Keenan Music's CEO has been pondering about the recent proposal of the Specialty Guitar Project. The accountant has done a capital budgeting analysis on the

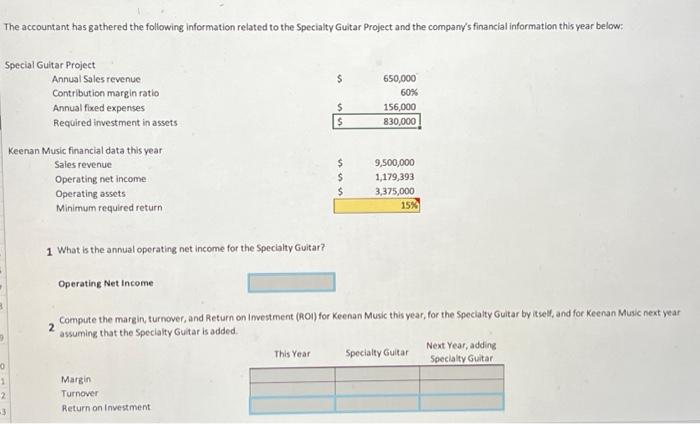

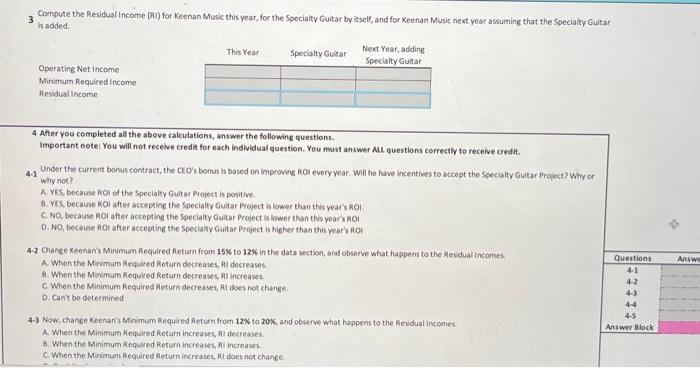

The accountant has gathered the following information related to the Specialty Guitar Project and the company's financial information this year below: Special Guitar Project Annual Sales revenue $ 650,000 Contribution margin ratio 60% Annual fixed expenses $ 156,000 Required investment in assets $ 830,000 Keenan Music financial data this year Sales revenue Operating net income Operating assets Minimum required return $ 9,500,000 $ 1,179,393 $ 3,375,000 15% 1 What is the annual operating net income for the Specialty Guitar? Operating Net Income Compute the margin, turnover, and Return on Investment (ROI) for Keenan Music this year, for the Specialty Guitar by itself, and for Keenan Music next year assuming that the Specialty Guitar is added. 1 Margin 2 Turnover -3 Return on Investment This Year Specialty Guitar Next Year, adding Specialty Guitar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

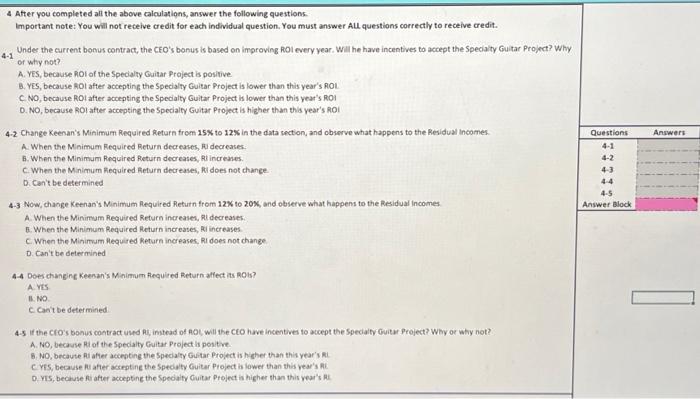

41 The answer is C NO because ROI after accepting the Specialty Guitar Project is lower ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started