Answered step by step

Verified Expert Solution

Question

1 Approved Answer

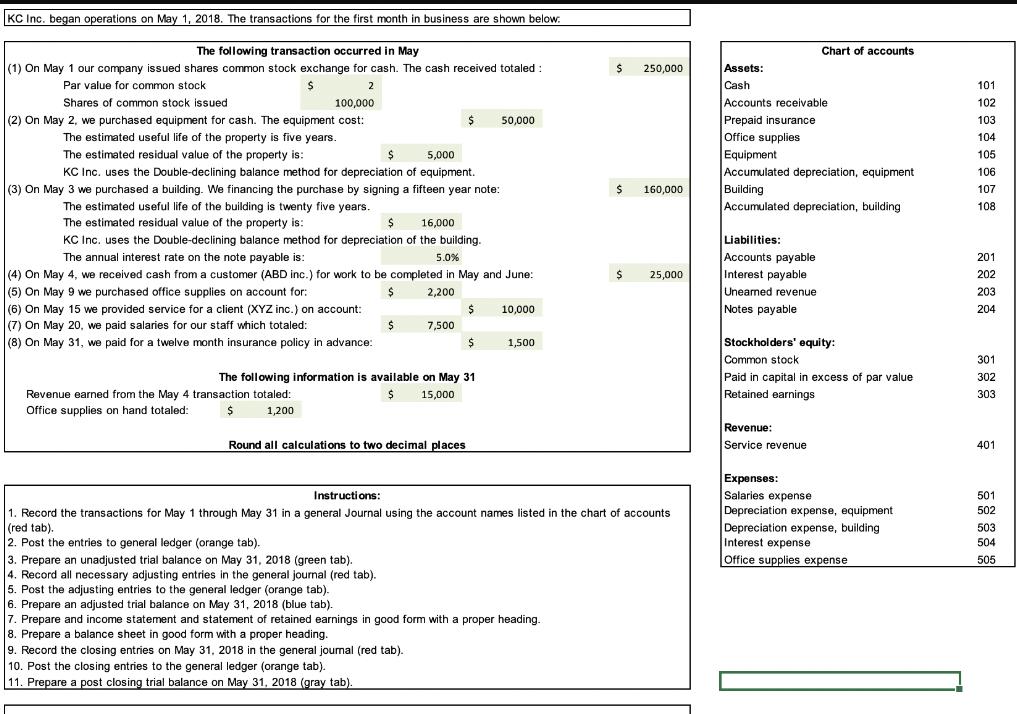

KC Inc. began operations on May 1, 2018. The transactions for the first month in business are shown below: The following transaction occurred in

KC Inc. began operations on May 1, 2018. The transactions for the first month in business are shown below: The following transaction occurred in May Chart of accounts (1) On May 1 our company issued shares common stock exchange for cash. The cash received totaled: 250,000 Assets: Par value for common stock 2 Cash 101 Accounts receivable Prepaid insurance Office supplies Shares of common stock issued 100,000 102 (2) On May 2, we purchased equipment for cash. The equipment cost: 50,000 103 The estimated useful lfe of the property is five years. 104 The estimated residual value of the property is: 5,000 Equipment 105 KC Inc. uses the Double-declining balance method for depreciation of equipment. Accumulated depreciation, equipment 106 (3) On May 3 we purchased a building. We financing the purchase by signing a fifteen year note: $ 160,000 Building Accumulated depreciation, building 107 The estimated useful life of the building is twenty five years. The estimated residual value of the property is: 108 16,000 KC Inc. uses the Double-declining balance method for depreciation of the building. Liabilities: Accounts payable Interest payable Uneamed revenue Notes payable The annual interest rate on the note payable is: 5.0% 201 (4) On May 4, we received cash from a customer (ABD inc.) for work to be completed in May and June: |(5) On May 9 we purchased office supplies on account for: (6) On May 15 we provided service for a client (XYZ inc.) on account: (7) On May 20, we paid salaries for our staff which totaled: (8) On May 31, we paid for a twelve month insurance policy in advance: 25,000 202 24 2,200 203 10,000 204 7,500 $ 1,500 Stockholders' equity: Common stock Paid in capital in excess of par value Retained earnings 301 The following information is available on May 31 302 Revenue earned from the May 4 transaction totaled: Office supplies on hand totaled: 15,000 303 2$ 1,200 Revenue: Service revenue Round all calculations to two decimal places 401 Expenses: Salaries expense Depreciation expense, equipment Depreciation expense, building Interest expense Office supplies expense Instructions: 501 502 1. Record the transactions for May 1 through May 31 in a general Journal using the account names listed in the chart of accounts (red tab). 2. Post the entries to general ledger (orange tab). 503 504 3. Prepare an unadjusted trial balance on May 31, 2018 (green tab). 4. Record all necessary adjusting entries in the general journal (red tab). 5. Post the adjusting entries to the general ledger (orange tab). 6. Prepare an adjusted trial balance on May 31, 2018 (blue tab). 7. Prepare and income statement and statement of retained earnings in good form with a proper heading. 8. Prepare a balance sheet in good form with a proper heading. 9. Record the closing entries on May 31, 2018 in the general journal (red tab). 10. Post the closing entries to the general ledger (orange tab). 11. Prepare a post closing trial balance on May 31, 2018 (gray tab). 505

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started