Answered step by step

Verified Expert Solution

Question

1 Approved Answer

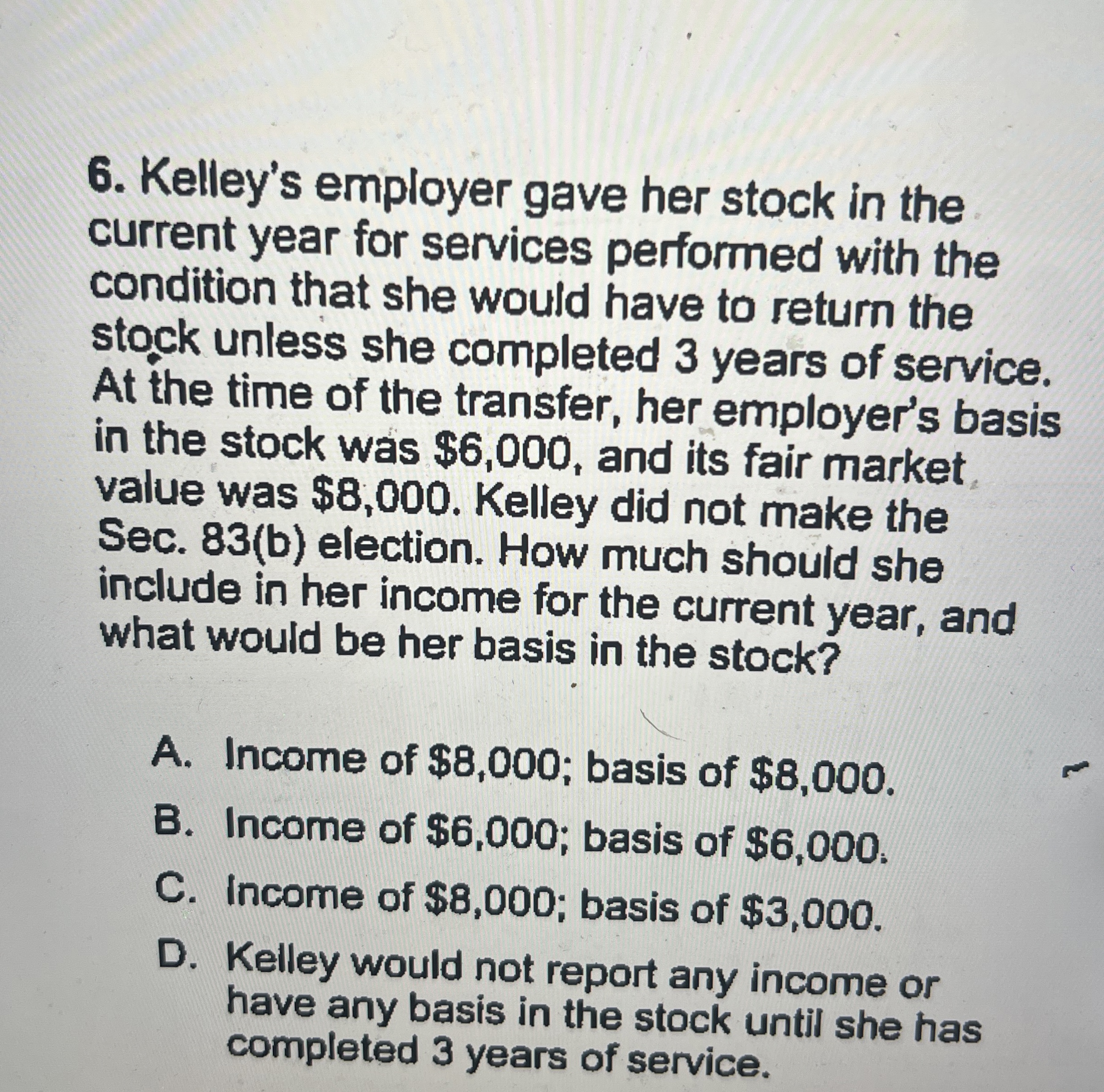

Kelley's employer gave her stock in the current year for services performed with the condition that she would have to return the stock unless she

Kelley's employer gave her stock in the

current year for services performed with the

condition that she would have to return the

stock unless she completed years of service.

At the time of the transfer, her employer's basis

in the stock was $ and its fair market

value was $ Kelley did not make the

Sec. b election. How much should she

include in her income for the current year, and

what would be her basis in the stock?

A Income of $; basis of $

B Income of $; basis of $

C income of $; basis of $

D Kelley would not report any income or

have any basis in the stock until she has

completed years of service.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started