Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Keelang Company is a middle size manufacturing company located at Jalan Kelang. The company just purchased an intelligent robot for its manufacturing line for RM570000

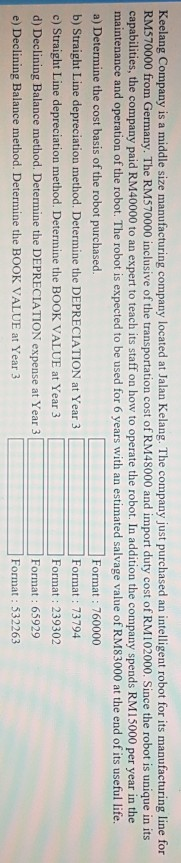

Keelang Company is a middle size manufacturing company located at Jalan Kelang. The company just purchased an intelligent robot for its manufacturing line for RM570000 from Germany. The RM570000 inclusive of the transportation cost of RM48000 and import duty cost of RM102000. Since the robot is unique in its capabilities, the company paid RM40000 to an expert to teach its staff on how to operate the robot. In addition the company spends RM15000 per year in the maintenance and operation of the robot. The robot is expected to be used for 6 years with an estimated salvage value of RM83000 at the end of its useful life. a) Determine the cost basis of the robot purchased. Format : 760000 b) Straight Line depreciation method. Determine the DEPRECIATION at Year 3 Format: 73794 c) Straight Line depreciation method. Determine the BOOK VALUE at Year 3 L Format : 239302 d) Declining Balance method. Determine the DEPRECIATION expense at Year 3 Format : 65929 e) Declining Balance method. Determine the BOOK VALUE at Year 3 Format : 532263

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started