Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Keiji Jones is the owner of a small retail business operated as a sole proprietorship. During 2 0 2 2 , his business recorded the

Keiji Jones is the owner of a small retail business operated as a sole proprietorship. During his business recorded the following items of income and expense: Keiji Jones is the owner of a small retail business operated as a sole proprietorship. During his business recorded the following

items of income and expense:

Required:

a Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in Keiji's Form

b Compute selfemployment tax payable on the earnings of Keiji's sole proprietorship by completing a Schedule SE Form

c Assume that Keiji's business is not a service business, and that it has $ unadjusted basis in tangible depreciable property.

Calculate Keiji's QBI deduction, before any overall taxable income limitation

Complete this question by entering your answers in the tabs below.

Schedule C

Schedule SE

Part a

Part b

Assume that Keiji's business is not a service business, and that it has $ unadjusted basis in tangible depreciable

property. Calculate Keiji's QBI deduction, before any overall taxable income limitation

Note: Round your intermediate computations and final answers to the nearest whole dollar value.

Revenue from inventory sales $

Cost of goods sold

Business license tax

Rent on retail space

Supplies

Wages paid to employees

Payroll taxes

Utilities

Required:

Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in Keijis Form

Compute selfemployment tax payable on the earnings of Keijis sole proprietorship by completing a Schedule SE Form

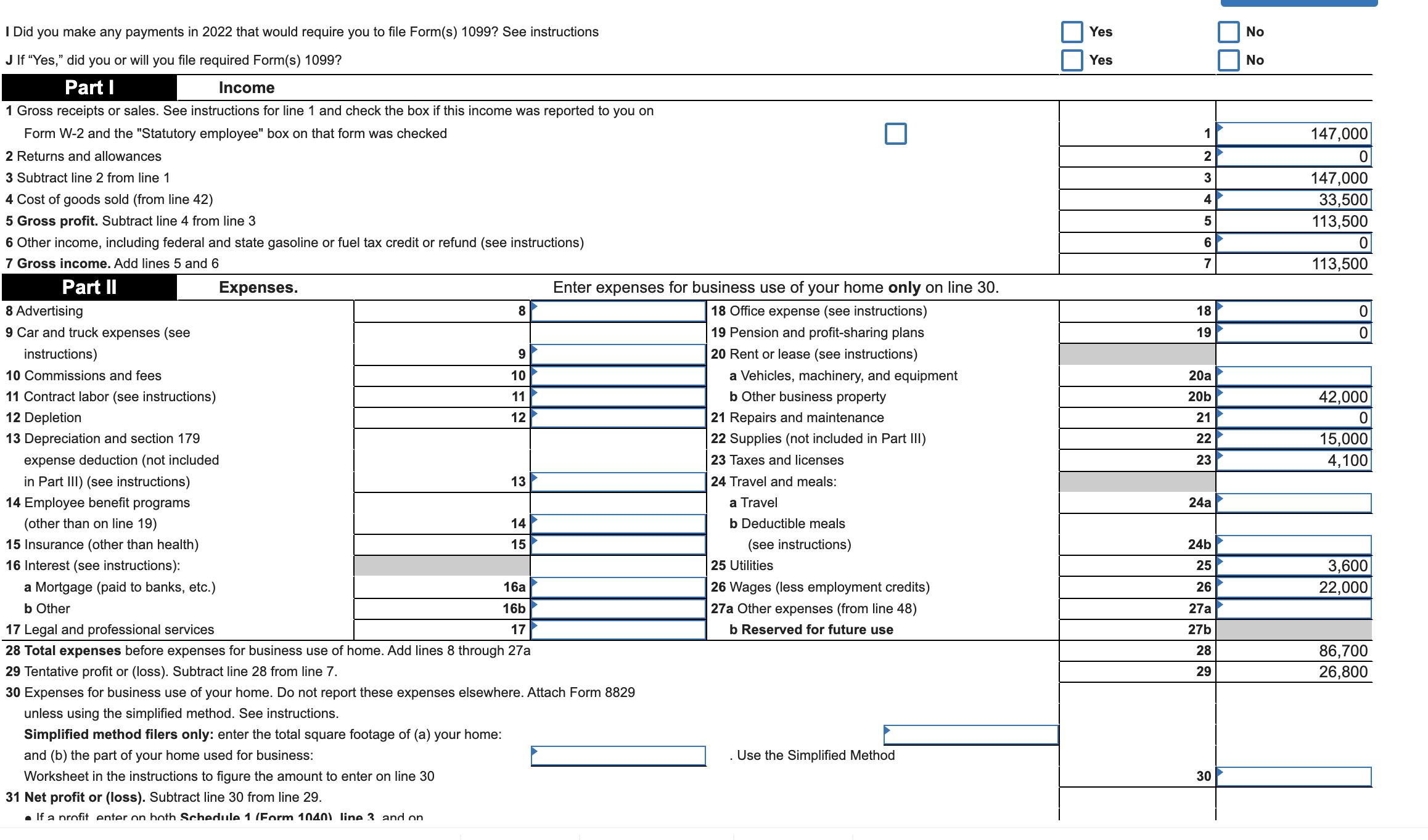

Assume that Keijis business is not a service business, and that it has $ unadjusted basis in tangible depreciable property. Calculate Keijis QBI deduction, before any overall taxable income limitationI Did you make any payments in that would require you to file Forms See instructions

J If "Yes," did you or will you file required Forms

Part I Income

Gross receipts or sales. See instructions for line and check the box if this income was reported to you on

Form W and the "Statutory employee" box on that form was checked

Returns and allowances

Subtract line from line

Cost of goods sold from line

Gross profit. Subtract line from line

Other income, including federal and state gasoline or fuel tax credit or refund see instructions

Gross income. Add lines and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started