Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kelveen Cline is in the business of producing customized T-shirts and currently uses a normal job order costing system. Each job represents an order

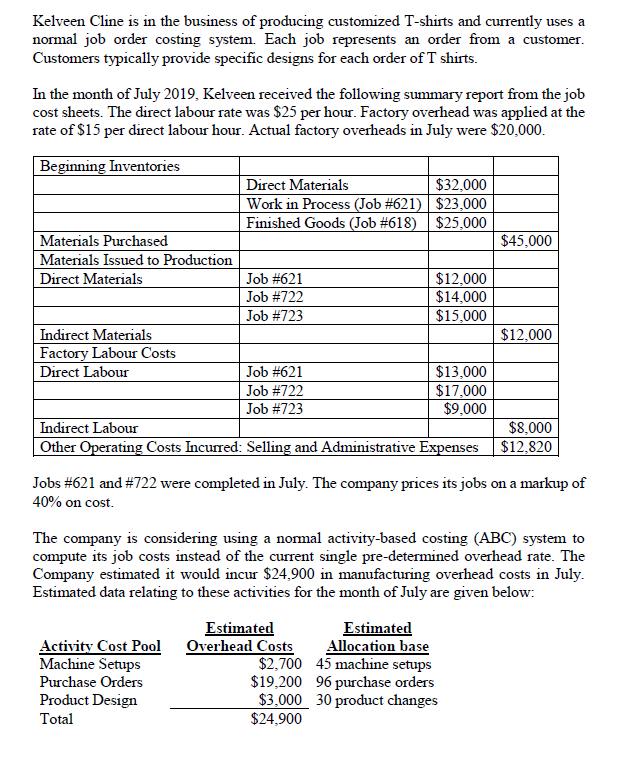

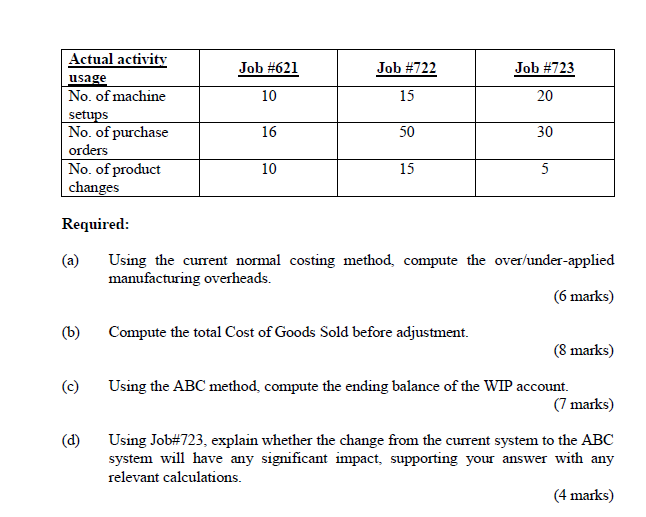

Kelveen Cline is in the business of producing customized T-shirts and currently uses a normal job order costing system. Each job represents an order from a customer. Customers typically provide specific designs for each order of T shirts. In the month of July 2019, Kelveen received the following summary report from the job cost sheets. The direct labour rate was $25 per hour. Factory overhead was applied at the rate of $15 per direct labour hour. Actual factory overheads in July were $20,000. Beginning Inventories Direct Materials $32,000 Work in Process (Job #621) | $23,000 Finished Goods (Job #618) $25,000 Materials Purchased $45,000 Materials Issued to Production Direct Materials Job #621 $12,000 Job #722 $14,000 Job #723 $15,000 Indirect Materials $12,000 Factory Labour Costs Direct Labour Job #621 $13,000 Job #722 $17,000 Job #723 $9,000 Indirect Labour $8,000 Other Operating Costs Incurred: Selling and Administrative Expenses $12,820 Jobs #621 and #722 were completed in July. The company prices its jobs on a markup of 40% on cost. The company is considering using a normal activity-based costing (ABC) system to compute its job costs instead of the current single pre-determined overhead rate. The Company estimated it would incur $24,900 in manufacturing overhead costs in July. Estimated data relating to these activities for the month of July are given below: Activity Cost Pool Machine Setups Purchase Orders Product Design Total Estimated Overhead Costs Estimated Allocation base $2,700 45 machine setups $19,200 96 purchase orders $3,000 30 product changes $24,900 Actual activity Job #621 Job #722 Job #723 usage No. of machine 10 15 20 setups No. of purchase 16 50 30 orders No. of product 10 15 5 changes Required: (a) Using the current normal costing method, compute the over/under-applied manufacturing overheads. (6 marks) (b) Compute the total Cost of Goods Sold before adjustment. (8 marks) (c) Using the ABC method, compute the ending balance of the WIP account. (7 marks) (d) Using Job#723, explain whether the change from the current system to the ABC system will have any significant impact, supporting your answer with any relevant calculations. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started