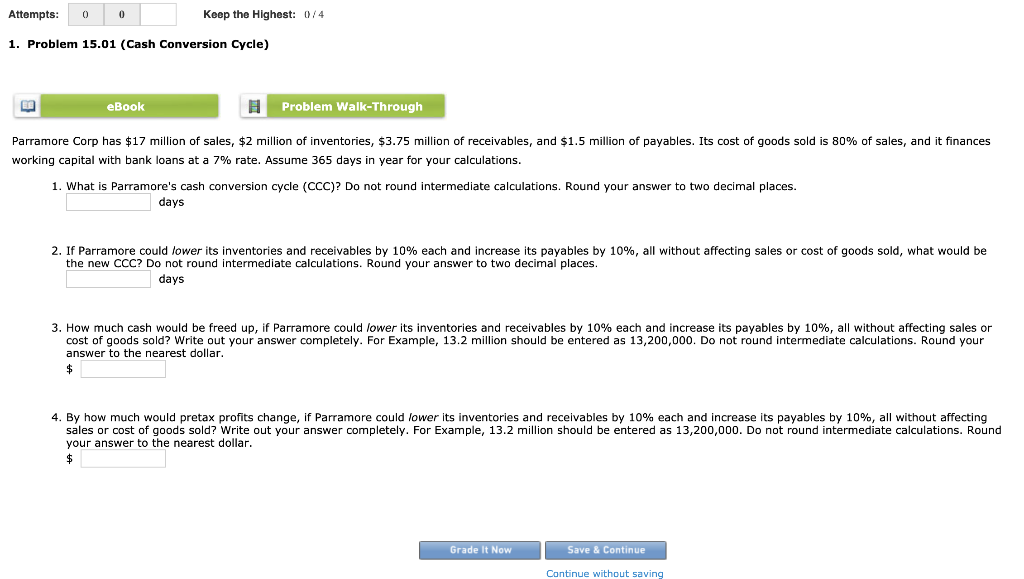

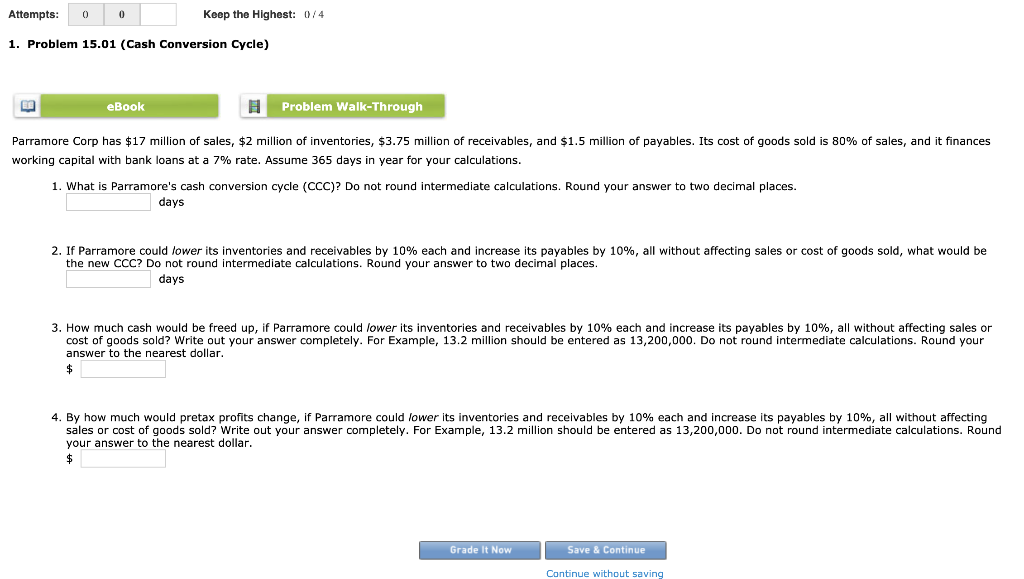

Keep the Highest: 0/4 Attempts: 1. Problem 15.01 (Cash Conversion Cycle) Problem Walk-Through eBook Parramore Corp has $17 million of sales, $2 million of inventories, $3.75 million of receivables, and $1.5 million of payables. Its cost of goods sold is 80% of sales, and it finances working capital with bank loans at a 7% rate. Assume 365 days in year for your calculations. 1. What is Parramore's cash conversion cycle (CCC)? Do not round intermediate calculations. Round your answer to two decimal places. days 2. If Parramore could lower its inventories and receivables by 10% each and increase its payables by 10%, all without affecting sales or cost of goods sold, what would be the new CCC? Do not round intermediate calculations. Round your answer to two decimal places. days 3. How much cash would be freed up, if Parramore could lower its inventories and receivables by 10% each and increase its payables by 10%, all without affecting sales or cost of goods sold? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. 4. By how much would pretax profits change, if Parramore could lower its inventories and receivables by 10% each and increase its payables by 10%, all without affecting sales or cost of goods sold? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $ Grade It Now Save & Continue Continue without saving Keep the Highest: 0/4 Attempts: 1. Problem 15.01 (Cash Conversion Cycle) Problem Walk-Through eBook Parramore Corp has $17 million of sales, $2 million of inventories, $3.75 million of receivables, and $1.5 million of payables. Its cost of goods sold is 80% of sales, and it finances working capital with bank loans at a 7% rate. Assume 365 days in year for your calculations. 1. What is Parramore's cash conversion cycle (CCC)? Do not round intermediate calculations. Round your answer to two decimal places. days 2. If Parramore could lower its inventories and receivables by 10% each and increase its payables by 10%, all without affecting sales or cost of goods sold, what would be the new CCC? Do not round intermediate calculations. Round your answer to two decimal places. days 3. How much cash would be freed up, if Parramore could lower its inventories and receivables by 10% each and increase its payables by 10%, all without affecting sales or cost of goods sold? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. 4. By how much would pretax profits change, if Parramore could lower its inventories and receivables by 10% each and increase its payables by 10%, all without affecting sales or cost of goods sold? Write out your answer completely. For Example, 13.2 million should be entered as 13,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar. $ Grade It Now Save & Continue Continue without saving