Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kelly and Mark are a married couple that file a joint tax return. Kelly owns a 30% in a partnership that operates a retail

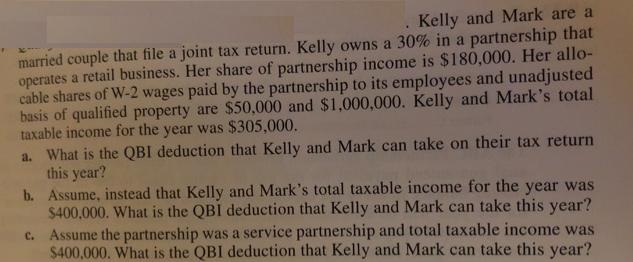

Kelly and Mark are a married couple that file a joint tax return. Kelly owns a 30% in a partnership that operates a retail business. Her share of partnership income is $180,000. Her allo- cable shares of W-2 wages paid by the partnership to its employees and unadjusted basis of qualified property are $50,000 and $1,000,000. Kelly and Mark's total taxable income for the year was $305,000. a. What is the QBI deduction that Kelly and Mark can take on their tax return this year? b. Assume, instead that Kelly and Mark's total taxable income for the year was $400,000. What is the QBI deduction that Kelly and Mark can take this year? c. Assume the partnership was a service partnership and total taxable income was $400,000. What is the QBI deduction that Kelly and Mark can take this year?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Basic QBI Deductions are 20QBI Limitation fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started