Question

Kelsey-White (K-W), an American multinational consumer goods company, manufactured and sold a variety of consumer packaged goods (CPG) around the world generally through brick-and-mortar

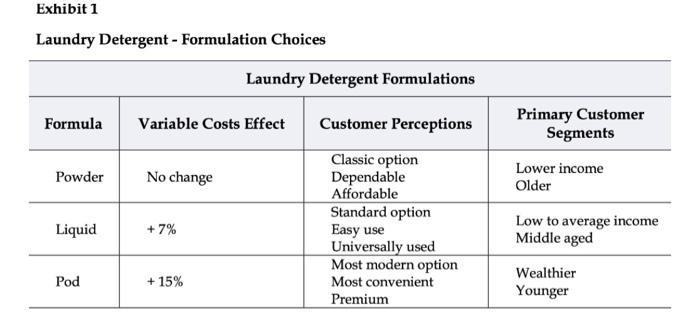

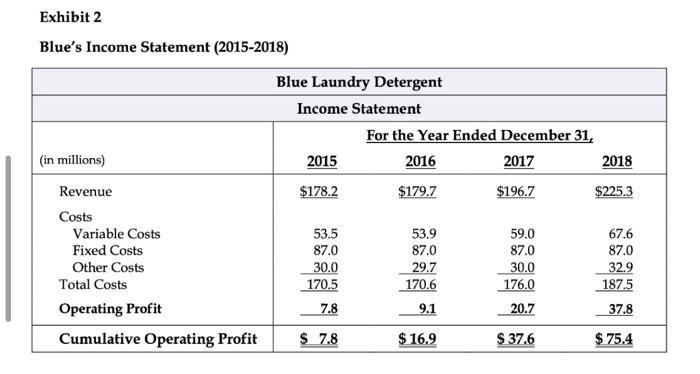

Kelsey-White (K-W), an American multinational consumer goods company, manufactured and sold a variety of consumer packaged goods (CPG) around the world – generally through brick-and-mortar retailers. In the U.S., laundry detergent was a key product for K-W in the form of Blue, its primary brand. Blue came in several formulations—liquid, powder, and single-use pods (See Exhibit 1)—and had been a staple of the laundry marketplace for several decades. Pod sales had been slow compared to other competitors, and long-term Blue customers sometimes even felt that liquid was too modern for their tastes. As the average age of its customers rose, Blue’s market share drifted downwards over the past several years. The product was still a profitable one for K-W, however (Exhibit 2), as the market as a whole had enjoyed steady growth.

K-W had historically been a relatively conservative company in which most marketing and manufacturing decisions were made on the basis of experience and gut feel about the market. However, four years ago the company had appointed a relatively new CEO, Sheila James, who had a strong belief in quantitative and data-based decision-making. One of her first acts as CEO was to initiate the development of K-W Vision, a system for displaying key information about market, financial, and operational performance. James’ goal was that K-W managers would use Vision to make strategic and operational decisions in many areas of the business. She had come from another company in the consumer products industry, and she argued that K-W was behind other firms in its use of data and analytics for decisions. Vision had just become available to the Blue product team.

In order to build K-W Vision, the company needed to compile several years of historical data. Most of it came directly from retailers, from syndicated providers of retail data about CPG firms, or from internal K-W systems. Much of the data had been used within K-W in the past, but it was fragmented and stayed within a variety of business silos. In addition, some parts of the organization were much more likely to use such data than others.

With strong support from Sheila James, the IT organization at K-W had put substantial energy and time into integrating the information, ensuring that it was consistent across the organization, and creating the Vision user interface. The goal of these efforts was to allow K-W managers to make key decisions about marketing and production based on analysis of “what works” as evidenced by data. The system also included data on key competitive brands, which was generally sourced from annual reports and syndicated industry data. The most recent version also employed some sophisticated Monte Carlo simulation analyses to understand the likelihood of different forecasting scenarios.

