Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kelly Construction Company, a three - year - old business, provides contracting and construction services to a variety of clients. Given that each construction job

Kelly Construction Company, a threeyearold business, provides contracting and construction services to a variety of clients. Given

that each construction job is different from the others, Susan Byrd the company's accountant, decided to use a joborder costing

system to allocate costs to the different jobs. She decided to use construction labour hours as the basis for overhead allocation. In

December she estimated the following amounts for the year :

Byrd recorded the following for the third quarter of for the three jobs that the company started and completed during the quarter.

Required:

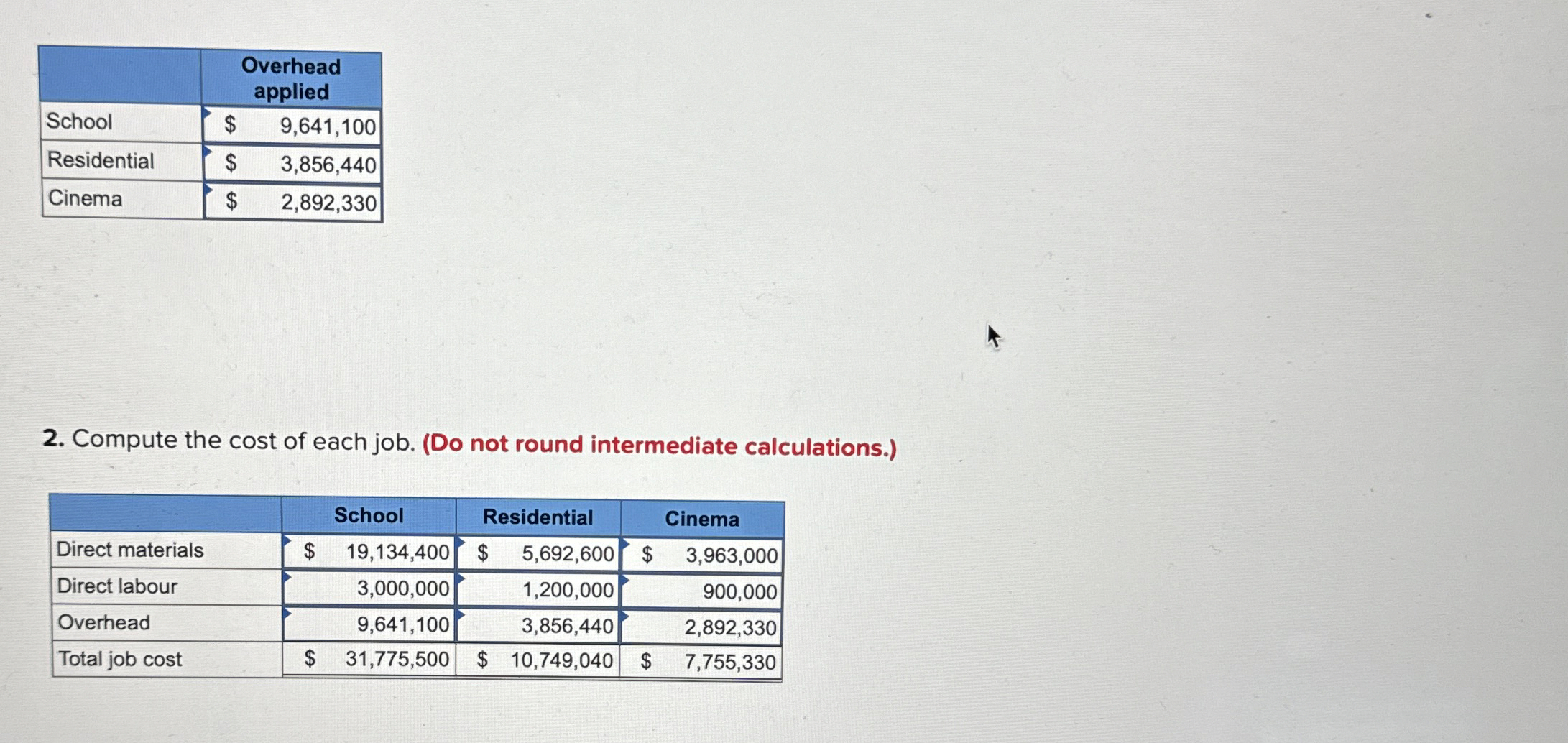

Compute the predetermined overhead allocation rate for and apply overhead to the three jobs. Round your "Predetermined

overhead allocation rate" to decimal places.

Compute the cost of each job. Do not round intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started