Question

Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 20Y5. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated

Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 20Y5. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into transactions. In Part 1 of this problem, the accounting cycle was completed up through the preparation of the adjusted trial balance.

| Required: | |||||

| 8. If you completed the end-of-period work sheet in Part 1, use the adjusted trial balance figures to prepare an income statement, a statement of owner’s equity, and a balance sheet. If you didn’t complete the end-of-period work sheet in Part 1, use the ledger (the Excel spreadsheet) to prepare an income statement, a statement of owner’s equity, and a balance sheet. Be sure to read the instructions above each statement carefully. | |||||

9.

| |||||

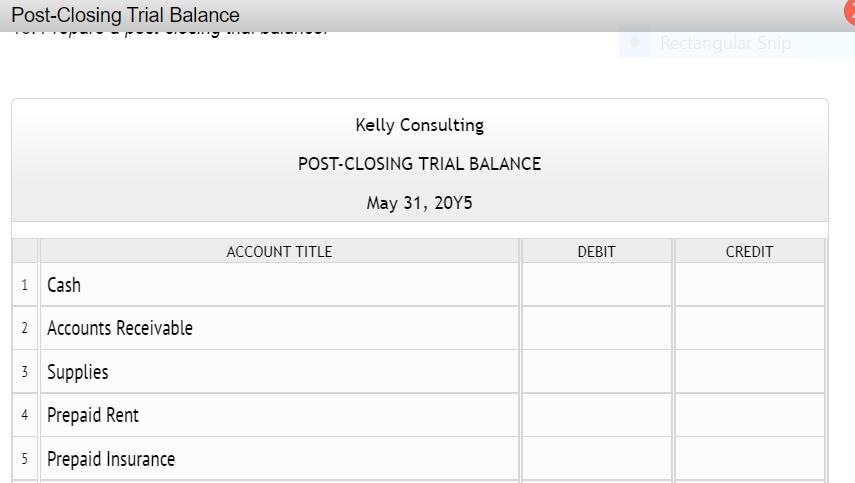

| 10. Prepare a post-closing trial balance. |

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||

| Kelly Consulting | |||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||

| CHART OF ACCOUNTS | |||||||||||||||||||||||||||||||||||

| Kelly Consulting | |||||||||||||||||||||||||||||||||||

| General Ledger | |||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||

| 9. A. | Prepare the closing entries on Page 8 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. |

| 9. B. | Add the appropriate posting reference to the closing entries in the journal in CengageNOW. |

8. If you completed the end-of-period work sheet in Part 1, use the adjusted trial balance figures to prepare an income statement. If you didn’t complete the end-of-period work sheet in Part 1, use the ledger (the Excel spreadsheet) to prepare an income statement. Be sure to complete the statement heading. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount. For example: Net loss should be negative. Expenses should be positive. You will not need to enter colons (:) on the income statement.

8. If you completed the end-of-period work sheet in Part 1, use the adjusted trial balance figures to prepare a statement of owner’s equity. If you didn’t complete the end-of-period work sheet in Part 1, use the ledger (the Excel spreadsheet) to prepare a statement of owner’s equity. Be sure to complete the statement heading. Refer to the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

8. If you completed the end-of-period work sheet in Part 1, use the adjusted trial balance figures to prepare a balance sheet. If you didn’t complete the end-of-period work sheet in Part 1, use the ledger (the Excel spreadsheet) to prepare a balance sheet. Be sure to complete the statement heading. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. You will not need to enter colons (:) or the word "Less" on the balance sheet; they will automatically insert where necessary. Enter all values as positive amounts. When entering assets, enter them in order of liquidity.

Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 20Y5. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions:

| May | 3 | Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $4,500. |

| 5 | Received cash from clients on account, $2,450. | |

| 9 | Paid cash for a newspaper advertisement, $225. | |

| 13 | Paid Office Station Co. for part of the debt incurred on April 5, $640. | |

| 15 | Provided services on account for the period May 1–15, $9,180. | |

| 16 | Paid part-time receptionist for two weeks’ salary including the amount owed on April 30, $750. | |

| 17 | Received cash from cash clients for fees earned during the period May 1–16, $8,360. |

Record the following transactions on Page 6 of the journal:

| May | 20 | Purchased supplies on account, $735. |

| 21 | Provided services on account for the period May 16–20, $4,820. | |

| 25 | Received cash from cash clients for fees earned for the period May 17–23, $7,900. | |

| 27 | Received cash from clients on account, $9,520. | |

| 28 | Paid part-time receptionist for two weeks’ salary, $750. | |

| 30 | Paid telephone bill for May, $260. | |

| 31 | Paid electricity bill for May, $810. | |

| 31 | Received cash from cash clients for fees earned for the period May 26–31, $3,300. | |

| 31 | Provided services on account for the remainder of May, $2,650. | |

| 31 | Kelly withdrew $10,500 for personal use. |

| Required: | |||||||||||||

| 1. | The chart of accounts is shown in a separate panel and the post-closing trial balance as of April 30, 20Y5, is shown below.

| ||||||||||||

| 2. | Post the journal entries on pages 5 and 6 of the journal to the ledger of four-column accounts.

| ||||||||||||

| 3. | Prepare an unadjusted trial balance. Accounts with zero balances can be left blank. | ||||||||||||

| 4. | At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).

| ||||||||||||

| 5. | (Optional) On your own paper or spreadsheet, enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. Find a blank end-of-period work sheet in the Excel spreadsheet you previously downloaded. | ||||||||||||

| 6. |

| ||||||||||||

| 7. | Prepare an adjusted trial balance. Accounts with zero balances can be left blank. |

Kelly Consulting

POST-CLOSING TRIAL BALANCE

April 30, 20Y5

| ACCOUNT TITLE | DEBIT | CREDIT | |

|---|---|---|---|

1 | Cash | 22,100.00 | |

2 | Accounts Receivable | 3,400.00 | |

3 | Supplies | 1,350.00 | |

4 | Prepaid Rent | 3,200.00 | |

5 | Prepaid Insurance | 1,500.00 | |

6 | Office Equipment | 14,500.00 | |

7 | Accumulated Depreciation | 330.00 | |

8 | Accounts Payable | 800.00 | |

9 | Salaries Payable | 120.00 | |

10 | Unearned Fees | 2,500.00 | |

11 | Kelly Pitney, Capital | 42,300.00 | |

12 | Totals | 46,050.00 |

Instructions Chart of Accounts Labels and Amount Descriptions Journal ournal 2 3 4 5 6 10 11

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Journal a 3 Cash 4500 Unearned Fees 4500 ay 5 Cash 2450 Accounts Receivable 2450 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started