the deduction for start-up costs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER To determine the deduction for startup costs we need to identify the costs that qualify as st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d9f71681ff_964311.pdf

180 KBs PDF File

663d9f71681ff_964311.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started