Answered step by step

Verified Expert Solution

Question

1 Approved Answer

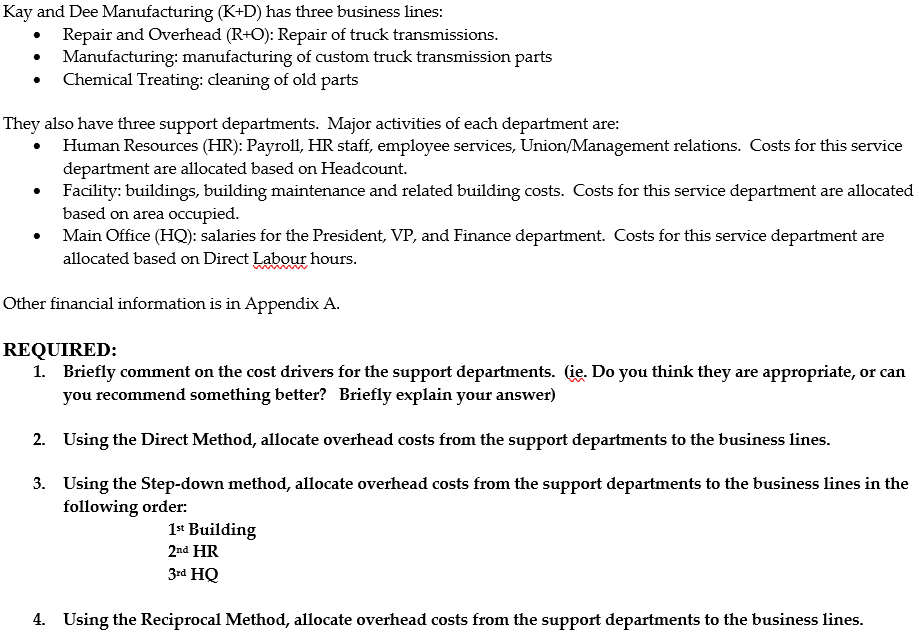

Kay and Dee Manufacturing (K+D) has three business lines: Repair and Overhead (R+O): Repair of truck transmissions. Manufacturing: manufacturing of custom truck transmission parts

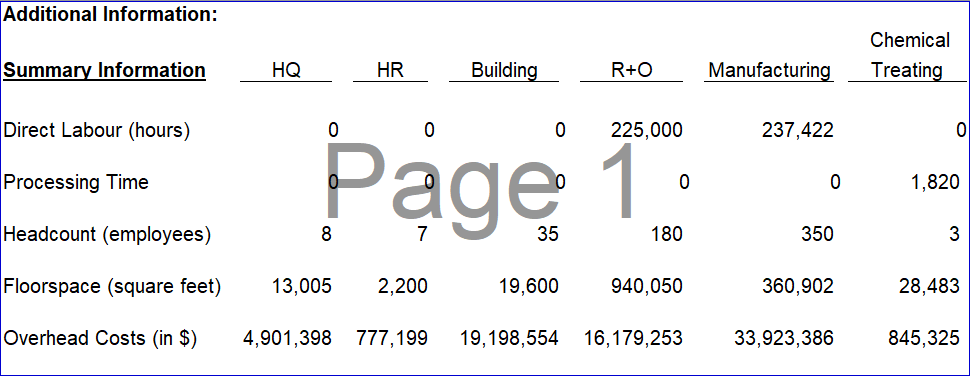

Kay and Dee Manufacturing (K+D) has three business lines: Repair and Overhead (R+O): Repair of truck transmissions. Manufacturing: manufacturing of custom truck transmission parts Chemical Treating: cleaning of old parts They also have three support departments. Major activities of each department are: Human Resources (HR): Payroll, HR staff, employee services, Union/Management relations. Costs for this service department are allocated based on Headcount. Facility: buildings, building maintenance and related building costs. Costs for this service department are allocated based on area occupied. Main Office (HQ): salaries for the President, VP, and Finance department. Costs for this service department are allocated based on Direct Labour hours. Other financial information is in Appendix A. REQUIRED: 1. Briefly comment on the cost drivers for the support departments. (ie. Do you thnk they are appropriate, or can you recommend something better? Briefly explain your answer) 2. Using the Direct Method, allocate overhead costs from the support departments to the business lines. 3. Using the Step-down method, allocate overhead costs from the support departments to the business lines in the following order: 1* Building 2nd HR 3rd HQ 4. Using the Reciprocal Method, allocate overhead costs from the support departments to the business lines. Additional Information: Chemical Summary Information HQ HR Building R+0 Manufacturing Treating Direct Labour (hours) 225,000 237,422 Page 1. Processing Time 1,820 Headcount (employees) 8 7 35 180 350 Floorspace (square feet) 13,005 2,200 19.600 940,050 360,902 28,483 Overhead Costs (in $) 4,901,398 777,199 19,198,554 16,179,253 33,923,386 845,325 3.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 The HR Buildings cost drivers are fairly good and appropriate However for HQ some cost drivers are better than the present direct labor hours A more suitable cost driver could be sales figures since ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started