Answered step by step

Verified Expert Solution

Question

1 Approved Answer

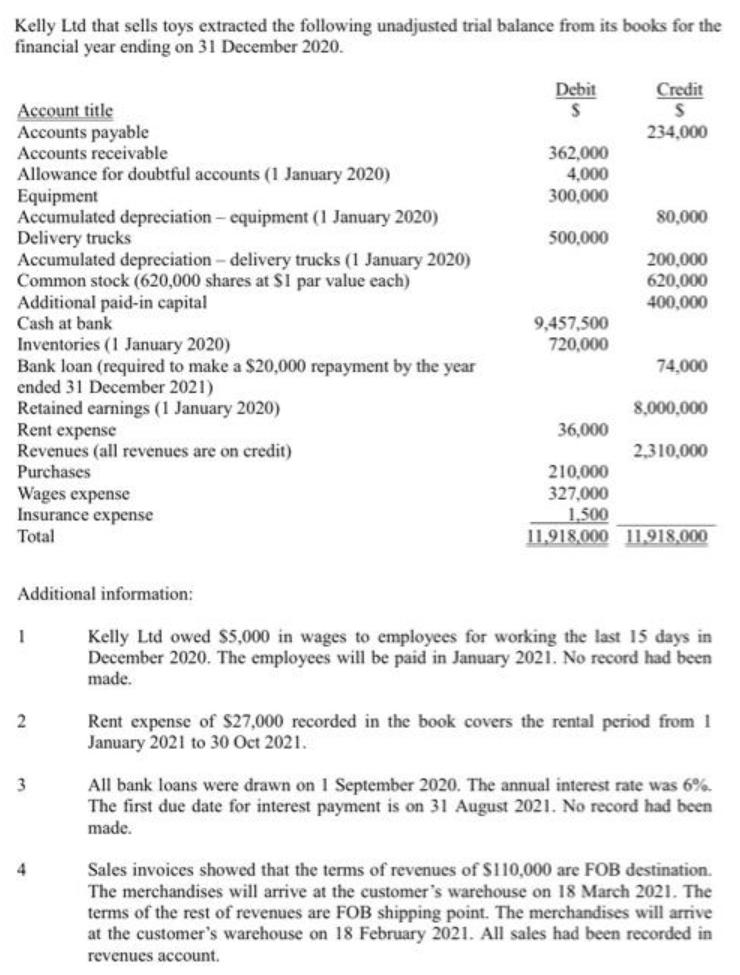

Kelly Ltd that sells toys extracted the following unadjusted trial balance from its books for the financial year ending on 31 December 2020. Debit

Kelly Ltd that sells toys extracted the following unadjusted trial balance from its books for the financial year ending on 31 December 2020. Debit Credit Account title Accounts payable Accounts receivable 234,000 362,000 4,000 300,000 Allowance for doubtful accounts (1 January 2020) Equipment Accumulated depreciation- equipment (1 January 2020) Delivery trucks Accumulated depreciation- delivery trucks (1 January 2020) Common stock (620,000 shares at S1 par value each) Additional paid-in capital Cash at bank Inventories (1 January 2020) Bank loan (required to make a $20,000 repayment by the year ended 31 December 2021) 80,000 500,000 200,000 620,000 400,000 9,457,500 720,000 74,000 Retained earnings (1 January 2020) Rent expense Revenues (all revenues are on credit) Purchases 8,000,000 36,000 2,310,000 Wages expense Insurance expense Total 210,000 327,000 1,500 11.918,000 11.918,000 Additional information: Kelly Ltd owed $5,000 in wages to employees for working the last 15 days in December 2020. The employees will be paid in January 2021. No record had been made. Rent expense of $27,000 recorded in the book covers the rental period from 1 January 2021 to 30 Oct 2021. 3 All bank loans were drawn on 1 September 2020. The annual interest rate was 6%. The first due date for interest payment is on 31 August 2021. No record had been made. Sales invoices showed that the terms of revenues of S110,000 are FOB destination. The merchandises will arrive at the customer's warehouse on 18 March 2021. The terms of the rest of revenues are FOB shipping point. The merchandises will arrive at the customer's warehouse on 18 February 2021. All sales had been recorded in 4 revenues account.

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answers The requirement is to prepare the journal entries for the given set of additional information The same is as follows The explanation to why en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started