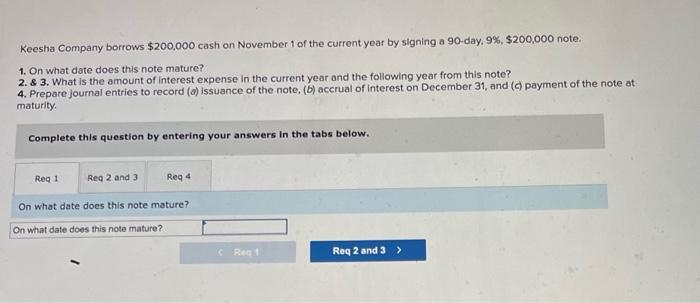

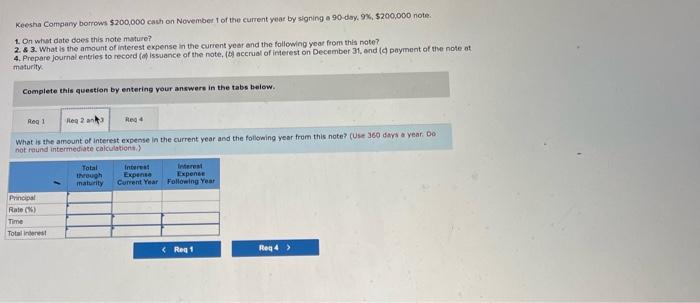

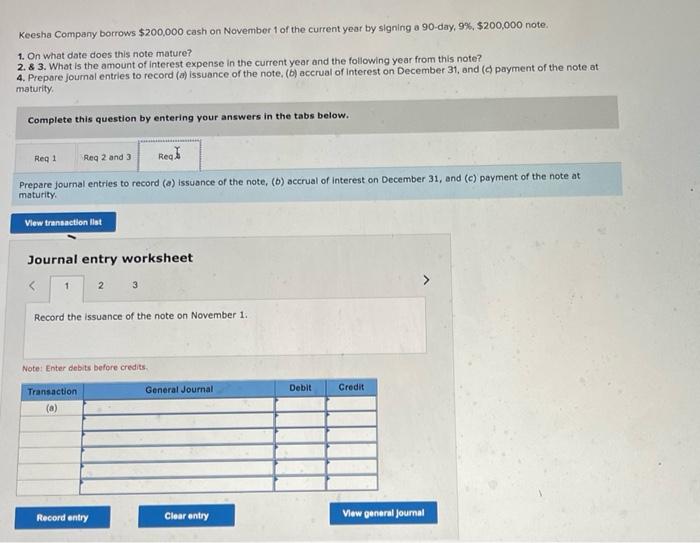

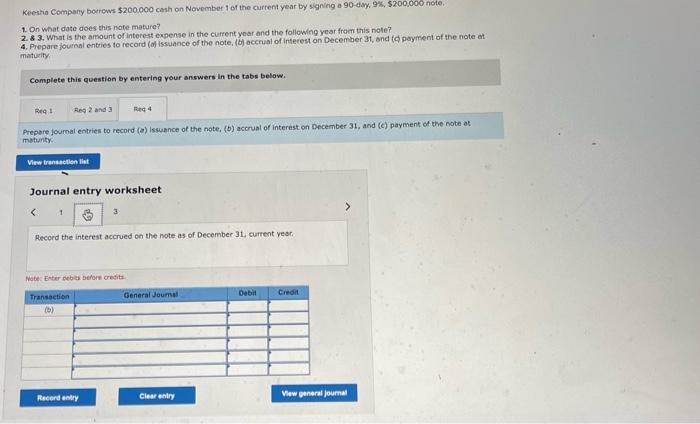

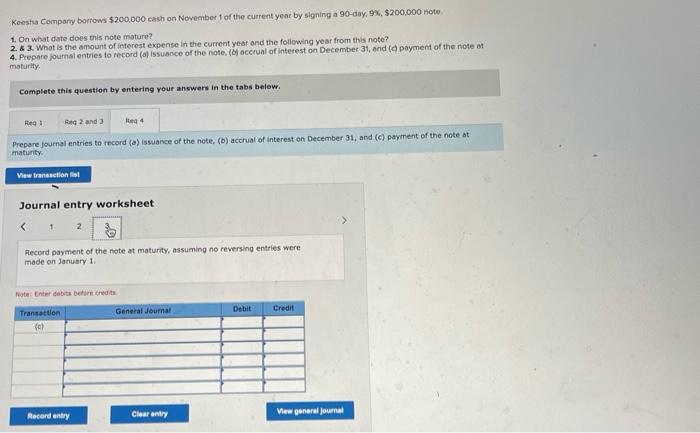

Keesha Company borrows $200,000 cash on November 1 of the current year by signing a 90 -day, 9%,$200,000 note. 1. On what date does this note mature? 2. & 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. On what date does this note mature? Keesha Company borrows $200,000 cach on November t of the current yeat by signing a 90 day, 9%,$200,000 note. 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in the current year and the followig year from this note? 4. Prepare journal entries to meced (of issuance of the note, (b) accrual of interest on December 31, and (c) payment af the note at maturity Complete this question by entering your answers in the tabs below. What is the amount of interest expense in the current year and the folowing year from this note? (Use je0 dayt a year. Do not reund intermeciate calculationts.) Keesha Company borrows $200,000 cash on November 1 of the current year by signing a 90 -day, 9%,$200,000 note. 1. On what date does this note mature? 2. 8 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare joumal entries to record (a) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. Prepare joumal entries to record (a) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note at maturity. Journal entry worksheet Record the issuance of the note on November 1. Note: Enter debits before credits. Keestia Company botrows $200000 cash on Nowember 1 of the curtent year by signing a. 90 day. 9.5,$200,000 tiote. 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in the curfent year and the following year from this nole? 2. \& 3. What is the ansount of interest expense in the cuifent year and the followng yeat ficeri this note? 4. Prepare journal enties to record (d) issuance of the note, (b) accrual of interest on December 3t, and (d) poyment of the note at matuzity Complete this question by entering your answers in the tabs below. Prepare journal entries to record (b) Issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note at metunty. Journal entry worksheet Record the interest accrued on the note as of December 31 , current ver. Note: Enter debat befors cresita. Koesha Compary boerows $200,000 cash on November t of the current year by slgning a 90d0y,90,$200,000 note. 1. On what date does this note mature? 2. 8 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal enties to mecord (d) issuance of the note, ( occiual of interest on December 31, and (c) payment of the note at maturty. Complete this question by entering your answers in the tabs below. Prepare journal entries to record (0) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note at matirity. Journal entry worksheet Mecord payment of the note at maturity, assuming no reversing entries were made on January 1 . frote Enter cebits betien credits