James was also attempting to change the culture of K-W in a more analytical direction. Her idea was that every manager within the company should become a data-driven executive, making key decisions on the basis of data and analytics whenever possible. She also believed that analytics and K-W Vision would be essential in pulling off the turnaround necessary for Blue and other key brands. She has made clear that decisions need to be described (“In plain English,” James often demanded) and justified with reference to the data and analyses used to make them, and regularly posed questions involving data about brand and business unit performance at management meetings. She had also suggested that managers who adopted this data-driven approach would be the most likely to succeed and be promoted at K-W in the future. In fact, James had accelerated this process by bringing in several new managers from outside the company who already had the desired analytical orientation.

In keeping with this analytical focus, Blue and other K-W brand teams had already seen their key resources tied to gains (or losses) in market share and profitability. James and other senior managers had made clear that brands that did well would receive more money for marketing and for increased production, and those that did not would be slowly starved of resources.

For the managers of the Blue brand, the new administration and the new tools provided an opportunity to reshape the brand and consumer perceptions of it in the marketplace. Blue had been known as a solid but unexciting brand in the marketplace; some have called it the “Ivory Soap of Detergents.” James and other managers had suggested to analysts that they thought Blue could be revitalized, and were open to suggestions from the brand team about how best to do that.

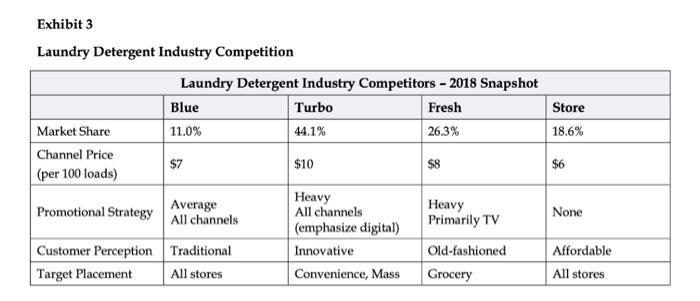

Blue’s primary competitor in the category was Turbo, a souped-up and heavily advertised brand that promised more cleaning power. Customers had responded well to that message, and Turbo had almost half the U.S. detergent market. Turbo had invested its marketing resources across a variety of channels, but almost 35% of its spending was on digital ads—perhaps the highest digital spending percentage in the industry. K-W managers speculated that Turbo’s brand managers were increasingly focused on the “millennials” market segment. Turbo’s greatest sales were through large retailers like Walmart and Target, although it was also the brand most likely to be found in small urban stores. Turbo’s price to retailers was the highest of any competitor (Exhibit 3). It had also been the first to introduce higher- priced formulations (liquid and pods) into the marketplace, and it had achieved success in persuading customers to purchase them.

Another competitive brand, Fresh, came from a Europe-based manufacturer. It had slightly larger share in the market than Blue, and its brand attributes centered on a fresh, clean smell for the clothes washed in it. Fresh’s brand managers had also said in industry journals that they wanted to increase its appeal to younger consumers. Its marketing strategies, however, were not youth-oriented to external appearances. It had a strong television focus, and still bought ads disproportionately on daytime television. Fresh’s strongest distribution channel was mid-sized grocery chains. Its price to the channel was lower than Turbo’s, but higher than Blue’s. Most of its sales were in the traditional powder formulation.

The only other major brands in most stores were generic store brands, which competed largely on price. K-W did manufacture detergent used in some store brands, but it did not advertise that fact and did not work closely with stores to try to build those brands.

Sheila James recently told Wall Street investment analysts, “Our fortunes in the detergent category will rise and fall on the basis of Blue. We have high hopes for that turnaround, and believe that our data- driven approach will ultimately grow the brand dramatically.”

Exhibit 1 Laundry Detergent - Formulation Choices Formula Variable Costs Effect Powder No change Liquid + 7% Pod + 15% Laundry Detergent Formulations Customer Perceptions Classic option Dependable Affordable Standard option Easy use Universally used Most modern option Most convenient Premium Primary Customer Segments Lower income Older Low to average income Middle aged Wealthier Younger

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

This Data Analytics Simulation Strategic Decision Making case study introduces the power of analytic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started