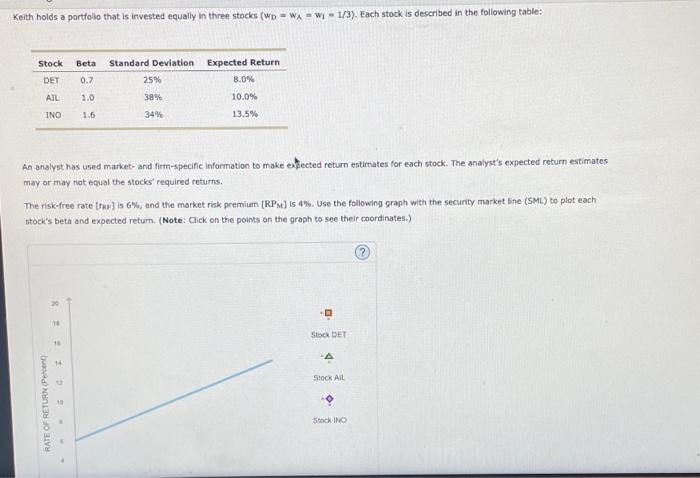

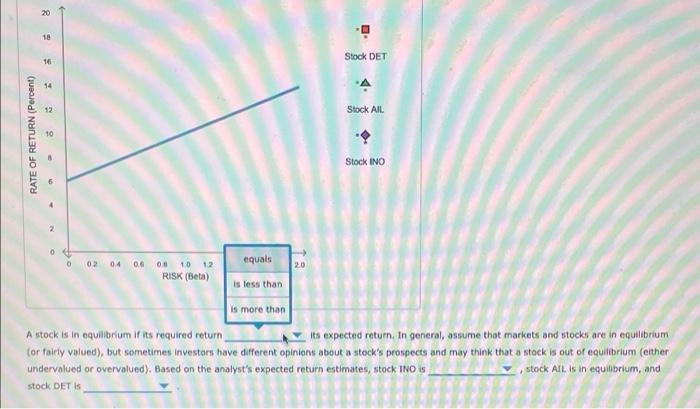

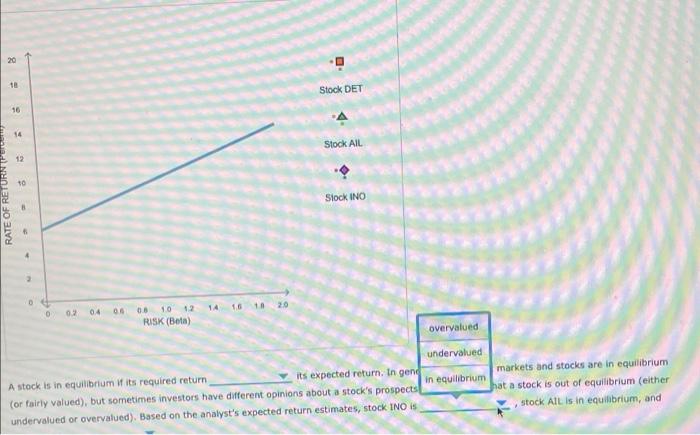

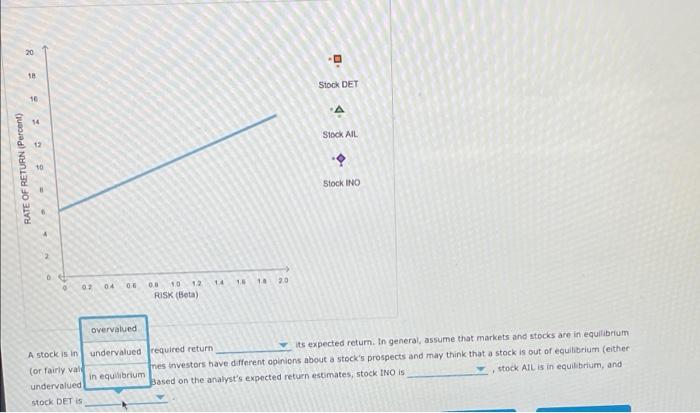

Keith holds a portfolio that is invested equally in three stocks (wp - w - -1/3). Each stock is described in the following table: Beta Standard Deviation Stock DET 0.7 25% Expected Return 8.0% 10.0% AIL 1.0 38% INO 1.6 34% 13.5% An analyst has used market and firm-specific information to make expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. The risk-free rate [p] is 6%, and the market risk premium (RPM) is 4%. Use the following graph with the security market line (SML) to plot each stock's beta and expected return. (Note: Click on the points on the graph to see their coordinates.) TE Stock DET 10 14 Stock All RATE OF RETURN (Percent) Stock INO . 18 Stock DET 16 14 A 12 Stock All RATE OF RETURN (Percent) 10 Stock INO 0 02 0.4 0.6 equals 20 0.8 10 12 RISK (Beta) is less than is more than A stock is in equilibrium if its required return its expected return. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes Investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, stock INO is stock All is in equilibrium, and stock DET is 20 Stock DET 16 14 Stock AIL 12 10 Stock INO RATE OF 6 4 14 16 18 20 02 04 05 08 10 12 RISK (Beta) overvalued undervalued A stock is in equilibrium If its required return its expected return. In gend markets and stocks are in equilibrium in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects hat a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, stock INOS stock All is in equilibrium, and 20 1 Stock DET 16 14 Stock AIL 12 RATE OF RETURN (Percent) 10 Stock INO 2 18 14 20 0 06 02 04 0.8 10 12 RISK (Beta) overvalued A stock is in undervalued required return its expected return. In general, assume that markets and stocks are in equilibrium (or fairly val fres investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either in equilibrium undervalued Based on the analyst's expected return estimates, stock INO is stock All is in equilibrium, and stock DET IS