Question

Keesha Co. borrows $290,000 cash on November 1, 2017 by signing a 90 day, 12% note, with a face value of $290,000. 1. On what

Keesha Co. borrows $290,000 cash on November 1, 2017 by signing a 90 day, 12% note, with a face value of $290,000.

1. On what date does this note mature? (Assume that February has 28 days.)

a. January 25, 2018 b. January 26, 2018 c. January 27, 2018 d. January 28, 2018 e. January 30, 2018

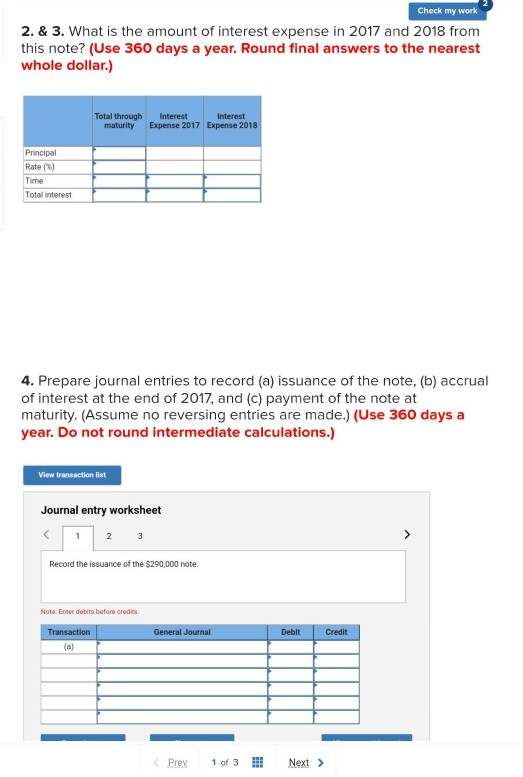

2 & 3. What is the amount of interest expense in 2017 and 2018? from this note (Use 360 days a year round final answers to the nearest whole dollar.)

4. Prepare journal entries to record (a) issuance of the note (b) accrual of interest at the end of 2017 and (c) payment of the note at maturity. (Assume no reversing entries are made.) (Use 360 days a year. Do not round intermediate calculations.)

Check my work 2. & 3. What is the amount of interest expense in 2017 and 2018 from this note? (Use 360 days a year. Round final answers to the nearest whole dollar.) Total through Interest Interest maturity Expense 2017 Expense 2018 Principal Rate(%) Time Total interest 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest at the end of 2017, and (c) payment of the note at maturity. (Assume no reversing entries are made.) (Use 360 days a year. Do not round intermediate calculations.) View transaction list Journal entry worksheet 3 > Record the issuance of the $290,000 note. Note: Emer dobits before credits General Journal Debit Credit Transaction (a) Prey 1 of 3 Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started