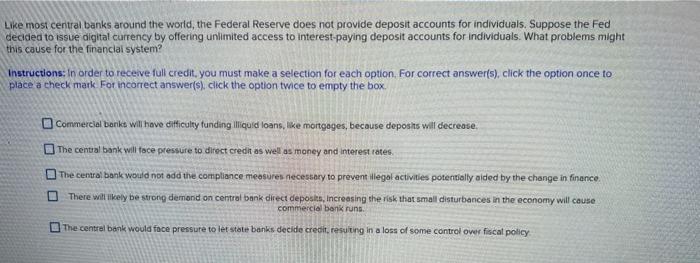

ke mosi cential banks around the world, the Federal Reserve does not provide deposit accounts for individuals. Suppose the Fed ecided to issue digital currency by offering unlimited access to interest-paying deposit accounts for individuals. What problems might 1is cause for the financiai system? astructions: In order to receive full credit, you must make a selection for each option. For correct answer(5), click the option once to lace a check mark. For incorrect answer(s), click the option twice to empty the box. Commercial borikt will hove dilficulty funding illiquid loans, like moitgoges, because deposhts will decreose. The cental bank will toce pressure to direct credit as well as money and interest rates. The central bank would not add the compliance meosures necessary to prevent illegol activites potentiolly aided by the change in finance. There willikey be strong demond on central bank direct deposits, Increasing the risk that small disturbances in the economy will cause commercial benkisuns. The centrel bank would face pressure to let stote banks decide credit, festing in a loss of some control over fiscal policy. ke mosi cential banks around the world, the Federal Reserve does not provide deposit accounts for individuals. Suppose the Fed ecided to issue digital currency by offering unlimited access to interest-paying deposit accounts for individuals. What problems might 1is cause for the financiai system? astructions: In order to receive full credit, you must make a selection for each option. For correct answer(5), click the option once to lace a check mark. For incorrect answer(s), click the option twice to empty the box. Commercial borikt will hove dilficulty funding illiquid loans, like moitgoges, because deposhts will decreose. The cental bank will toce pressure to direct credit as well as money and interest rates. The central bank would not add the compliance meosures necessary to prevent illegol activites potentiolly aided by the change in finance. There willikey be strong demond on central bank direct deposits, Increasing the risk that small disturbances in the economy will cause commercial benkisuns. The centrel bank would face pressure to let stote banks decide credit, festing in a loss of some control over fiscal policy