Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kayla Co. Ltd cash flow forecast shows that it will have to borrow $2m from Nana's Bank in four months' time for a period

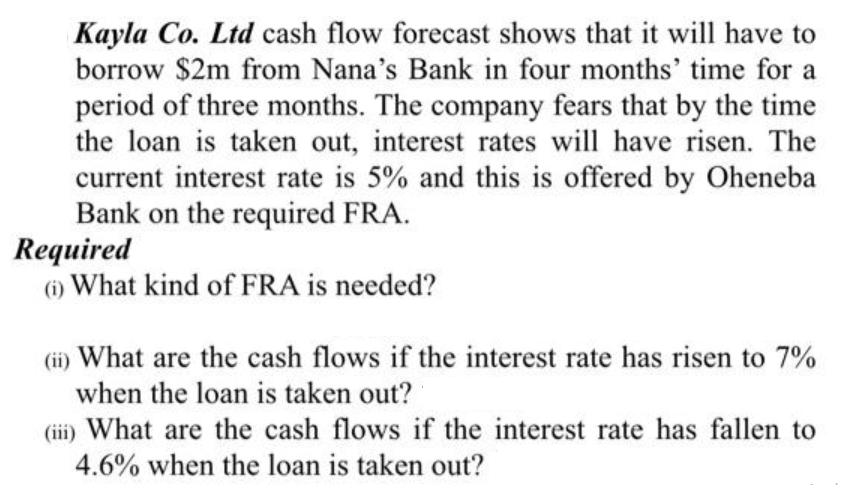

Kayla Co. Ltd cash flow forecast shows that it will have to borrow $2m from Nana's Bank in four months' time for a period of three months. The company fears that by the time the loan is taken out, interest rates will have risen. The current interest rate is 5% and this is offered by Oheneba Bank on the required FRA. Required 6) What kind of FRA is needed? (i) What are the cash flows if the interest rate has risen to 7% when the loan is taken out? (i) What are the cash flows if the interest rate has fallen to 4.6% when the loan is taken out?

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a i 4 x 7 FRA is required to hedge or speculate interest rates Cash is requir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

608c00a37e90d_208192.pdf

180 KBs PDF File

608c00a37e90d_208192.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started